- United States

- /

- Semiconductors

- /

- NasdaqGS:AMKR

A Look at Amkor Technology’s (AMKR) Valuation After Debt Restructuring and Index Removal

Reviewed by Kshitija Bhandaru

Here’s something to give investors pause: Amkor Technology (AMKR) just executed a $500 million senior notes offering while simultaneously announcing its plan to redeem $400 million worth of older, higher-interest debt. This shuffle in the capital structure, paired with its recent exit from the PHLX Semiconductor Sector Index, isn’t the type of headline that usually turns heads. Still, these moves signal management’s intent to control costs and free up cash, even as operational headwinds like tight margins and deferred customer purchases persist.

What’s catching attention is that, despite those hurdles, Amkor Technology’s shares have been on the move. Over the past month, the stock has climbed over 18%, and it surged by 37% across the past three months. Even stretching back several years, those who’ve held on have seen meaningful gains. Momentum appears to be building again after a year where performance lagged, as the company’s latest financial engineering seems to spark new questions about its valuation.

So after all this action and a surprisingly strong rally, is Amkor Technology a value play that is still flying under the radar, or has the market already priced in future growth?

Most Popular Narrative: 17% Overvalued

The prevailing market narrative suggests that Amkor Technology is currently trading at a significant premium to its fair value. Analyst consensus is pricing in a more optimistic future than underlying fundamentals may warrant.

"The accelerated adoption of AI in both edge devices and data centers is driving substantial demand for advanced semiconductor packaging, with Amkor winning high-volume manufacturing contracts (e.g., High-Density Fan-Out and 2.5D technologies) and rapidly ramping capacity for lead customers. This is expected to meaningfully boost top-line revenue growth and increase long-term earnings visibility."

Curious what’s fueling the “overvalued” call? The narrative hinges on aggressive growth assumptions and bold profit margin goals that could signal big surprises ahead, or a reality check. Which projections put this stock under the microscope, and what future baseline are analysts betting on? Take a closer look under the hood of this consensus. It just might reshape your view of what’s possible for Amkor.

Result: Fair Value of $24.88 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing operational challenges in Japan, as well as heavy capital expenditures, could put long-term profitability and analyst projections at risk.

Find out about the key risks to this Amkor Technology narrative.Another View: Look Beyond the Numbers

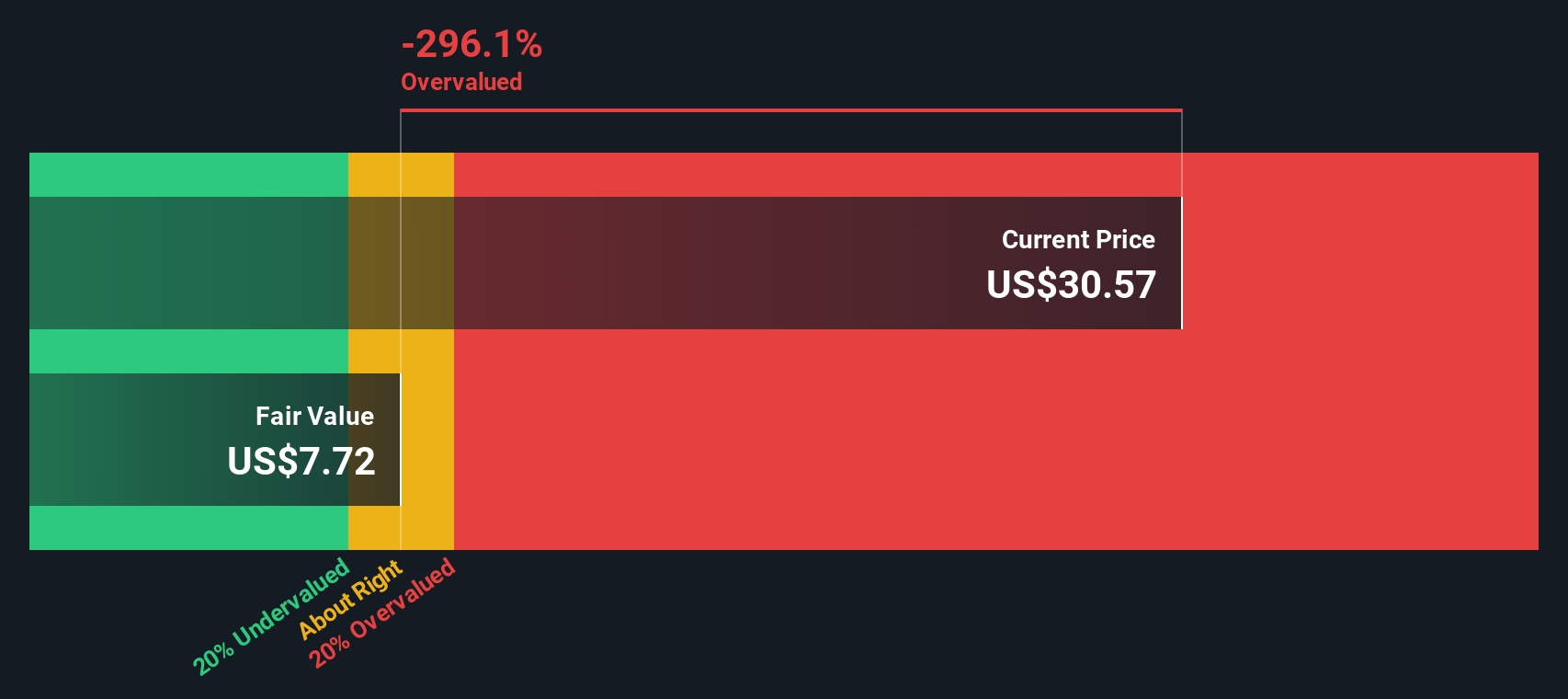

While analyst projections suggest Amkor Technology is priced for aggressive growth, our SWS DCF model arrives at a sharply different conclusion and sees the shares as materially overvalued. Does this disconnect hint at hidden risks, or is the market seeing something the models cannot capture?

Look into how the SWS DCF model arrives at its fair value.

Stay updated when valuation signals shift by adding Amkor Technology to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Amkor Technology Narrative

If you’re not convinced or want to follow your own trail of research, you can shape your perspective and run your own checks in minutes with Do it your way.

A great starting point for your Amkor Technology research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Why settle for one opportunity? Get ahead of the market by targeting the trends and sectors propelling tomorrow’s winners. You’ll sharpen your edge and spot game-changers before most investors even notice.

- Uncover hidden gems positioned for explosive growth when you use our undervalued stocks based on cash flows, which pinpoint stocks trading at a discount to their cash flow potential.

- Target high-yield payouts and reliable income streams by using the dividend stocks with yields > 3% to spot companies with consistently strong and attractive dividends.

- Capitalize on healthcare’s AI revolution and find pioneers in medical technology with the healthcare AI stocks for a fresh approach to cutting-edge breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMKR

Amkor Technology

Provides outsourced semiconductor packaging and test services in the United States, Japan, Europe, and the Asia Pacific.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success