- United States

- /

- Semiconductors

- /

- NasdaqGS:ASML

Is ASML Still a Smart Bet After Its 10% Surge and Industry Investment News?

Reviewed by Bailey Pemberton

Thinking about what to do with ASML Holding stock? You’re not alone. Plenty of investors are weighing their options after the hefty run-up this tech giant has seen. Over the past month, ASML shares have climbed 10.0%, adding to an already impressive 46.3% gain so far this year. If you zoom out even more, the story is just as impressive: the stock is up 191.2% over five years. Clearly, there’s a lot of momentum here.

Part of that excitement comes from ASML’s continuing dominance in the chipmaking-equipment space. Recent news that industry peers are increasing their investments in next-generation lithography machines has underscored ASML’s critical role in global semiconductor manufacturing. This narrative, combined with positive sentiment around tech, has helped fuel gains as more investors view the company as a central pillar in the world’s chip supply chain.

But is the market getting ahead of itself, or is there still value to unlock? Our quick valuation score, a simple way to see how a company measures up across six key value checks, rates ASML at 2 out of 6. That means it’s undervalued by just two measures, suggesting the road ahead is nuanced.

Let’s dig into precisely how ASML stacks up against different valuation yardsticks. Later on, I’ll share an approach that could help you assess the company’s performance with even deeper insight.

ASML Holding scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: ASML Holding Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's value. This approach helps investors determine what a company is really worth, beyond current market sentiment.

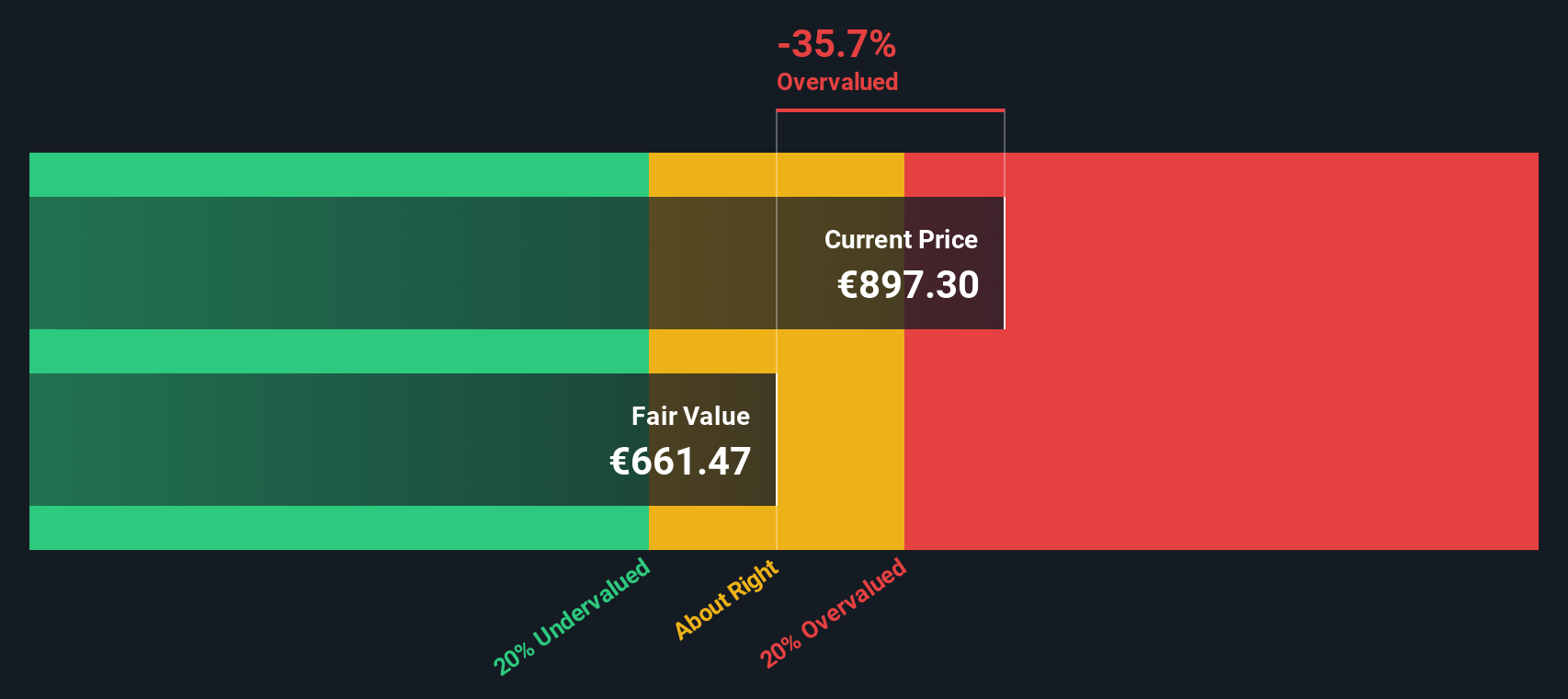

ASML Holding's most recent reported Free Cash Flow (FCF) stands at approximately €8.56 billion. Analysts provide FCF projections for the next five years, and further projections up to 2035 are extrapolated by Simply Wall St. According to these estimates, ASML's FCF is expected to rise to about €21.56 billion by 2035, indicating robust expected growth in the company's future cash generation.

Based on these cash flow forecasts, the DCF model computes an estimated intrinsic value of €699.80 per share for ASML Holding. This compares to the current share price and suggests the stock is around 46.5% overvalued relative to its calculated intrinsic value.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests ASML Holding may be overvalued by 46.5%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: ASML Holding Price vs Earnings

For profitable companies like ASML Holding, the Price-to-Earnings (PE) ratio is a go-to metric because it directly ties a company’s market value to its bottom line profits. It helps investors gauge how much they are paying for each dollar of current earnings. This is a tidy way to compare stocks within the same industry.

Of course, a “normal” or fair PE ratio is not set in stone. It depends on growth expectations and risk. Companies growing faster or perceived as less risky often trade at higher multiples, while slower growth or more volatility can warrant lower ratios.

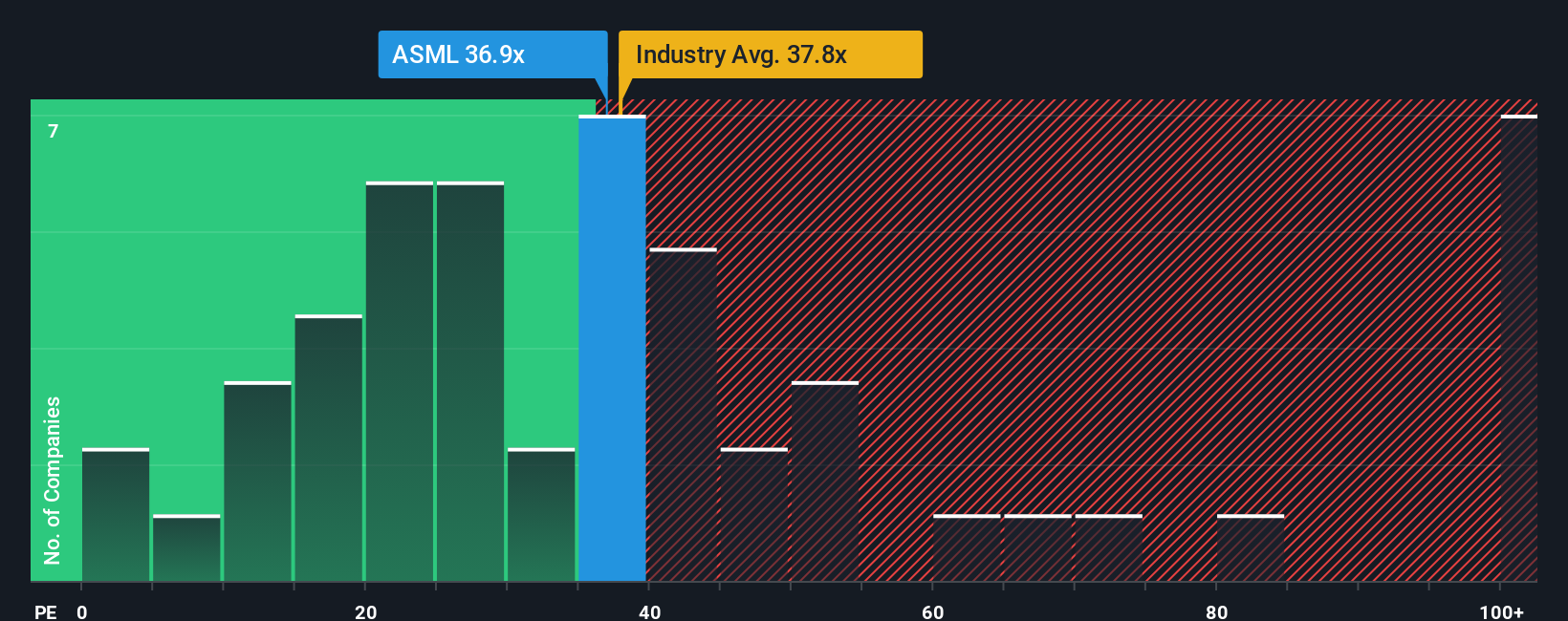

Currently, ASML Holding trades at a PE ratio of 36.4x. That is nearly in line with both its Semiconductor industry average (37.4x) and the average of its closest peers (36.6x). This suggests investor sentiment about its price is largely consistent with industry norms.

To dig deeper, Simply Wall St’s Fair Ratio for ASML is 35.1x. This proprietary metric refines the comparison by weighing not just sector and peer trends, but also ASML’s own growth prospects, profit margins, market cap, and risk profile. It provides a more individualized benchmark, cutting through general averages for a sharper assessment.

Given ASML’s current PE and its Fair Ratio are within 0.1x of each other, the stock looks fairly valued by this approach.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your ASML Holding Narrative

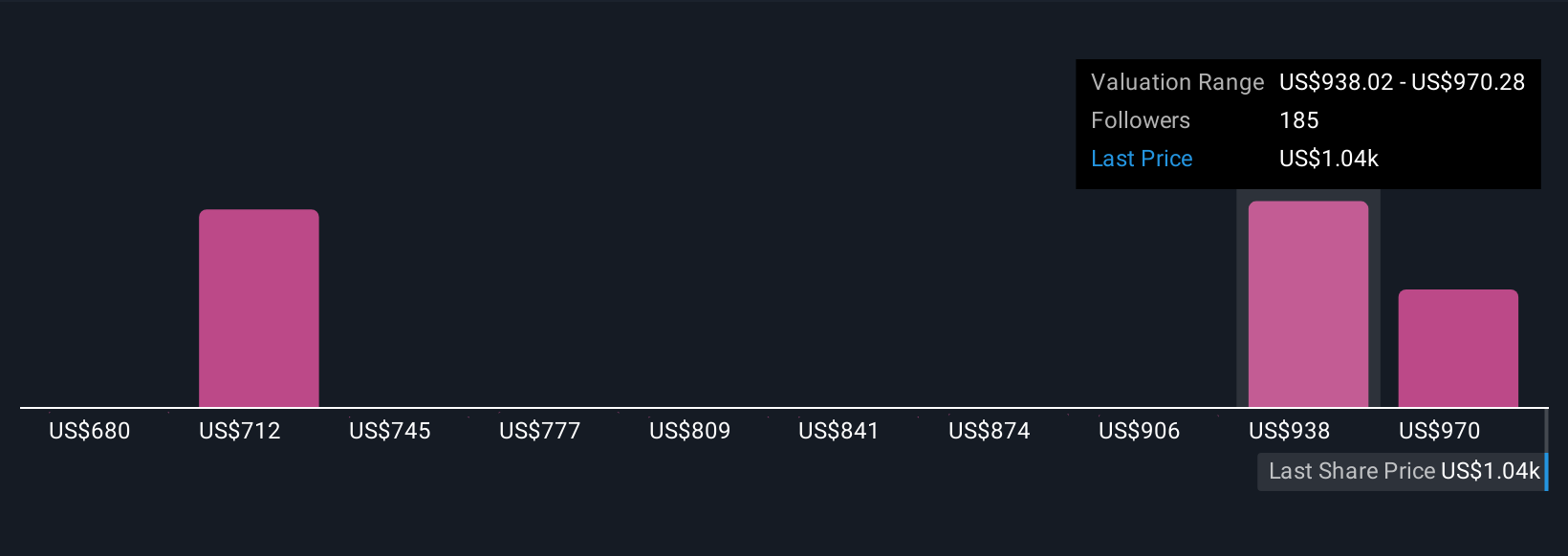

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. In the simplest terms, a Narrative is your personal story about a company, connecting your perspective on its future with the key numbers behind it: your assumptions about ASML’s fair value, expected growth, and profit margins.

Narratives link a company's story, such as why you believe in its future or foresee challenges ahead, to your financial forecast and ultimately to a fair value estimate. Unlike static valuation models, Narratives are interactive and dynamic, allowing you to adapt your outlook as new information arrives.

Millions of investors already use Narratives on the Simply Wall St Community page, where they can assess, discuss, and refine their views in a lively, supportive environment. With Narratives, you can quickly compare your estimated fair value to the current share price, helping you decide if it’s the right time to buy or sell, and your Narrative will update automatically as news or earnings are released.

For example, some investors see ASML’s fair value above €1,000 based on strong growth and a technological edge, while others estimate it around €700 due to macro risks and sector volatility. This shows just how flexible Narratives can be to individual insights and convictions.

Do you think there's more to the story for ASML Holding? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ASML

ASML Holding

Provides lithography solutions for the development, production, marketing, sales, upgrading, and servicing of advanced semiconductor equipment systems.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion