- United States

- /

- Semiconductors

- /

- NasdaqGS:AOSL

Alpha and Omega Semiconductor Limited (NASDAQ:AOSL) Have a Great Shareholder Mix

There are a few main types of shareholders which every investor should pay attention to:

- The institutions - Large private and public organizations that adopt mostly long strategies, but if they are active traders then be careful with larger stock volatility

- The general public - This group comes with a positive and a negative. The positive is when they hold or buy shares in a company with a future. The negative is when they don’t vote their shares and management circumvents them to propel their own agenda

- Insiders of the company - We want these to have between 5 and 30 percent of the ownership, depending on the size of the company. Why? Because they should have enough skin in the game to want to improve the business but not a majority stake (51%+) which makes them cling to control

- The government - Rare in US stocks. Usually present in European and Developing markets - Companies with high government stakes tend to be risk averse, ineffective and sometimes pay too much in taxes.

Every investor in Alpha and Omega Semiconductor Limited ( NASDAQ:AOSL ) should be aware of the most powerful shareholder groups. As Nassim Nicholas Taleb said, 'Don’t tell me what you think, tell me what you have in your portfolio.

So let’s break down the ownership mix.

See our latest analysis for Alpha and Omega Semiconductor

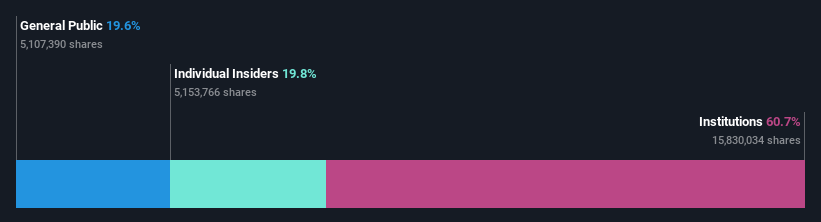

NasdaqGS:AOSL Ownership Breakdown, June 2021

Institutions at 60.7%

The main thing to know about institutions is that they follow a pre-set strategy. They can be long on growth stocks, pick smaller companies for diversification, or have a value approach and turn over large portions of their positions when a stock price approaches their target price.

Institutions take calculated risks, they expect a stock to perform a certain way, if it doesn't, they usually slowly unwind their position without scaring other shareholders. If the market does not perform on the other hand, they may engage in a sell off.

What investors need to know about institutions is that they usually do not interfere with management on big moves because it is more profitable to just find a better stock than to influence a company which they might end up selling a year down the line.

For AOSL this means that the 60.7% institution ownership will prompt the CEO and Management to perform but not to necessarily change.

Insider Ownership at 19.5%

Looking at our data, we can see that the largest shareholder is the CEO Mike Fushing Chang with 16% of shares outstanding.

It is great to see insiders so invested in the business. It might be worth checking if those insiders have been buying recently.

General Public Ownership at 20%

While this size of ownership may not be enough to sway a policy decision in their favor, they can still make a collective impact on company policies and move the price.

Key Takeaway

Alpha and Omega Semiconductor Limited have a great and balanced mix of ownership. It seems that institutions provide enough interest for the equity, which the company can use to grow, and that management has a significant portion of skin in the game to work towards increasing the value of the company.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:AOSL

Alpha and Omega Semiconductor

Designs, develops, and supplies power semiconductor products for computing, consumer electronics, communication, and industrial applications in Hong Kong, China, South Korea, the United States, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives