- United States

- /

- Semiconductors

- /

- NasdaqGS:ARM

Can Arm (ARM) Leverage AI Partnerships Without Heightening Investor Concerns Over Sector Valuations?

Reviewed by Sasha Jovanovic

- Arm Holdings participated in the PyTorch Conference 2025 in San Francisco on October 22 and 23, with presentations by Gian Marco Iodice and Sharbani Roy, while its recent initiatives include expanding its Flexible Access licensing program and collaborating with Meta Platforms for AI-driven personalization systems.

- This collaboration with Meta, involving a US$1.5 billion investment in an Arm-powered data center, highlights Arm's growing influence and pivotal role in the AI ecosystem.

- We'll examine how broader investor caution toward high AI sector valuations may affect Arm Holdings' growth expectations and risk outlook.

Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

Arm Holdings Investment Narrative Recap

Arm Holdings attracts shareholders who believe in its long-term leadership in AI data centers and edge computing, with the central catalyst being adoption of Arm-based custom silicon by major cloud and platform providers. The recent dip in SoftBank and Arm’s share prices, connected to investor caution over rich AI sector valuations, does not materially change the primary short-term focus on Arm’s data center momentum, but it does reinforce the risk of ongoing valuation sensitivity that could impact sentiment and capital flows.

Among recent business moves, Arm’s expanded Flexible Access licensing program, now covering the Armv9 edge AI platform, stands out as vital for supporting the AI data center growth thesis. By making leading-edge IP more accessible, the company is positioning itself to benefit as hyperscale and enterprise partners scale out new AI workloads, tying directly to the main growth catalyst highlighted by the Meta partnership and related conference activity.

But on the flip side, investors should be aware that this bullish setup exists alongside the risk that high valuations and shifting investor sentiment can lead to...

Read the full narrative on Arm Holdings (it's free!)

Arm Holdings is projected to reach $7.4 billion in revenue and $2.3 billion in earnings by 2028. This outlook assumes annual revenue growth of 21.5% and an earnings increase of $1.6 billion from the current $699 million.

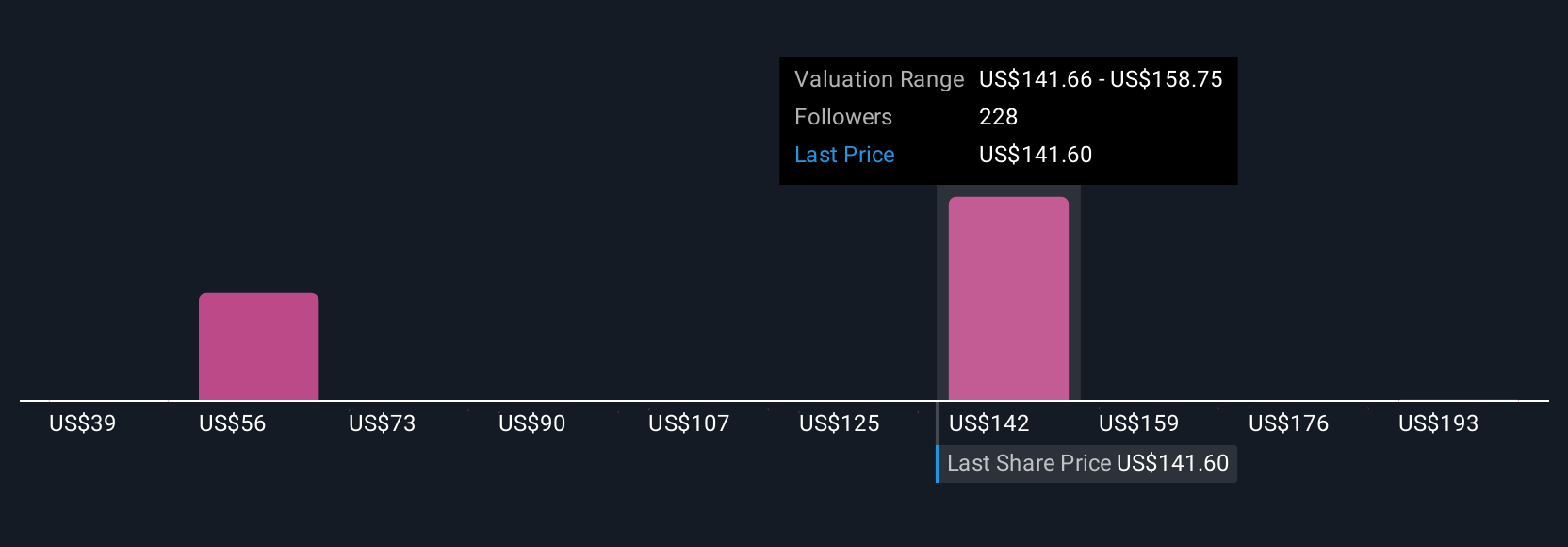

Uncover how Arm Holdings' forecasts yield a $157.52 fair value, in line with its current price.

Exploring Other Perspectives

Some analysts see even faster growth ahead, with top estimates putting Arm’s annual revenue at US$8.6 billion by 2028. If you’re considering what could accelerate or hold back Arm’s success, remember that a few are forecasting Arm’s market share in data center CPUs could soar beyond 75 percent. These more optimistic voices highlight just how widely opinions differ and why the latest news could be a turning point for the company’s outlook.

Explore 17 other fair value estimates on Arm Holdings - why the stock might be worth as much as 31% more than the current price!

Build Your Own Arm Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Arm Holdings research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Arm Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Arm Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ARM

Arm Holdings

Arm Holdings plc architects, develops, and licenses central processing unit products and related technologies for semiconductor companies and original equipment manufacturers.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion