- United States

- /

- Semiconductors

- /

- NasdaqGS:AMD

Is AMD's Recent 19% Price Drop a Sign of Hidden Value in 2025?

Reviewed by Bailey Pemberton

- Ever wondered if Advanced Micro Devices is really worth its price tag, or if there's hidden value the market hasn't noticed yet?

- The stock has had a wild ride, soaring 68.9% year-to-date, but recently pulled back with a 17.4% drop in the last week and a 19.4% slide over the past month.

- Headlines have been buzzing about AMD's latest moves in AI chips and partnerships with major cloud providers, which many believe are fueling both excitement and volatility. Recent regulatory discussions around semiconductor exports and global chip demand have also played a part in shaping investor sentiment.

- Right now, AMD earns a 2 out of 6 on our key valuation checks. Let's dig into what that really means, and stick around because we'll reveal a smarter way to think about valuation before we wrap up.

Advanced Micro Devices scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Advanced Micro Devices Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them back to today’s dollars. This process helps determine what the company might truly be worth, based on its ability to generate cash in the years ahead.

For Advanced Micro Devices, DCF analysis starts with a current free cash flow of $5.57 billion. Analysts supply Free Cash Flow estimates for the next five years, and these projections show healthy expansion. By 2029, anticipated free cash flow reaches $30.92 billion, representing more than a fivefold increase in less than a decade. After 2029, forecasts become extrapolations that extend the growth trend further, relying on underlying momentum and industry factors.

Based on this model, AMD’s estimated intrinsic value is $393.29 per share. This figure is 48.2% higher than the current share price, signaling substantial upside and suggesting that AMD is significantly undervalued by the market right now.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Advanced Micro Devices is undervalued by 48.2%. Track this in your watchlist or portfolio, or discover 927 more undervalued stocks based on cash flows.

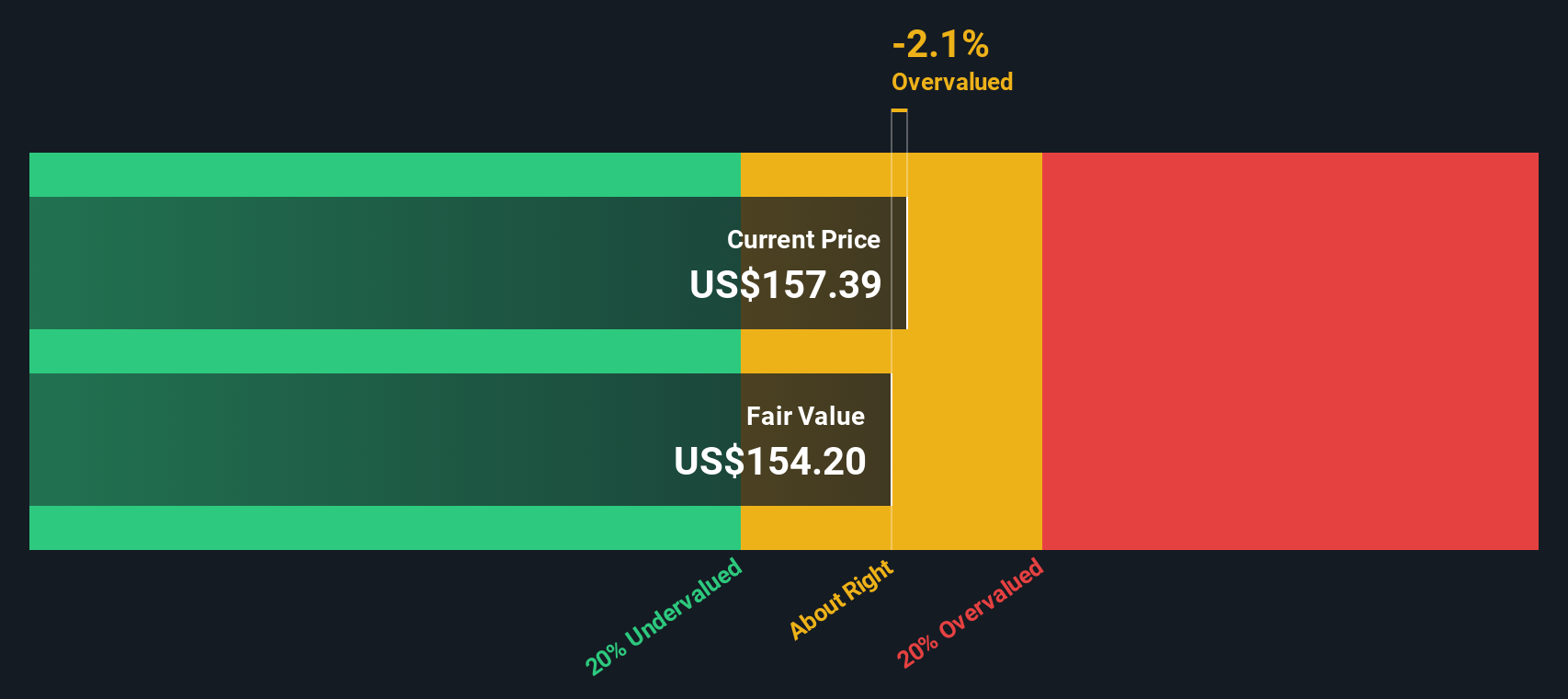

Approach 2: Advanced Micro Devices Price vs Earnings

The Price-to-Earnings (PE) ratio is a go-to method for valuing profitable companies because it directly compares a company's share price with its actual earnings. This is a critical measure of performance. For companies like Advanced Micro Devices that are generating profit, the PE ratio helps investors quickly gauge how much they are paying for each dollar of earnings. This makes it handy for assessing value versus the broader market.

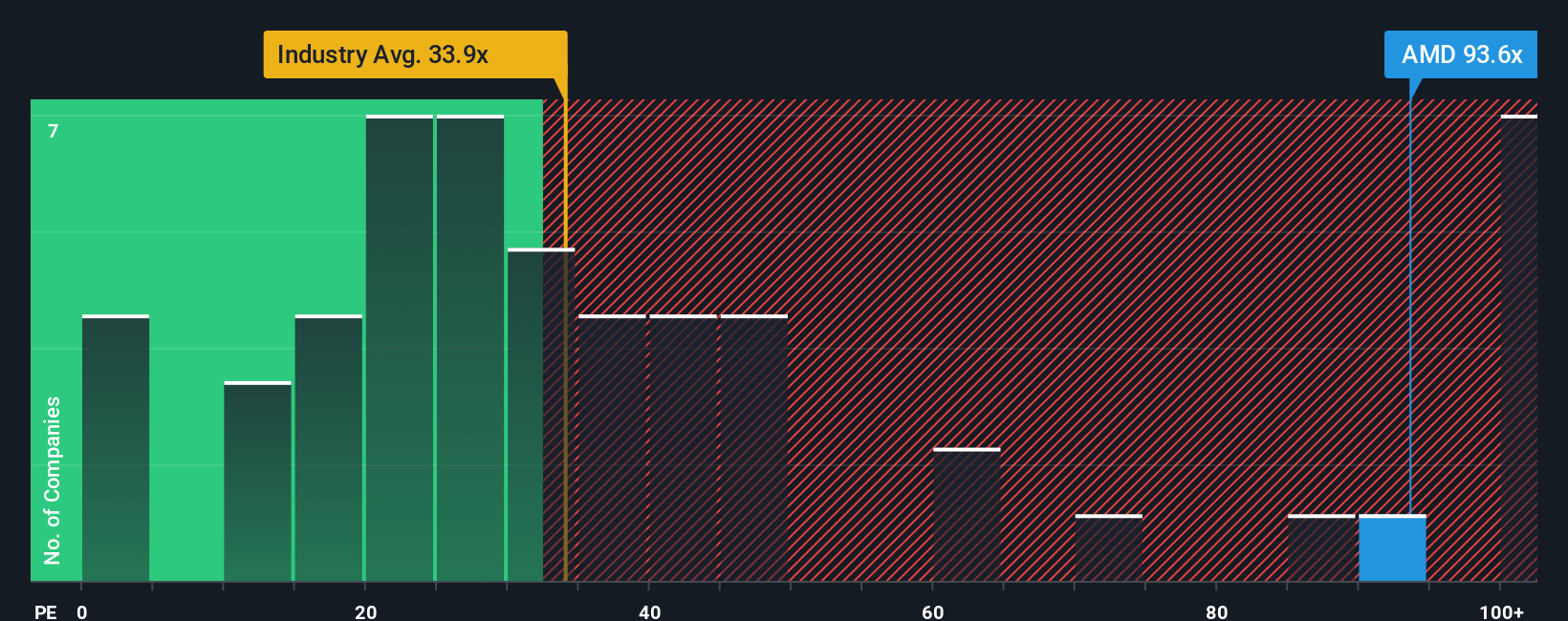

A "normal" or fair PE ratio is not universal. It is influenced by expectations for future growth and the company’s risk profile. Fast-growing firms typically receive a premium, or higher PE, while companies with uncertain outlooks or higher risks may warrant lower PE multiples. With AMD, its current PE sits at 106x. For context, this is much higher than both the semiconductor industry average of 34x and the peer group average of 64x. This shows that investors have lofty growth expectations for AMD compared to similar companies.

This is where Simply Wall St’s Fair Ratio comes in. The Fair Ratio for AMD is calculated at 63x, reflecting not just market averages but a tailored adjustment for AMD’s growth prospects, profit margins, market cap, and industry risks. Unlike a straight peer or industry comparison, the Fair Ratio provides a more balanced and customized benchmark for valuation, making it a stronger reference point for decision-making.

Comparing AMD’s current 106x PE with its Fair Ratio of 63x shows that the stock is trading well above the level its fundamentals would suggest. This signals that AMD’s shares are currently overvalued based on market-adjusted expectations.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1430 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Advanced Micro Devices Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. In simple terms, a Narrative is your unique story or perspective about a company, combining what you think about its future (your expectations for revenue, earnings, and profit margins) with your own estimate of fair value, all laid out in a clear, logical forecast.

Unlike traditional valuation methods that just crunch numbers, Narratives make investing more personal and dynamic by connecting a company's story to its financial outlook and then to a fair value, so every assumption you make is explicit and transparent. Narratives are available directly within the Simply Wall St platform, right on the Community page, and are used by millions of investors to make smarter, more confident choices.

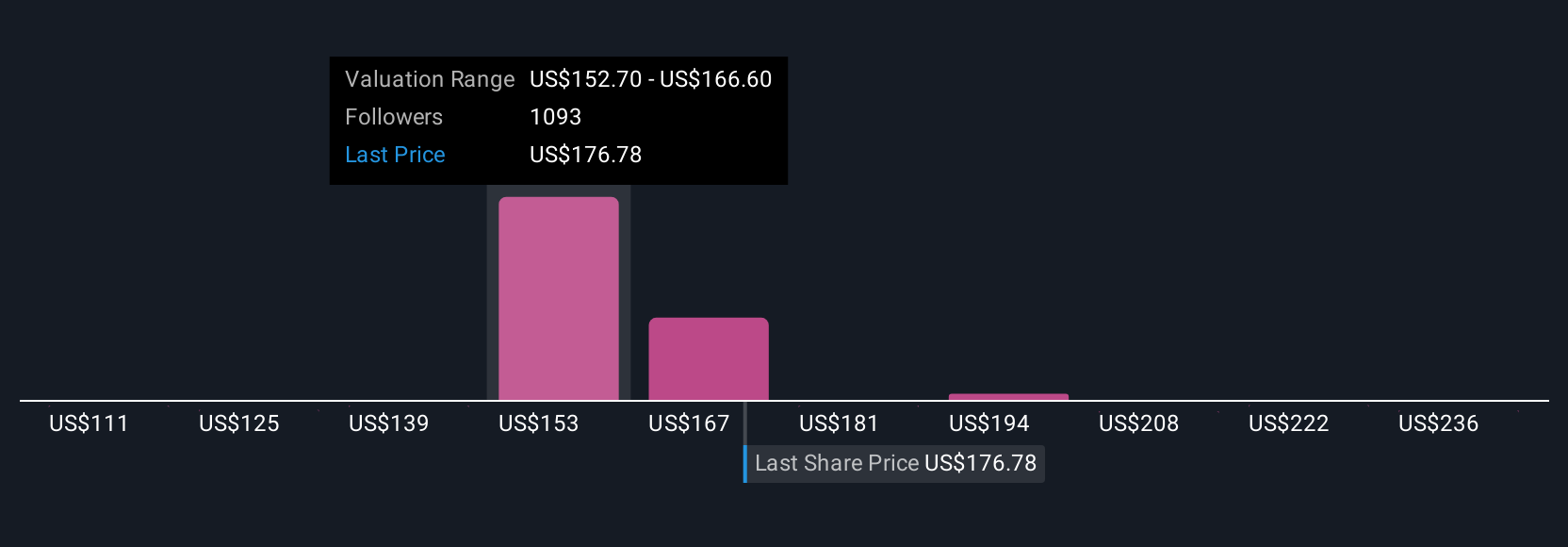

This approach empowers you to decide when to buy or sell based on your Fair Value estimate relative to the current share price, and because Narratives automatically update when new information, such as earnings reports or news, arrives, your investment thesis always stays relevant. For example, some investors see Advanced Micro Devices' fair value closer to $230 thanks to rapid AI and data center growth, while others set it as low as $137 due to rising competition and regulatory risks. The difference comes down to each Narrative's story and numbers.

For Advanced Micro Devices, here are previews of two leading Advanced Micro Devices Narratives:

- 🐂 Advanced Micro Devices Bull Case

Fair Value: $277

Current price is 26.7% below this fair value

Revenue Growth Assumption: 32.9%

- Analyst consensus expects strong growth in AI and data centers, but cautions that current optimism could be ahead of near-term realities given execution risks and potential regulatory headwinds.

- Profitability is projected to expand significantly, with analysts forecasting revenue to grow 18.5% per year and profit margins to more than double in the next three years.

- Despite higher business expectations in the future, the analysts’ price target is lower than today’s market price, suggesting that the market may be overly optimistic at present.

- 🐻 Advanced Micro Devices Bear Case

Fair Value: $194

Current price is 5% above this fair value

Revenue Growth Assumption: 18.8%

- Highlights AMD’s strong positioning in CPUs, GPUs, and AI chips, but warns that intense competition from Nvidia and Intel and reliance on TSMC for manufacturing create ongoing risks.

- Sees AI, data center demand, and partnerships as major growth catalysts, but notes that market saturation, execution risks, and margin pressures could limit near-term upside.

- Suggests the stock is best suited to growth-oriented investors with high risk tolerance, while risk-averse investors may wish to wait for clearer execution in AI and evidence AMD can consistently take share from larger competitors.

Do you think there's more to the story for Advanced Micro Devices? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMD

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives