- United States

- /

- Semiconductors

- /

- NasdaqGS:ALGM

Can China’s New Export Controls Reshape Allegro MicroSystems’ (ALGM) Supply Chain Strategy?

Reviewed by Sasha Jovanovic

- Earlier this week, Allegro MicroSystems announced plans to release its second quarter fiscal 2026 financial results before the market opens on October 30, 2025, followed by a conference call with its CEO and CFO to discuss the results and business outlook.

- At the same time, new export controls from China on critical minerals have heightened supply chain uncertainty for companies like Allegro that rely on rare-earth materials used in high-tech manufacturing.

- We'll examine how the increased supply chain risk from China's export controls could influence Allegro MicroSystems' investment narrative.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Allegro MicroSystems Investment Narrative Recap

For investors considering Allegro MicroSystems, the core thesis centers on the company's exposure to electrification trends in automotive and industrial sectors, underpinned by growth in electric vehicles and automation demands. The recent announcement of China's export controls on critical minerals could heighten near-term supply chain risks, but the degree to which this disrupts Allegro’s key short-term growth catalysts, such as automotive design wins and product launches, may not be material if the company has ample inventory or diversified sourcing.

Amidst these uncertainties, Allegro’s upcoming Q2 fiscal 2026 results on October 30, 2025, and the accompanying executive conference call remain the most relevant announcement for investors tracking near-term momentum. This event is likely to provide the most current insights on supply chain management, customer demand, and any early impacts from the export controls that may affect outlook or margin expectations.

In contrast, the greatest risk investors should watch for relates to...

Read the full narrative on Allegro MicroSystems (it's free!)

Allegro MicroSystems' outlook anticipates revenue of $1.2 billion and earnings of $249.0 million by 2028. This is based on analysts' forecasts of a 17.3% annual revenue growth rate and a $317.6 million increase in earnings from current earnings of -$68.6 million.

Uncover how Allegro MicroSystems' forecasts yield a $37.83 fair value, a 46% upside to its current price.

Exploring Other Perspectives

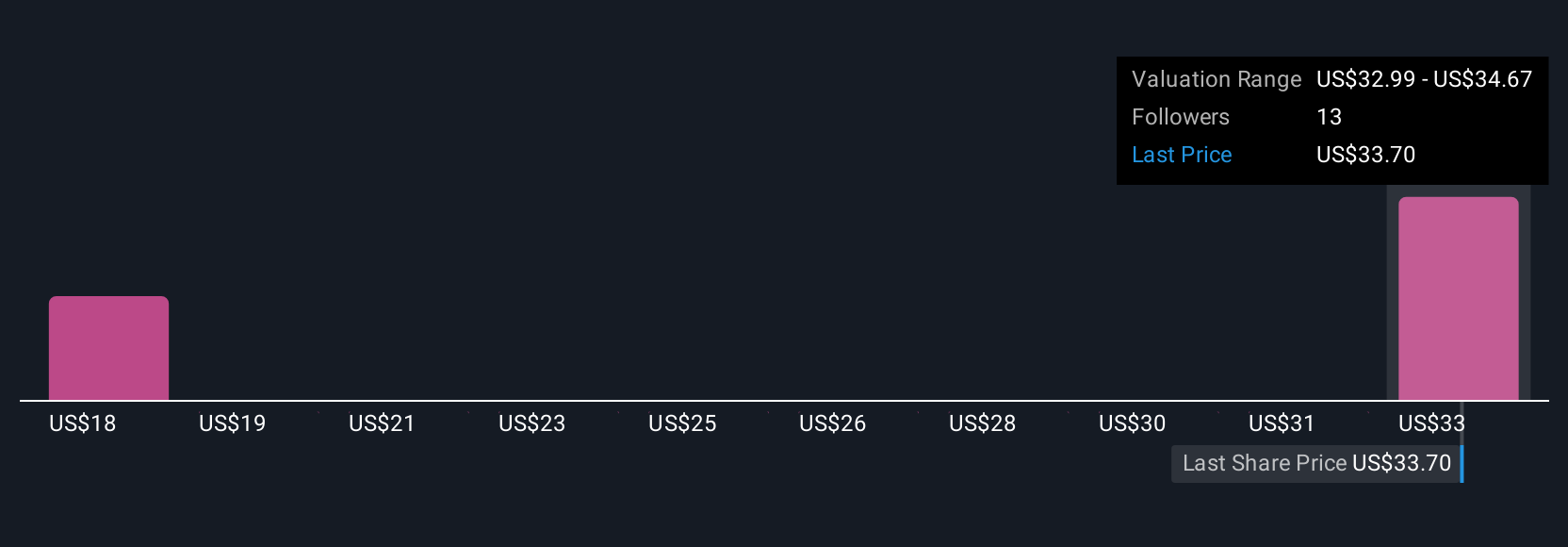

Three members of the Simply Wall St Community have posted fair value estimates for Allegro ranging from US$23 to US$37.83 per share. While these opinions vary widely, supply chain risks tied to China's export controls could shape the company’s performance in ways that aren't fully captured by these pre-news forecasts.

Explore 3 other fair value estimates on Allegro MicroSystems - why the stock might be worth as much as 46% more than the current price!

Build Your Own Allegro MicroSystems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Allegro MicroSystems research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Allegro MicroSystems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Allegro MicroSystems' overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALGM

Allegro MicroSystems

Designs, develops, manufactures, and markets sensor integrated circuits (ICs) and application-specific power ICs for motion control and energy-efficient systems.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion