- United States

- /

- Semiconductors

- /

- NasdaqGS:AVGO

Is Broadcom’s 121% Stock Surge in 2025 Justified by Its Fundamentals?

Reviewed by Bailey Pemberton

- Ever wondered whether Broadcom’s soaring share price is still backed by solid value, or if it is starting to outpace its fundamentals? You are not alone, and today we are putting its valuation under the microscope.

- Broadcom’s stock has delivered eye-catching returns, climbing 4.4% in the last week, 10.9% in the past month, and an impressive 59.3% year-to-date, with a staggering 121% gain over the past year.

- Recent headlines have been all about Broadcom’s growing presence in the AI semiconductor space and its high-profile acquisitions. These factors are fueling optimism about long-term growth. These developments have driven renewed attention and may be shifting how investors see the company’s risk and reward profile.

- Despite the buzz, Broadcom scores a 0/6 on our valuation checks, meaning it is not undervalued according to any of our standard measures. In the next section, we will explore the different approaches to valuing Broadcom and hint at a smarter way to evaluate whether this stock is truly worth its price tag.

Broadcom scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Broadcom Discounted Cash Flow (DCF) Analysis

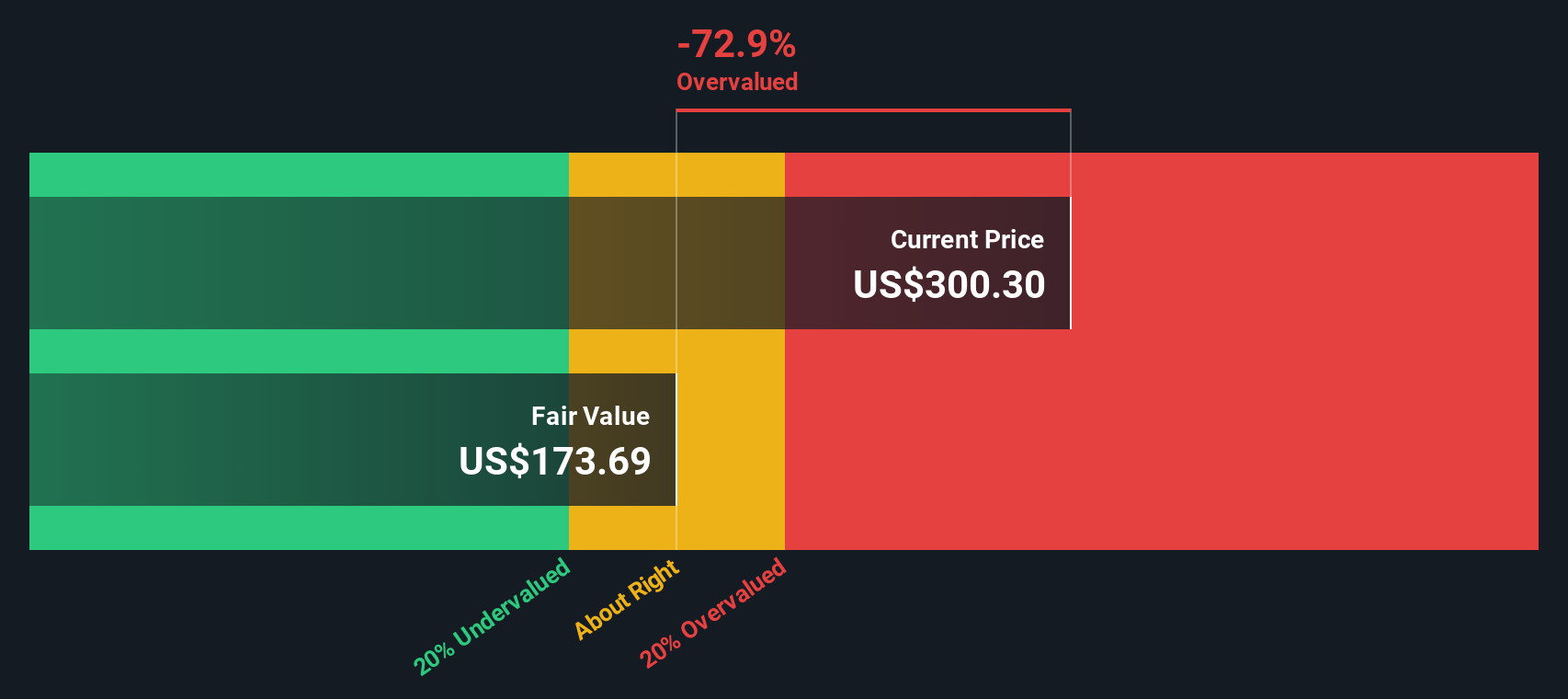

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future free cash flows and discounting them back to today’s dollars. This approach aims to capture what Broadcom is truly worth based on its ability to generate cash over time.

For Broadcom, current free cash flow stands at $24.8 Billion. Analysts estimate the company’s free cash flow will grow substantially, reaching about $94.1 Billion by 2029. Beyond that, Simply Wall St extrapolates even further, projecting free cash flows to continue increasing over the next decade. While analyst coverage is strong over the next 5 years, estimates past that period are based on broader growth assumptions.

Using this method, Broadcom’s intrinsic value per share is estimated at $313.06. Compared to the current share price, this implies the stock is trading at an 18.1% premium, meaning it is overvalued according to the DCF model.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Broadcom may be overvalued by 18.1%. Discover 832 undervalued stocks or create your own screener to find better value opportunities.

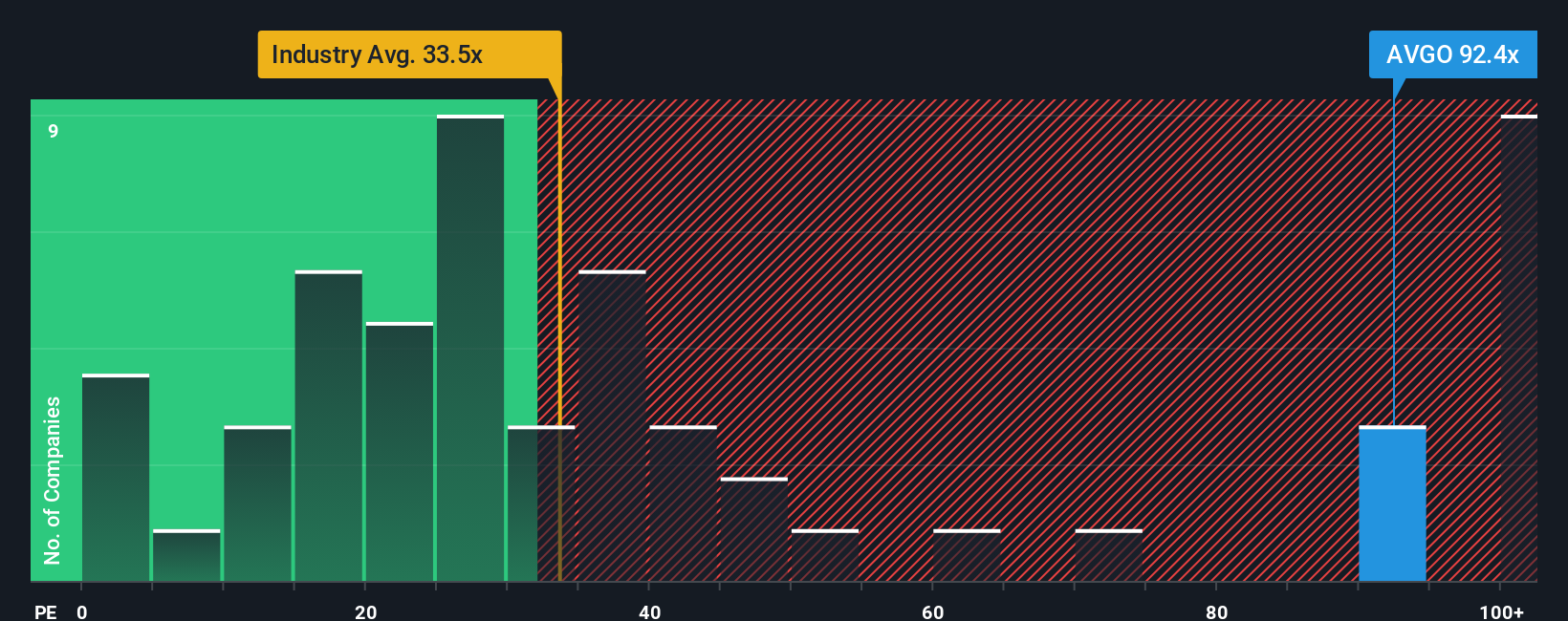

Approach 2: Broadcom Price vs Earnings

The Price-to-Earnings (PE) ratio is often considered the gold standard for valuing profitable companies like Broadcom. It links a company’s share price to its earnings per share, offering investors an instant view of how much they are paying for a dollar of Broadcom’s current profits.

What counts as a "fair" PE ratio depends largely on expectations. If a company is growing quickly or is viewed as lower risk, investors are generally willing to pay a higher PE. In contrast, lower growth or higher risk usually justifies a lower PE.

Broadcom’s current PE ratio is 92.8x, which is substantially higher than both the semiconductor industry average of 37.6x and the average of its direct peers at 63.8x. While this suggests a premium, Simply Wall St’s proprietary "Fair Ratio" model estimates a fair PE for Broadcom would be 63.3x. This Fair Ratio goes beyond basic comparisons by considering Broadcom’s unique growth outlook, profit margins, market capitalization, industry dynamics, and potential risks. It provides a more nuanced benchmark than simply looking at peers or industry averages.

Comparing Broadcom’s current PE of 92.8x to its Fair Ratio of 63.3x, the stock appears significantly overvalued by this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

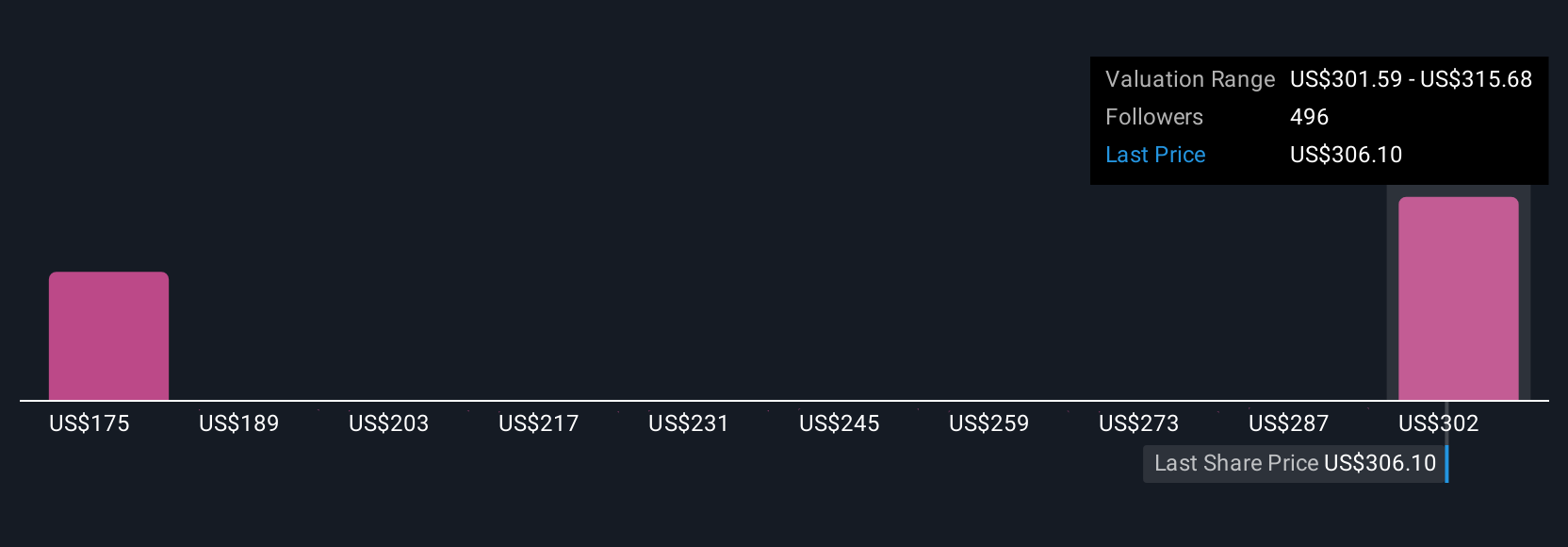

Upgrade Your Decision Making: Choose your Broadcom Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. In simple terms, a Narrative is your personalized story about a company. It is how you connect what you believe about Broadcom’s future with a financial forecast and a fair value estimate.

Rather than relying solely on stock charts or standard ratios, a Narrative helps you clearly lay out your assumptions for things like future revenue, profit margins, and risks, then links those beliefs directly to an estimated fair value. This turns abstract numbers into an actionable story, making valuation much more approachable and intuitive.

Millions of investors already use Narratives on Simply Wall St’s Community page, where you can set your own fair value and see how it stacks up against the current price and others’ views. Narratives update automatically as new information, such as earnings or breaking news, comes in. This helps you stay aligned with the latest outlook and make buy or sell decisions confidently.

For Broadcom, one investor’s Narrative might forecast robust AI chip demand and successful VMware integration, supporting a fair value above $460 per share. Another investor might see tough competition and execution risks, believing the shares are only worth $218. This highlights the importance of your own research and perspective.

Do you think there's more to the story for Broadcom? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Broadcom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVGO

Broadcom

Designs, develops, and supplies various semiconductor devices and infrastructure software solutions worldwide.

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Community Narratives