- United States

- /

- Semiconductors

- /

- NasdaqGS:ALAB

Will Astera Labs (ALAB) Gain an Edge in Open AI Infrastructure Amid Rising Chiplet Competition?

Reviewed by Sasha Jovanovic

- Astera Labs recently announced a collaboration with Arm Total Design, integrating its Intelligent Connectivity Platform with Arm Neoverse Compute Subsystems to accelerate custom AI infrastructure solutions through multi-protocol chiplet capabilities and validated, interoperable connectivity.

- This initiative comes as the company highlights broad industry momentum around open-standards-based AI infrastructure, showcased in ecosystem collaborations and live demonstrations at the 2025 OCP Global Summit.

- We’ll examine how Astera Labs’ push for open, multi-vendor AI rack infrastructure could reshape its investment narrative in the face of new competition.

We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Astera Labs Investment Narrative Recap

To be a shareholder in Astera Labs, you need to believe in the rising demand for open, multi-vendor AI infrastructure driven by hyperscalers, and that the company can maintain a technological edge even as cloud providers and major chipmakers move rapidly. While the recent collaboration with Arm Total Design expands Astera's ecosystem and highlights momentum for open standards, the most important short-term catalyst, broad AI infrastructure deployments with hyperscale customers, remains fundamentally unchanged. The principal risk continues to be pressure from competitors integrating connectivity directly into their silicon; this news does not materially alter that equation.

Of the recent news, Astera Labs’ unveiling of its PCIe 6 connectivity portfolio earlier this month stands out as especially relevant, as it directly supports the push toward open rack-scale AI architectures shown at the 2025 OCP Global Summit. This product expansion reinforces Astera’s exposure to large-scale deployments, which underpin its growth catalyst of capturing new rack-level AI use cases across a broadening set of cloud customers. Ultimately, investors should be aware that, despite growing industry support for open standards, fierce competition among chipmakers could still threaten Astera Labs’ long-term differentiation if...

Read the full narrative on Astera Labs (it's free!)

Astera Labs' outlook anticipates $1.5 billion in revenue and $393.5 million in earnings by 2028. This scenario assumes a 34.1% annual revenue growth rate and a $293.3 million increase in earnings from the current $100.2 million level.

Uncover how Astera Labs' forecasts yield a $186.22 fair value, a 14% upside to its current price.

Exploring Other Perspectives

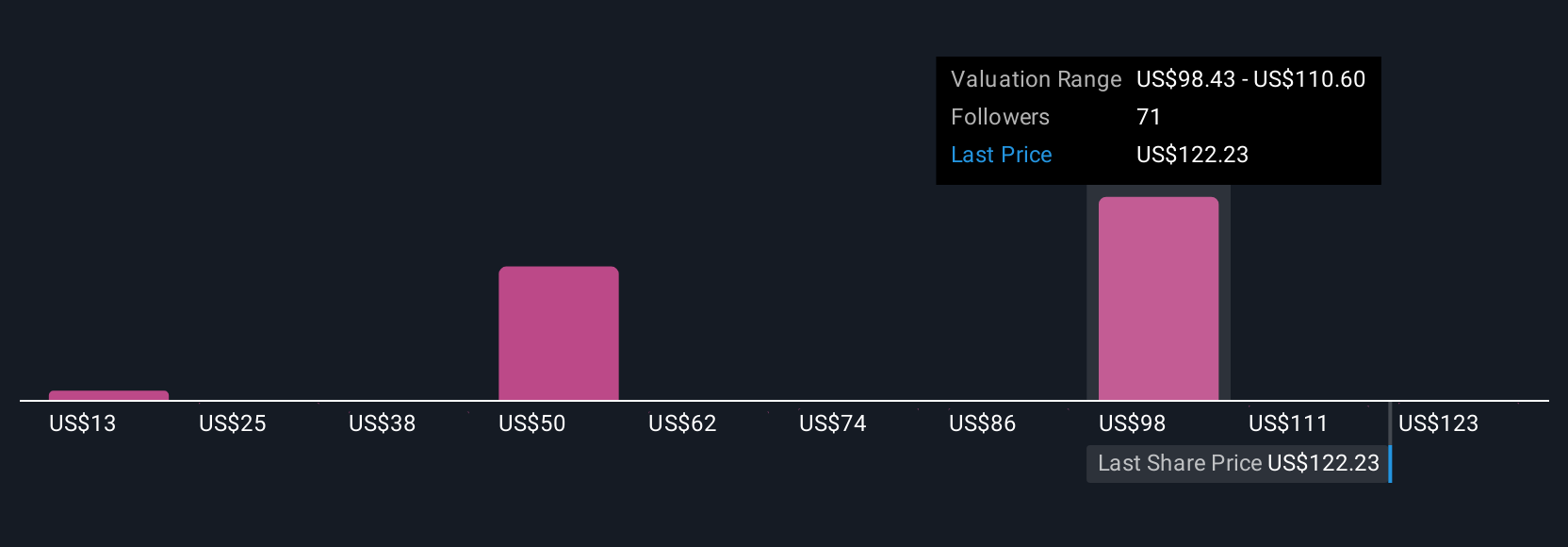

The Simply Wall St Community offers 32 fair value estimates for Astera Labs, ranging from US$15.98 to US$262.56 per share. While the company’s ecosystem partnerships are expanding, ongoing competition from integrated solutions by larger chipmakers could have bigger implications for future growth and differentiation, make sure to compare these views before forming your own.

Explore 32 other fair value estimates on Astera Labs - why the stock might be worth less than half the current price!

Build Your Own Astera Labs Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Astera Labs research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Astera Labs research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Astera Labs' overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALAB

Astera Labs

Designs, manufactures, and sells semiconductor-based connectivity solutions for cloud and AI infrastructure.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives