- United States

- /

- Semiconductors

- /

- NasdaqGS:ASML

ASML Holding (NasdaqGS:ASML): Evaluating Valuation as Shares Approach All-Time Highs

Reviewed by Simply Wall St

See our latest analysis for ASML Holding.

Momentum in ASML Holding has been building fast, with a 41.5% share price return in the past three months and a 46.4% total shareholder return over the last year. While headlines highlight brisk demand across the semiconductor sector, the latest run-up reflects both renewed optimism in chip markets as well as persistent investor confidence in ASML’s long-term technology leadership and profitability.

If you want to see what other tech and AI leaders are moving the market right now, explore the opportunities with See the full list for free.

With ASML shares trading near all-time highs, investors must weigh whether strong recent results signal more upside ahead or if current prices already reflect the company’s premium positioning and future growth expectations.

Most Popular Narrative: 3% Overvalued

ASML's closing price of $1,033.10 now sits slightly above the latest fair value narrative. This suggests optimism is running just ahead of long-term fundamentals. The stage is set for a deeper dive into how the narrative supports this valuation stance.

ASML repurchased €1.4 billion worth of shares during the quarter and declared an interim dividend of €1.60 per share, reaffirming its commitment to shareholder returns. AI chip demand, advanced node development, and the global push for semiconductor independence all support ASML’s long-term relevance. Even with near-term uncertainty, the structural growth story remains intact.

Want to see what powers this high valuation? The fair value hinges on a bullish take: massive future profit margins, robust recurring revenues, and explosive AI chip demand. Ready to learn which numbers fuel this growth engine and how shareholder rewards impact the big picture? Dive in and uncover the drivers behind this premium price tag.

Result: Fair Value of $1,002.53 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, macroeconomic uncertainty and new export restrictions to China remain potential catalysts that could quickly change the current valuation narrative for ASML.

Find out about the key risks to this ASML Holding narrative.

Another View: What do earnings multiples say?

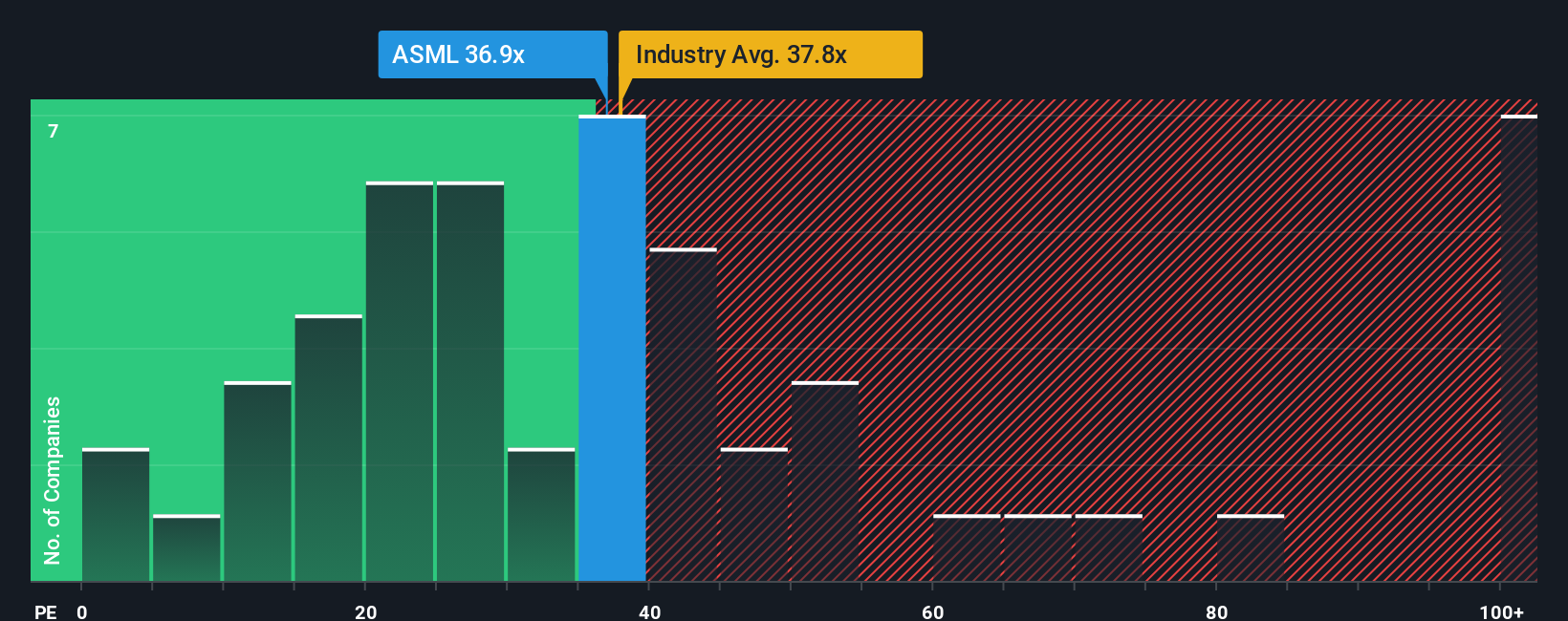

Looking at the company's price-to-earnings ratio of 36.6x, ASML trades below the US Semiconductor industry average of 39.5x and is roughly in line with peers at 36.7x. However, this is a notch above the fair ratio of 35.2x, which implies the stock may still carry an extra layer of optimism. Could this gap signal risk for buyers, or is the market confident for a reason?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ASML Holding Narrative

If you see the numbers differently, or want a deeper look at the details, you can shape your own perspective in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding ASML Holding.

Looking for more investment ideas?

Smart investors never limit their options. Take action now and see what’s trending across the market using hand-picked ideas that could unlock your next big move.

- Tap into emerging breakthroughs in medical technology by checking out these 33 healthcare AI stocks, which could transform patient care and diagnostics.

- Boost your portfolio’s income potential with these 17 dividend stocks with yields > 3% offering attractive yields and reliable long-term rewards.

- Ride the wave of AI innovation by exploring these 27 AI penny stocks involved in automation, big data, and digital intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ASML

ASML Holding

Provides lithography solutions for the development, production, marketing, sales, upgrading, and servicing of advanced semiconductor equipment systems.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives