Stock Analysis

- United States

- /

- Semiconductors

- /

- NasdaqGS:AMD

Revenues Not Telling The Story For Advanced Micro Devices, Inc. (NASDAQ:AMD) After Shares Rise 26%

Advanced Micro Devices, Inc. (NASDAQ:AMD) shares have continued their recent momentum with a 26% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 98%.

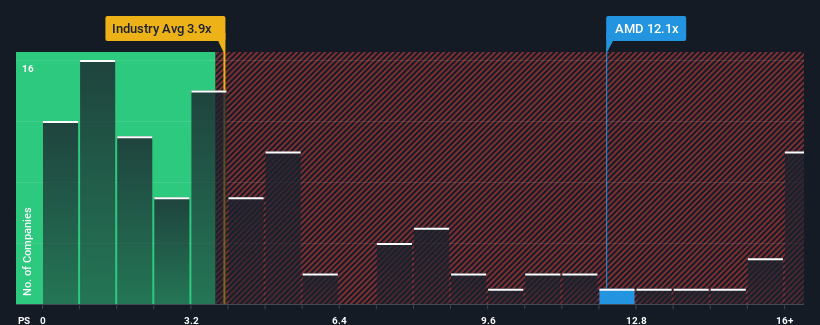

After such a large jump in price, Advanced Micro Devices may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 12.1x, when you consider almost half of the companies in the Semiconductor industry in the United States have P/S ratios under 3.9x and even P/S lower than 1.6x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Advanced Micro Devices

How Has Advanced Micro Devices Performed Recently?

Advanced Micro Devices could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Advanced Micro Devices will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Advanced Micro Devices' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 3.9% decrease to the company's top line. Even so, admirably revenue has lifted 132% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 20% per year as estimated by the analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 25% per annum, which is noticeably more attractive.

With this information, we find it concerning that Advanced Micro Devices is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

Advanced Micro Devices' P/S has grown nicely over the last month thanks to a handy boost in the share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've concluded that Advanced Micro Devices currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. At these price levels, investors should remain cautious, particularly if things don't improve.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Advanced Micro Devices that you should be aware of.

If these risks are making you reconsider your opinion on Advanced Micro Devices, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're helping make it simple.

Find out whether Advanced Micro Devices is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About NasdaqGS:AMD

Advanced Micro Devices

Advanced Micro Devices, Inc. operates as a semiconductor company worldwide.

Flawless balance sheet with reasonable growth potential.