- United States

- /

- Semiconductors

- /

- NasdaqGS:AMKR

Assessing Amkor Technology After Strong 2024 Gains and Rising Advanced Packaging Demand

Reviewed by Bailey Pemberton

Deciding what to do with Amkor Technology stock? You are not alone. With semiconductor stocks taking center stage, Amkor’s share price has drawn fresh attention, especially after its solid run this year. If you have watched Amkor move, you have noticed the stock rising 21.1% so far in 2024, tacking on gains of 16.5% in just the past month, and up 2.8% in one week. While some may wonder if most of the value is already baked in, Amkor’s longer-term climb of nearly 157.3% over five years shows it is no stranger to outperformance, particularly when industry tailwinds are in play.

Much of this renewed momentum ties back to shifting global supply chain priorities and the increasing push for advanced packaging in the chip sector. Market watchers have taken note, which may explain the cautious but growing optimism you are seeing reflected in the price. Still, the debate now centers on whether Amkor is undervalued or if the easy gains have been made.

Digging into the valuation, Amkor currently earns a value score of 3 out of 6, meaning it checks the box for being undervalued on half of the metrics analysts use. With these numbers in mind, it is a perfect moment to size up the traditional valuation approaches. There is also an even smarter method to make sense of Amkor’s value by the end of this article.

Why Amkor Technology is lagging behind its peers

Approach 1: Amkor Technology Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s value. This approach helps investors gauge what a business is worth based on its ability to generate cash in the years ahead.

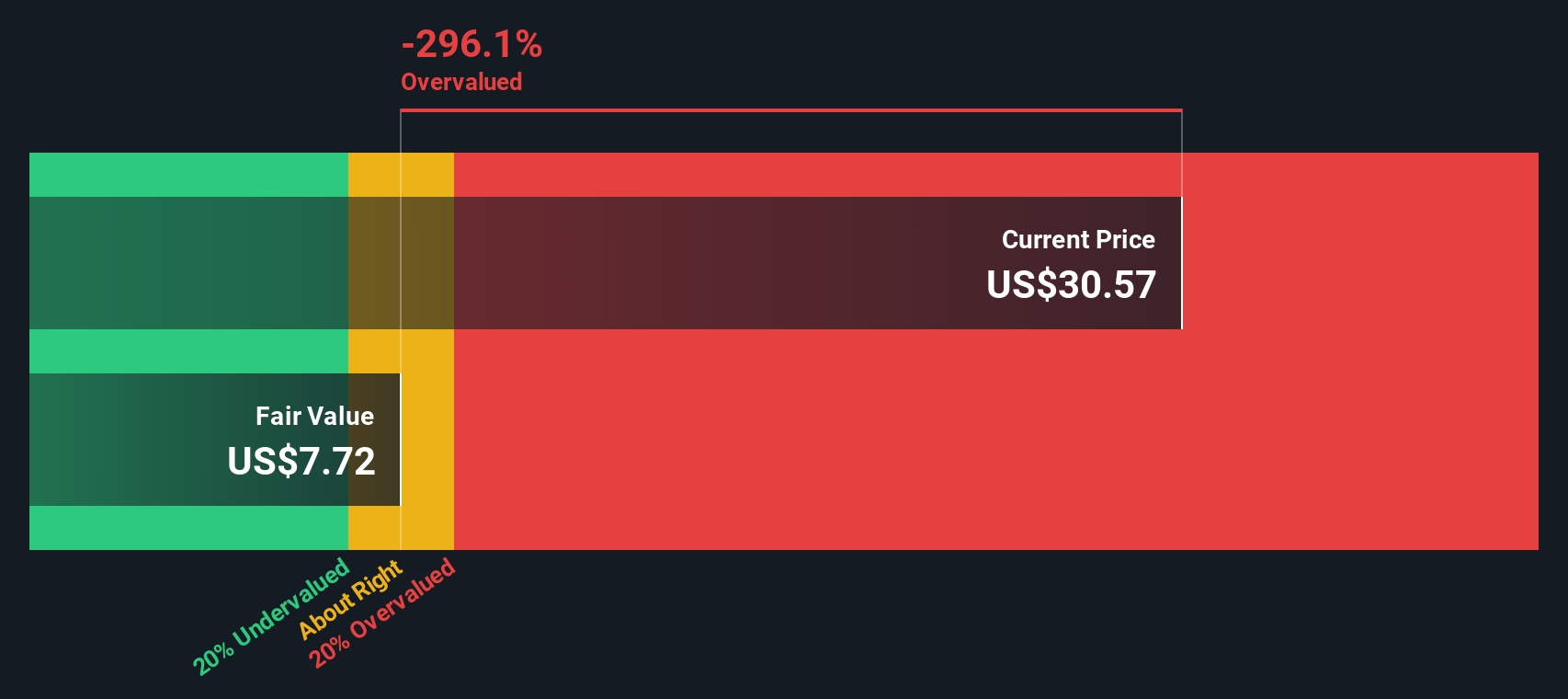

For Amkor Technology, the DCF uses a 2 Stage Free Cash Flow to Equity model and projects future cash flows in millions of dollars ($). Amkor’s latest twelve-month Free Cash Flow stands at $248.0 million. Analyst forecasts see cash flow at $196.8 million by the end of 2027, with figures for subsequent years extrapolated by Simply Wall St, estimating around $195.9 million in 2035. Over the next decade, free cash flow is projected to fluctuate but generally remain below $200 million annually.

Based on these cash flow projections, the DCF model calculates Amkor’s fair value at $7.82 per share. This is significantly lower than the current market price and implies the stock is trading at a 303.1% premium to its intrinsic value. In summary, the DCF perspective indicates that Amkor Technology shares are substantially overvalued at today's levels.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Amkor Technology may be overvalued by 303.1%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Amkor Technology Price vs Earnings (P/E)

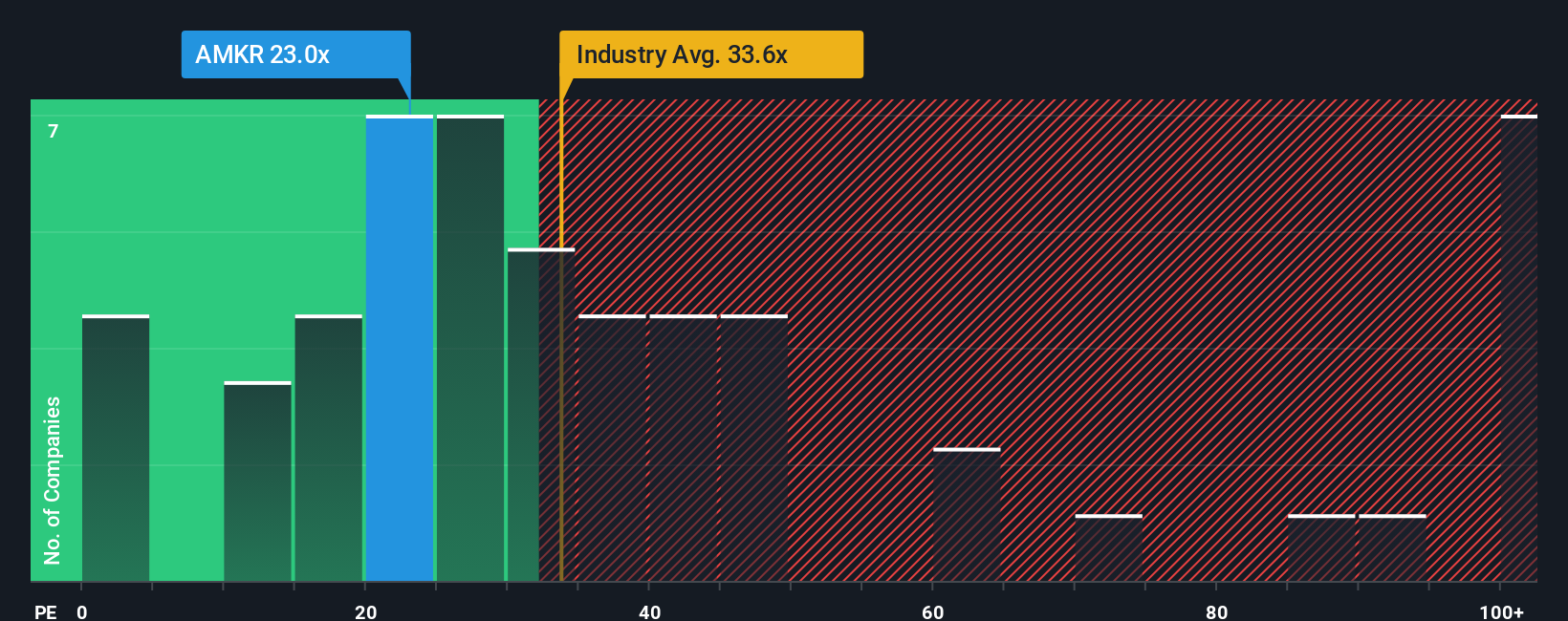

The Price-to-Earnings (P/E) ratio is the market’s go-to yardstick for evaluating profitable companies like Amkor Technology, as it compares a company’s share price to its annual earnings. For profit-generating businesses, the P/E ratio helps investors gauge whether a stock is trading at a reasonable price compared to its earning power.

Growth expectations and perceived risk are major factors here. Fast-growing or low-risk companies tend to command higher P/E ratios. On the other hand, slower growth or higher uncertainty can reduce what investors are willing to pay for each dollar of earnings.

As of now, Amkor Technology trades at a P/E of 25.6x. That is notably lower than both the semiconductor industry average of 35.6x and the peer average of 39.0x, positioning Amkor as relatively cheap on a surface-level comparison. To get a clearer picture, we look at Simply Wall St’s “Fair Ratio,” which, at 32.3x, reflects a tailored expectation based on Amkor’s current growth pace, profit margin, market cap, and risk profile. This approach is more comprehensive than relying solely on industry or peer comparisons, as it accounts for factors unique to Amkor’s business and future outlook.

Comparing Amkor’s actual P/E to its Fair Ratio shows the stock is trading below what would be considered fair value for its circumstances, suggesting it could be undervalued at present levels.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

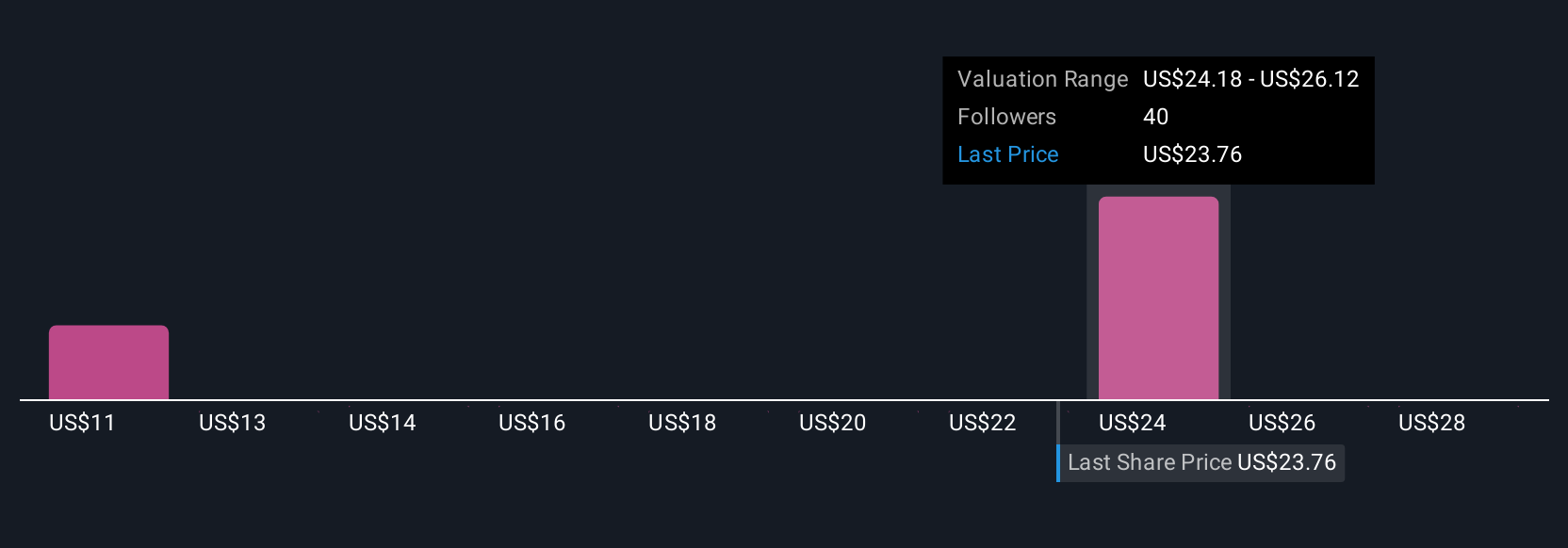

Upgrade Your Decision Making: Choose your Amkor Technology Narrative

Earlier we mentioned that there’s an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personalized story or viewpoint about a company, bringing together your understanding of its future prospects and how those expectations translate into numbers regarding fair value, revenue, earnings, and profit margins. Rather than focusing on just a single figure or model, Narratives connect the company’s real-world story to a financial forecast and ultimately an actionable fair value. Narratives are available to everyone on Simply Wall St's Community page, making sophisticated analysis accessible for all investors.

This tool helps you decide when to buy or sell by showing how your Narrative’s fair value stacks up against the current share price, and it automatically adapts as new news, earnings, or industry updates come in, keeping your investment thesis fresh and relevant. For example, with Amkor Technology, some investors have built bullish Narratives, projecting robust earnings growth from advanced packaging and AI demand, leading to higher price targets. Others see risks from heavy capital expenditure or supply chain exposures, resulting in more conservative estimates and lower valuations.

Narratives empower you to move beyond standard valuation formulas and truly connect your conviction with the latest company updates, so you can invest with clarity and confidence.

Do you think there's more to the story for Amkor Technology? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMKR

Amkor Technology

Provides outsourced semiconductor packaging and test services in the United States, Japan, Europe, and the Asia Pacific.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives