- United States

- /

- Semiconductors

- /

- NasdaqGS:AMD

AMD (AMD) Is Up 10.3% After Securing Major AI Cloud Wins With Oracle and OpenAI

Reviewed by Sasha Jovanovic

- In October 2025, Oracle and AMD announced an expanded collaboration where Oracle Cloud Infrastructure will launch a large-scale AI supercluster using 50,000 AMD Instinct MI450 GPUs and AMD's new Helios rack design starting in 2026, with additional significant supply agreements secured with OpenAI for future next-generation AI infrastructure.

- An important takeaway is that AMD’s new hardware platform and marquee cloud deals mark a step change in its ability to compete for hyperscale AI deployments against entrenched industry leaders.

- We’ll explore how these major AI customer wins and the launch of AMD’s Helios platform could reshape expectations for its AI data center growth narrative.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Advanced Micro Devices Investment Narrative Recap

To be a shareholder in AMD, you need to believe in its vision to capture a large share of the accelerating AI and high-performance compute markets. The recent mega-deal with Oracle and OpenAI strengthens AMD’s short-term growth catalyst in data center AI, but execution on these landmark contracts, and timely delivery of Helios hardware, remains the biggest near-term risk. The impact of the news event is clearly material, as it enhances visibility for AMD’s next-generation platforms and hyperscale opportunities.

The most relevant new announcement is Oracle Cloud’s large-scale commitment to deploying 50,000 AMD Instinct MI450 GPUs in its upcoming AI supercluster. This deal not only validates demand for AMD’s MI450 and Helios rack, but also may shift near-term sentiment and expectations for ongoing partnerships. These next steps in hyperscaler adoption highlight how contract wins are vital to support AMD’s AI growth narrative, while any stumble could affect both immediate momentum and longer-term outlook.

But on the flip side, investors should also consider growing risks from execution delays and major customer dependency, especially if...

Read the full narrative on Advanced Micro Devices (it's free!)

Advanced Micro Devices' narrative projects $46.2 billion in revenue and $9.0 billion in earnings by 2028. This requires 18.5% annual revenue growth and a $6.8 billion increase in earnings from the current $2.2 billion.

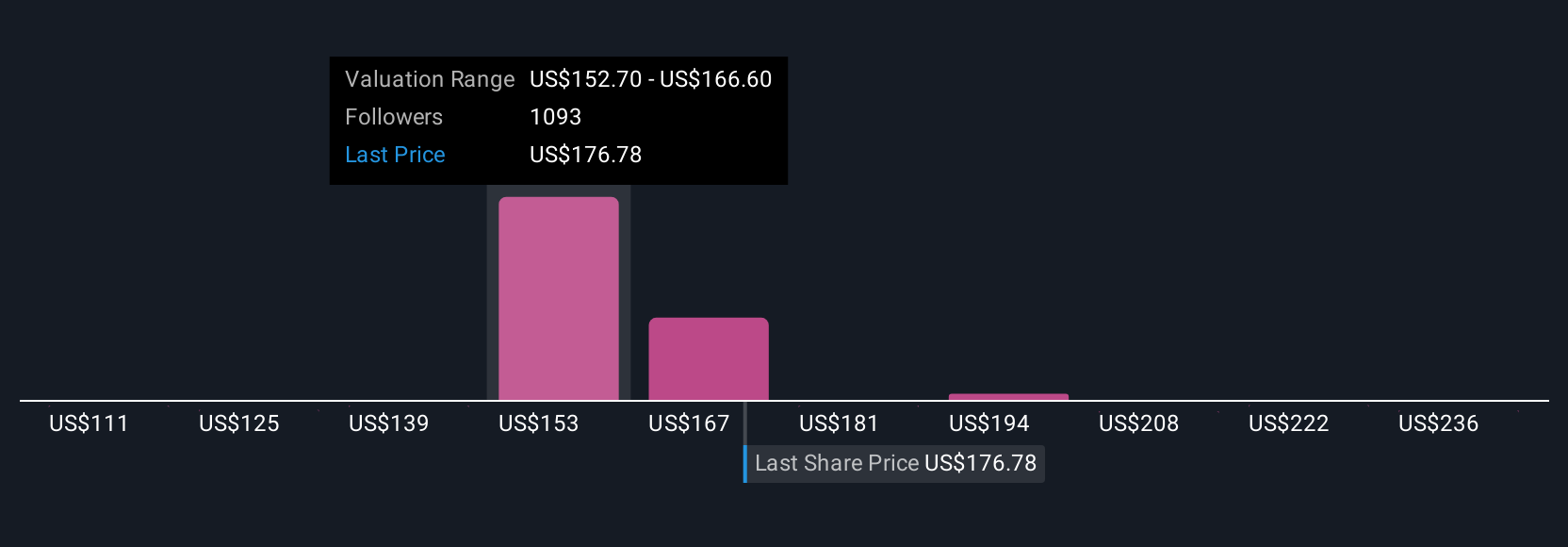

Uncover how Advanced Micro Devices' forecasts yield a $213.93 fair value, a 11% downside to its current price.

Exploring Other Perspectives

Some of the lowest analyst estimates forecasted AMD’s annual revenue to reach US$44,800,000,000 by 2028, with a much less optimistic view than the consensus. While today’s news could shift these projections, it is important to remember that expectations can swing widely depending on whether you focus on big partnerships or see ongoing export and manufacturing risks as limiting factors. Be sure to compare both perspectives as you form your own view.

Explore 108 other fair value estimates on Advanced Micro Devices - why the stock might be worth as much as 21% more than the current price!

Build Your Own Advanced Micro Devices Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Advanced Micro Devices research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Advanced Micro Devices research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Advanced Micro Devices' overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMD

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives