- United States

- /

- Semiconductors

- /

- NasdaqGS:AMAT

Applied Materials (NASDAQ:AMAT) Will Face the External Threats With a Solid Balance Sheet

Between Evergrande to Omicron, there will be many highlights of 2021, but we can expect semiconductors to rank highly among those.

From geopolitical to supply chain issues, the semiconductor situation forced expansion for all the major producers and propelled sector leaders like Applied Materials, Inc. ( NASDAQ: AMAT ) to new highs.

Overall, the stock is looking to close the year with a 90% gain. Despite this run, it still has a relatively average valuation at P/E 20.

Check out our latest analysis for Applied Materials

Full-year 2021 results

- EPS : US$6.47 (up from US$3.95 in FY 2020).

- Revenue: US$23.1b (up 34% from FY 2020).

- Net income: US$5.89b (up 63% from FY 2020).

- Profit margin: 26% (up from 21% in FY 2020). The increase in margin was driven by higher revenue.

Revenue missed analyst estimates by 1.1%. Earnings per share (EPS) were mostly in line with analyst estimates. Earnings per share (EPS) were mostly in line with analyst estimates.

- Over the next year, revenue is forecast to grow 15%, compared to an 18% growth forecast for the industry in the US.

- Over the last 3 years, on average, earnings per share have increased by 25% per year, but its share price has risen by 71% per year, which means it is tracking significantly ahead of earnings growth.

Meanwhile, Applied Materials signed a 5-year extension research & development agreement with the Institute of Microelectronics, a research institute of Singapore's Agency for Science. The agreement worth US$210m focuses on breakthroughs in heterogeneous integration and advanced packaging for semiconductor innovation.

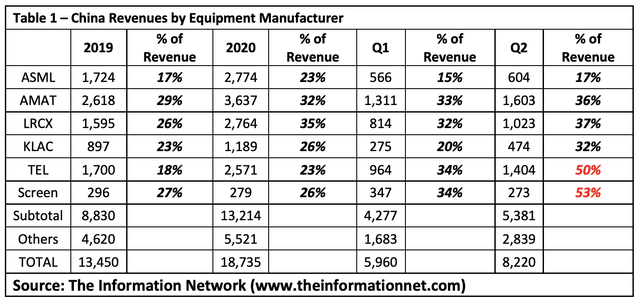

While ties with Singapore seem to be stronger, one of the rare headwinds is growing restrictions on Chinese chipmakers. Further restrictions would certainly impose the export limits and hurt the revenues in the market where AMAT is a leader by a wide margin.

Examining the Balance Sheet

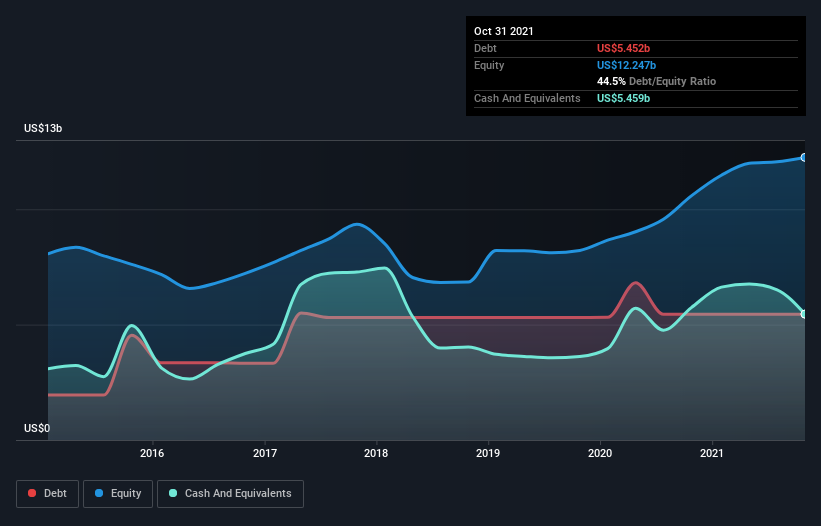

As you can see below, Applied Materials had US$5.45b of debt in October 2021, which is about the same as the year before. You can click the chart for greater detail.

But it also has US$5.46b in cash to offset that, meaning it has US$7.00m net cash.

How Strong Is Applied Materials' Balance Sheet?

The latest balance sheet data shows that Applied Materials had liabilities of US$6.34b due within a year and liabilities of US$7.23b falling due after that.Offsetting these obligations, it had cash of US$5.46b as well as receivables valued at US$5.15b due within 12 months.So its liabilities total US$2.97b more than the combination of its cash and short-term receivables.

Since publicly traded Applied Materials has a market cap of US$144.6b, it seems unlikely that this level of liabilities would be a significant threat.However, we think it is worth keeping an eye on its balance sheet strength, as it may change over time.Despite its noteworthy liabilities, Applied Materials boasts net cash, so it's fair to say it does not have a heavy debt load.

On top of that, Applied Materials grew its EBIT by 62% over the last twelve months, and that growth will make it easier to handle its debt.The balance sheet is the obvious place to start when analyzing debt levels.But it is future earnings, more than anything, that will determine Applied Materials' ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt. Over the last three years, Applied Materials recorded free cash flow worth 73% of its EBIT, which is normal, given that free cash flow excludes interest and tax.This free cash flow puts the company in a good position to pay down debt when appropriate.

Summing up

While it is always sensible to look at a company's total liabilities, it is very reassuring that Applied Materials has US$7.00m in net cash.And we liked the look of last year's 62% year-on-year EBIT growth.So we don't think Applied Materials' use of debt is risky.

The most considerable risk for the company currently lies in the external environment, not internal. The administration in the US has changed, but trade relations with China remain on thin ice. Meanwhile, China has done significant regulatory changes in the domestic market, pushing it 14% in the red for the year.

While the balance sheet is the area to focus on when you are analyzing debt, ultimately, every company can contain risks outside of the balance sheet. To that end, you should be aware of the 1 warning sign we've spotted with Applied Materials .

If, after all that, you're more interested in a fast-growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NasdaqGS:AMAT

Applied Materials

Engages in the provision of manufacturing equipment, services, and software to the semiconductor, display, and related industries.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives