- United States

- /

- Semiconductors

- /

- NasdaqGS:ARM

Arm’s Expanding AI Partnerships and Chip Adoption Might Change The Case For Investing In Arm Holdings (ARM)

Reviewed by Sasha Jovanovic

- At the recent PyTorch Conference held in San Francisco, Arm Holdings expanded its AI ecosystem presence, with company leaders presenting alongside industry partners.

- This event follows news that Qualcomm has adopted Arm’s latest chip architecture and Arm has deepened its collaboration with Meta to improve AI efficiency across devices and data centers.

- We'll examine how Arm's growing influence in AI partnerships and next-generation chip adoption could impact its future investment appeal.

Find companies with promising cash flow potential yet trading below their fair value.

Arm Holdings Investment Narrative Recap

Arm Holdings' investment case centers on its ability to capture outsized royalty growth as the shift to AI data centers and next-gen chipsets gathers momentum. The latest AI ecosystem collaborations, such as those showcased at the PyTorch Conference, reinforce Arm's leadership narrative, but do little to address the main short-term catalyst, further premiumization of its architecture in flagship devices. Key risks remain heavy reliance on the premium smartphone market and intensifying R&D investment, which could strain future earnings if not carefully balanced.

Of recent announcements, Qualcomm’s adoption of Arm’s ninth-generation chip architecture is the most relevant. This development underscores Arm’s ongoing success in deepening penetration across flagship chipsets, a catalyst that could help drive higher royalty rates. While ecosystem partnerships attract headlines, it’s meaningful customer adoption of Arm’s newest platforms that moves the catalyst needle for top-line growth.

However, investors should be aware that, despite these growth opportunities, ongoing concentration in smartphones and escalating R&D spending mean...

Read the full narrative on Arm Holdings (it's free!)

Arm Holdings' outlook anticipates $7.4 billion in revenue and $2.3 billion in earnings by 2028. This scenario is built on forecast annual revenue growth of 21.5% and an increase in earnings of approximately $1.6 billion from current earnings of $699 million.

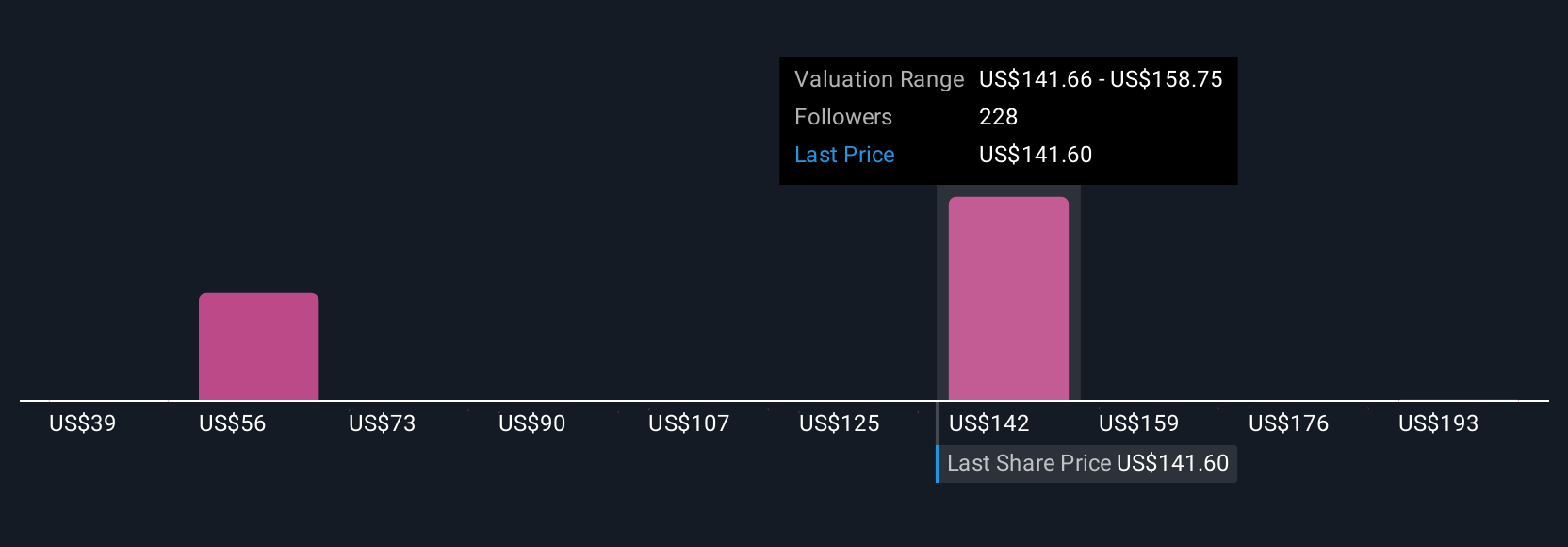

Uncover how Arm Holdings' forecasts yield a $155.61 fair value, a 10% downside to its current price.

Exploring Other Perspectives

The most optimistic analysts anticipate annual revenue growth above 27 percent and a leap in profit margins as Arm extends its data center reach. Compared to consensus, these forecasts reflect much greater confidence in new platform adoption and market share, but they may underestimate emerging risks from rival open-source designs. Your beliefs about Arm’s future could differ widely, making it important to weigh more than one view before deciding.

Explore 17 other fair value estimates on Arm Holdings - why the stock might be worth as much as 21% more than the current price!

Build Your Own Arm Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Arm Holdings research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Arm Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Arm Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ARM

Arm Holdings

Arm Holdings plc architects, develops, and licenses central processing unit products and related technologies for semiconductor companies and original equipment manufacturers.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives