- United States

- /

- Semiconductors

- /

- NasdaqGS:AMAT

How Investors May Respond To Applied Materials (AMAT) Workforce Reductions and Automation Push

Reviewed by Sasha Jovanovic

- Earlier this week, Applied Materials announced a global restructuring plan that will reduce its workforce by about 1,400 roles, aiming to streamline operations and adapt to automation and shifting geographic demand.

- This decision coincided with widespread analyst optimism about the company’s long-term positioning despite new U.S. export controls impacting business in China and anticipated near-term restructuring charges.

- As the company accelerates automation and digital transformation, we’ll explore how these changes may impact the broader investment narrative for Applied Materials.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Applied Materials Investment Narrative Recap

Investors in Applied Materials typically need confidence in the company’s ability to deliver solutions for AI-driven semiconductor innovation and capitalize on long-term growth in advanced chip manufacturing. The recent announcement to reduce its global workforce by 4% appears aimed at positioning the company for improved efficiency, but it does not materially alter the primary short-term catalyst, which remains the ramp in demand for advanced manufacturing equipment, nor does it reduce the largest risk tied to revenue uncertainty from ongoing US-China export restrictions.

Among recent events, the unveiling of new advanced semiconductor manufacturing systems targeted at enhancing AI chip performance is a key development connected to Applied Materials’ growth catalysts. This announcement reinforces the company’s alignment with rising demand for high-performance computing and advanced packaging, both considered essential drivers of future revenue and margin expansion.

Yet, in contrast to this optimistic outlook, investors should be aware that unresolved export license risks with China could quickly shift the...

Read the full narrative on Applied Materials (it's free!)

Applied Materials' narrative projects $32.5 billion revenue and $9.2 billion earnings by 2028. This requires 4.3% yearly revenue growth and a $2.4 billion earnings increase from $6.8 billion.

Uncover how Applied Materials' forecasts yield a $215.06 fair value, a 6% downside to its current price.

Exploring Other Perspectives

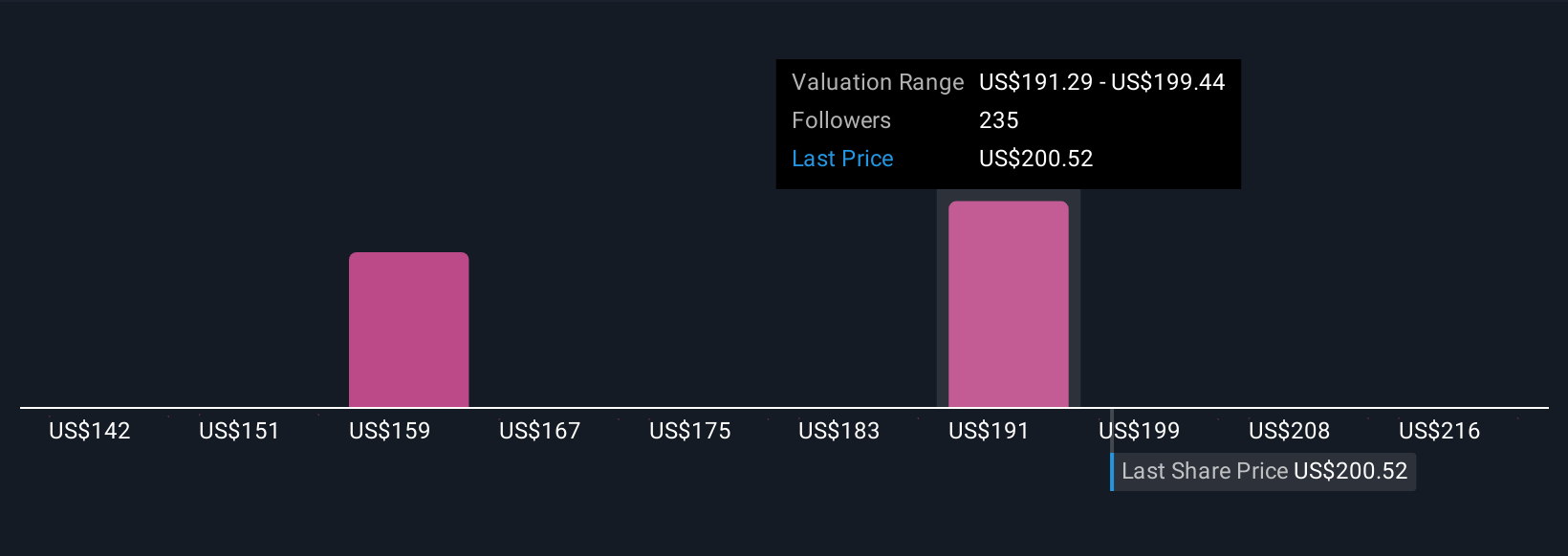

Fair value estimates from 17 members of the Simply Wall St Community for Applied Materials range widely from US$146 to US$230.54 per share. As you weigh these diverse views, keep in mind that export license uncertainty with China could have broader implications for future revenue and competitive position. Explore additional analyses to see how these opinions compare.

Explore 17 other fair value estimates on Applied Materials - why the stock might be worth as much as $230.54!

Build Your Own Applied Materials Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Applied Materials research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Applied Materials research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Applied Materials' overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMAT

Applied Materials

Provides materials engineering solutions, equipment, services, and software to the semiconductor and related industries in the United States, China, Korea, Taiwan, Japan, Southeast Asia, Europe, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion