- United States

- /

- Semiconductors

- /

- NasdaqCM:ATOM

It's Unlikely That Atomera Incorporated's (NASDAQ:ATOM) CEO Will See A Huge Pay Rise This Year

Key Insights

- Atomera to hold its Annual General Meeting on 1st of May

- Total pay for CEO Scott Bibaud includes US$417.7k salary

- Total compensation is 149% above industry average

- Atomera's EPS declined by 3.4% over the past three years while total shareholder loss over the past three years was 68%

Shareholders of Atomera Incorporated (NASDAQ:ATOM) will have been dismayed by the negative share price return over the last three years. In addition, the company's per-share earnings growth is not looking good, despite growing revenues. Shareholders will have a chance to take their concerns to the board at the next AGM on 1st of May and vote on resolutions including executive compensation, which studies show may have an impact on company performance. Here's our take on why we think shareholders might be hesitant about approving a raise at the moment.

View our latest analysis for Atomera

How Does Total Compensation For Scott Bibaud Compare With Other Companies In The Industry?

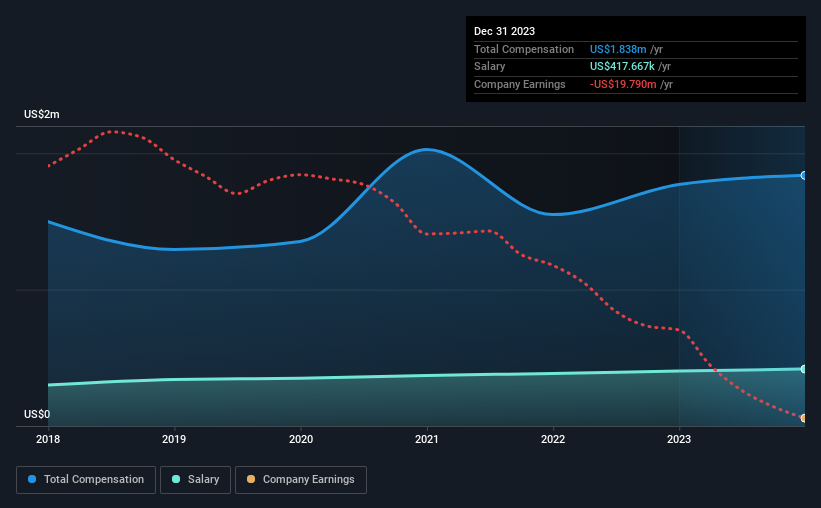

Our data indicates that Atomera Incorporated has a market capitalization of US$144m, and total annual CEO compensation was reported as US$1.8m for the year to December 2023. That's just a smallish increase of 3.8% on last year. While we always look at total compensation first, our analysis shows that the salary component is less, at US$418k.

In comparison with other companies in the American Semiconductor industry with market capitalizations under US$200m, the reported median total CEO compensation was US$738k. Accordingly, our analysis reveals that Atomera Incorporated pays Scott Bibaud north of the industry median. Furthermore, Scott Bibaud directly owns US$1.9m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$418k | US$403k | 23% |

| Other | US$1.4m | US$1.4m | 77% |

| Total Compensation | US$1.8m | US$1.8m | 100% |

Speaking on an industry level, nearly 11% of total compensation represents salary, while the remainder of 89% is other remuneration. According to our research, Atomera has allocated a higher percentage of pay to salary in comparison to the wider industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at Atomera Incorporated's Growth Numbers

Over the last three years, Atomera Incorporated has shrunk its earnings per share by 3.4% per year. It achieved revenue growth of 44% over the last year.

The reduction in EPS, over three years, is arguably concerning. On the other hand, the strong revenue growth suggests the business is growing. It's hard to reach a conclusion about business performance right now. This may be one to watch. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Atomera Incorporated Been A Good Investment?

The return of -68% over three years would not have pleased Atomera Incorporated shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

The loss to shareholders over the past three years is certainly concerning and possibly has something to do with the fact that the company's earnings haven't grown. In the upcoming AGM, shareholders will get the opportunity to discuss any issues with the board, including those related to CEO remuneration and assess if the board's plan is in line with their expectations.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We identified 4 warning signs for Atomera (1 is concerning!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:ATOM

Atomera

Engages in the developing, commercializing, and licensing proprietary processes and technologies for the semiconductor industry in North America and Europe.

Flawless balance sheet with moderate risk.

Market Insights

Community Narratives