- United States

- /

- Semiconductors

- /

- NasdaqGS:ALGM

Assessing Allegro MicroSystems (ALGM) Valuation After Sector Lift From Micron’s Bullish Revenue Outlook

Reviewed by Simply Wall St

Allegro MicroSystems (ALGM) climbed about 4% after Micron Technology issued an upbeat revenue forecast, which lifted sentiment across semiconductor names and signaled healthier demand and pricing for AI exposed chipmakers.

See our latest analysis for Allegro MicroSystems.

Today’s move comes after a choppy stretch, with a roughly 15% 3 month share price decline followed by a near 15% 1 month share price rebound. This suggests momentum is tentatively returning despite a stronger 1 year total shareholder return.

If this AI fueled bounce has your attention, it could be a good moment to explore other high growth tech and AI names using high growth tech and AI stocks.

Yet with Allegro still trading below consensus price targets despite strong revenue growth and a recent rebound, investors now face a key question: is this an underappreciated AI enabler, or has the market already priced in its next leg of growth?

Most Popular Narrative Narrative: 30.8% Undervalued

With Allegro MicroSystems last closing at $26.70 against a narrative fair value of $38.58, the story leans toward meaningful upside if forecasts land.

Ongoing investments and recent improvements in proprietary manufacturing and test yield (notably in TMR sensor ICs) are translating to cost reductions and enhanced gross margins, which is expected to continue as product differentiation and scale improve, positively impacting net margins.

Curious how much revenue acceleration, margin expansion, and future earnings power sit behind that upside case? The narrative leans on aggressive, tech style profit math. Want to see the full playbook driving that valuation?

Result: Fair Value of $38.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained auto dependence and intensifying Chinese competition could quickly pressure Allegro’s growth, margins, and ultimately the bullish AI enabler narrative.

Find out about the key risks to this Allegro MicroSystems narrative.

Another Way To Look At Valuation

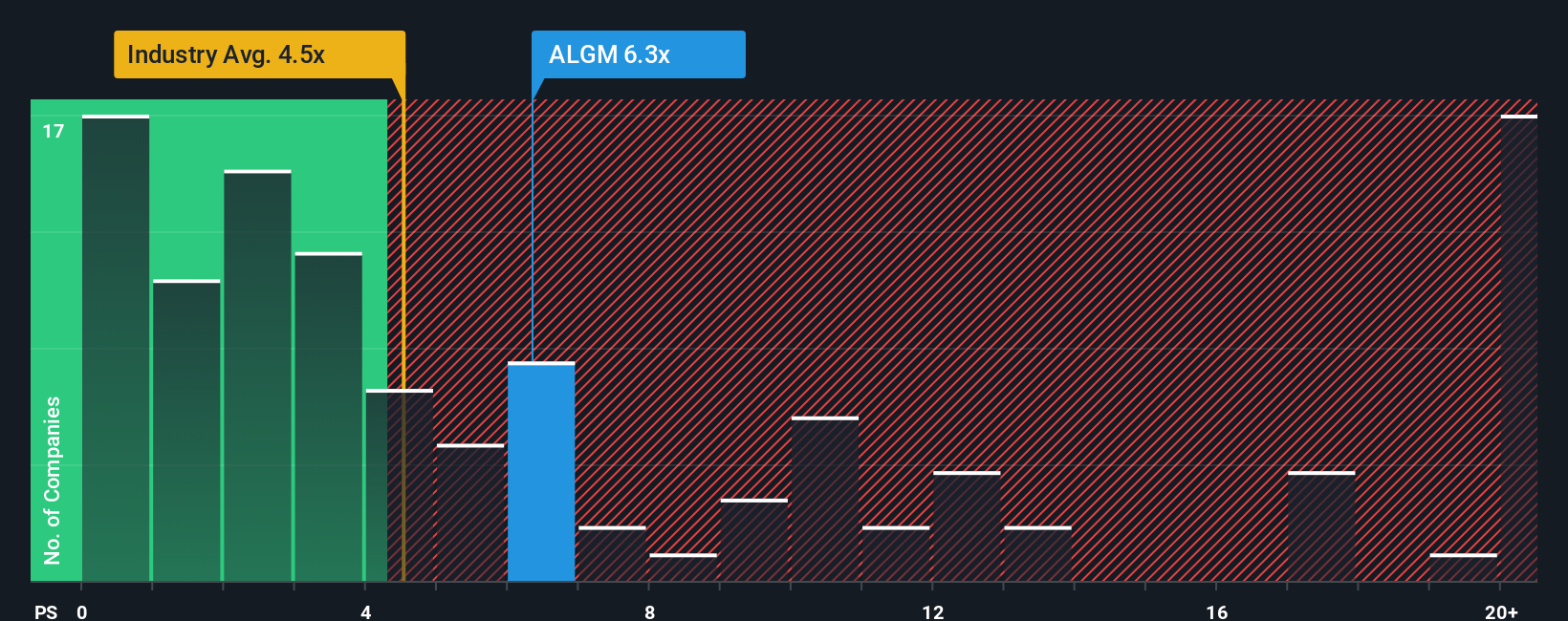

Allegro might look cheap versus narrative fair value and analyst targets, but its price to sales ratio of 6.3 times tells a tougher story. That is richer than the US Semiconductor average of 5.1 times and above a fair ratio of 4.7 times, hinting at downside if sentiment cools. Which signal do you trust more?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Allegro MicroSystems Narrative

If you are not fully aligned with this view or would rather dig into the numbers yourself, you can build a personalized Allegro story in just a few minutes, Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Allegro MicroSystems.

Looking for more investment ideas?

Before you move on, lock in your next smart idea with a quick screen or two on Simply Wall Street, so fresh opportunities do not pass you by.

- Capture potential multi baggers early by scanning these 3625 penny stocks with strong financials, which already back their tiny share prices with solid fundamentals.

- Ride the next wave of innovation by targeting these 25 AI penny stocks, positioned at the intersection of rapid growth and transforming industries with artificial intelligence.

- Boost your income stream by focusing on these 13 dividend stocks with yields > 3%, which combine attractive yields with the potential for long term total returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALGM

Allegro MicroSystems

Designs, develops, manufactures, and markets sensor integrated circuits (ICs) and application-specific power ICs for motion control and energy-efficient systems.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion