- United States

- /

- Semiconductors

- /

- NasdaqGS:ALAB

Can Astera Labs (ALAB) Parlay Azure CXL Memory Expansion Into Long-Term Cloud Advantage?

Reviewed by Sasha Jovanovic

- Microsoft announced that Astera Labs' Leo CXL Smart Memory Controllers are enabling evaluation of Compute Express Link (CXL) memory expansion capabilities on Azure M-series virtual machines, marking the industry's first deployment of CXL-attached memory for cloud workloads such as AI and in-memory databases.

- This collaboration addresses longstanding memory bottlenecks in server architecture by allowing significant scalability for data-intensive enterprise applications and underscores Astera Labs' role in advanced memory connectivity for cloud infrastructure.

- Let's examine how enabling CXL memory expansion for Azure M-series VMs could shape Astera Labs' investment narrative going forward.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Astera Labs Investment Narrative Recap

To be a shareholder in Astera Labs, you need conviction in the growing role of specialized memory connectivity in enabling large-scale AI and data-centric workloads for cloud providers. The recent Microsoft-Astera partnership, connecting Leo CXL controllers to Azure M-series VMs, supports this thesis by showcasing industry-first CXL memory deployment, but near-term revenue remains sensitive to continued AI infrastructure spending by hyperscalers, and the customer concentration risk is unchanged after this news.

One relevant announcement is Astera Labs' October collaboration at the OCP Global Summit, where it highlighted open standards like PCIe, UALink, and CXL. This aligns with the catalyst of broadening hyperscaler partnerships and supporting the shift to open, interoperable AI infrastructure, an area underscored by the Azure news.

But against this backdrop, investors should also look closely at the risk that Astera Labs’ revenues rely on a concentrated buyer base and shifting cloud capex trends...

Read the full narrative on Astera Labs (it's free!)

Astera Labs' narrative projects $1.5 billion revenue and $393.5 million earnings by 2028. This requires 34.1% yearly revenue growth and a $293.3 million earnings increase from $100.2 million currently.

Uncover how Astera Labs' forecasts yield a $196.83 fair value, a 39% upside to its current price.

Exploring Other Perspectives

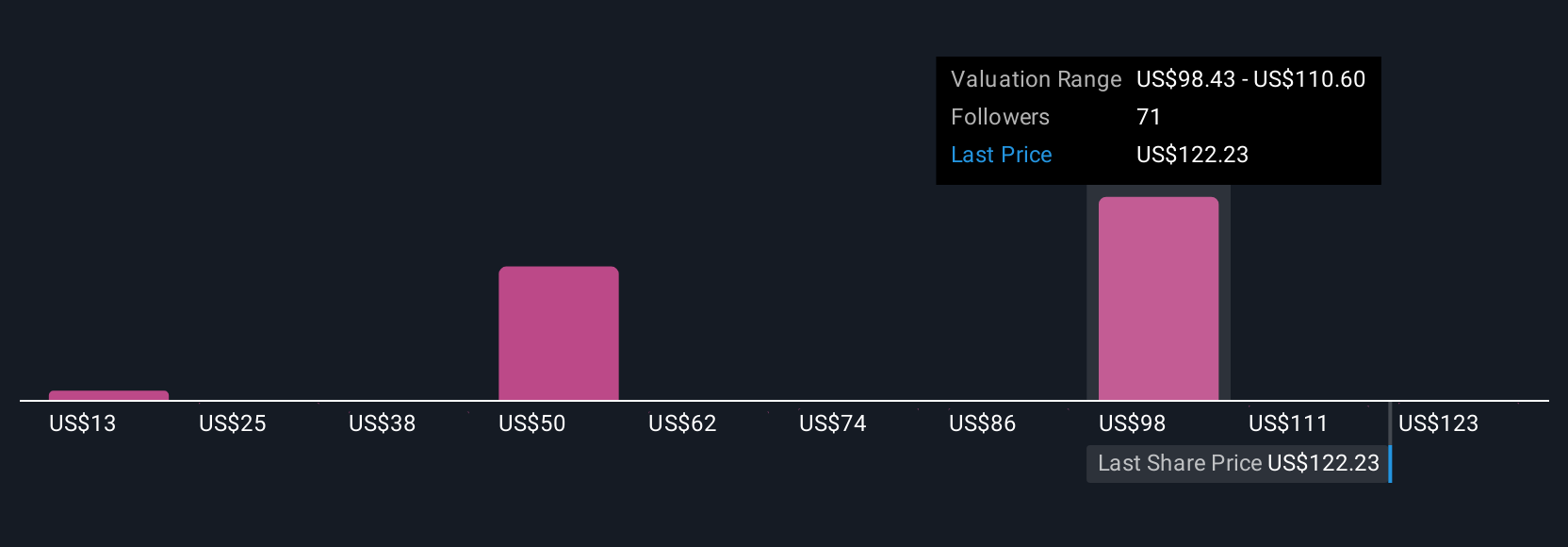

Fair value opinions for Astera Labs in the Simply Wall St Community span US$17.11 to US$251.33 across 28 different perspectives. As confidence in AI infrastructure spending drives current catalysts, you can explore for yourself how others see the potential rewards, alongside risks of high customer concentration.

Explore 28 other fair value estimates on Astera Labs - why the stock might be worth less than half the current price!

Build Your Own Astera Labs Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Astera Labs research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Astera Labs research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Astera Labs' overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALAB

Astera Labs

Designs, manufactures, and sells semiconductor-based connectivity solutions for cloud and AI infrastructure.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives