- United States

- /

- Semiconductors

- /

- NasdaqGS:AMD

How AMD’s Expanding AI Partnerships with OpenAI and Oracle Could Shape the Investment Outlook (AMD)

Reviewed by Sasha Jovanovic

- In recent weeks, AMD has announced major collaborations in the AI and high-performance computing space, including supplying chips for OpenAI's infrastructure, a US$1 billion partnership with the U.S. Department of Energy for supercomputers, and teaming up with Oracle to deploy 50,000 AI processors. These partnerships showcase AMD's growing influence as a supplier of key technologies for both commercial and government-led AI initiatives.

- The depth of AMD's involvement in government-backed AI infrastructure and partnerships with market leaders like OpenAI highlights the company's increasing role in critical national and enterprise computing projects.

- We’ll examine how AMD’s expanded AI partnerships, particularly the deal with OpenAI, may influence its investment outlook and growth expectations.

Find companies with promising cash flow potential yet trading below their fair value.

Advanced Micro Devices Investment Narrative Recap

Owning shares of AMD means betting on the company’s ability to lead and capture growth as AI and high-performance computing reshape the semiconductor market. Investors focused on the stock’s short-term catalysts remain closely attuned to AMD’s AI partnerships and the upcoming earnings report, while the newly announced patent lawsuits from Adeia add a layer of uncertainty, though the immediate financial impact appears limited, ongoing legal risks could influence sentiment and future cost projections.

Among the most relevant recent developments, AMD’s US$1 billion partnership with the U.S. Department of Energy to deliver next-generation supercomputers highlights its prominent role in government-backed tech initiatives. This move not only reinforces AMD’s position in national AI infrastructure but also aligns with market optimism around ramping high-performance computing solutions as a major revenue catalyst.

Yet, investors should also pay close attention to possible disruptions tied to legal disputes, export regulations, or competition...

Read the full narrative on Advanced Micro Devices (it's free!)

Advanced Micro Devices' narrative projects $46.2 billion in revenue and $9.0 billion in earnings by 2028. This requires an 18.5% yearly revenue growth and a $6.8 billion increase in earnings from the current $2.2 billion.

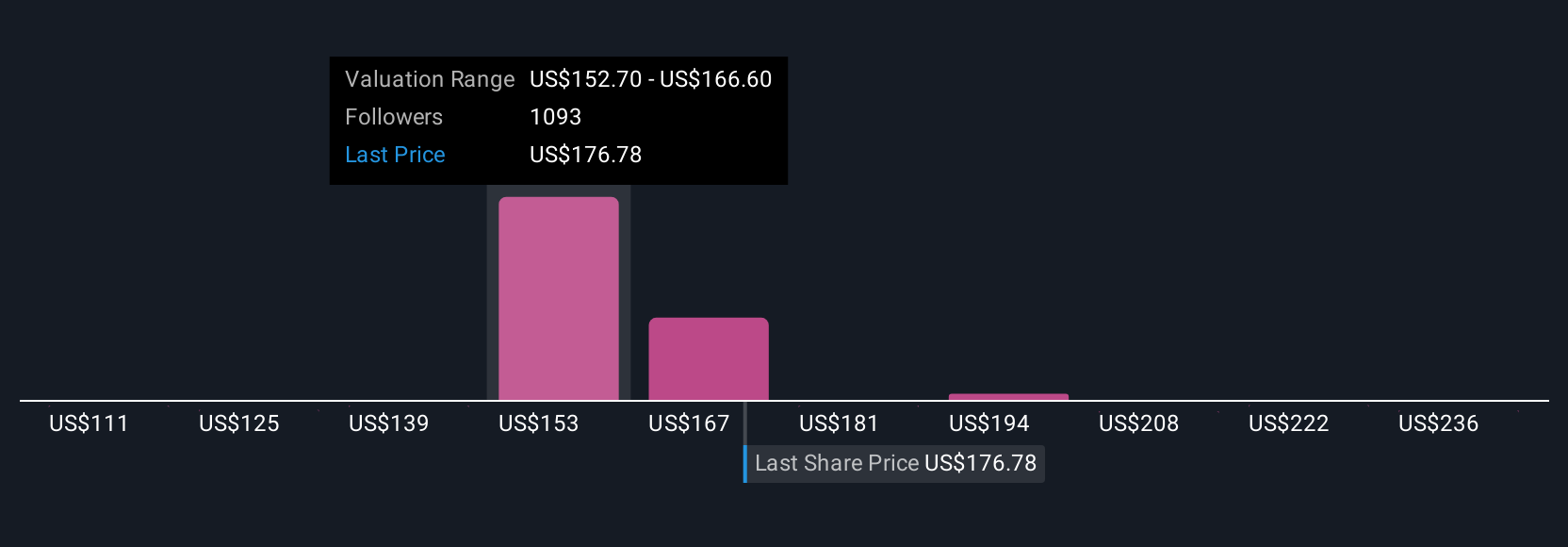

Uncover how Advanced Micro Devices' forecasts yield a $239.11 fair value, a 4% downside to its current price.

Exploring Other Perspectives

Some analysts have been far more optimistic, previously projecting AMD revenue to grow by 26.4 percent a year and earnings to hit US$12.5 billion by 2028. These bullish forecasts highlight confidence in rapid AI data center adoption, but opinions about risks and catalysts now matter more than ever given the recent legal challenge. Whatever your perspective, it pays to consider how quickly expectations can shift after news breaks.

Explore 107 other fair value estimates on Advanced Micro Devices - why the stock might be worth as much as 16% more than the current price!

Build Your Own Advanced Micro Devices Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Advanced Micro Devices research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Advanced Micro Devices research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Advanced Micro Devices' overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMD

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives