- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:ASTS

Astera Labs And 2 Other Growth Companies With Significant Insider Ownership

Reviewed by Simply Wall St

As the U.S. stock market continues to show strength with major indexes posting weekly and monthly gains, investors are increasingly interested in growth companies that demonstrate robust performance and resilience. In this favorable environment, stocks with significant insider ownership can be particularly appealing, as they often indicate a strong alignment between company leaders and shareholders' interests.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Upstart Holdings (UPST) | 12.6% | 92.9% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| FTC Solar (FTCI) | 23.1% | 63% |

| Credo Technology Group Holding (CRDO) | 10.9% | 30.4% |

| Cloudflare (NET) | 10.4% | 43.4% |

| Celsius Holdings (CELH) | 10.8% | 31.6% |

| Atour Lifestyle Holdings (ATAT) | 18.2% | 23.7% |

| Astera Labs (ALAB) | 12.1% | 31.1% |

| AppLovin (APP) | 27.5% | 25.6% |

| Accelerant Holdings (ARX) | 24.9% | 66.1% |

Here we highlight a subset of our preferred stocks from the screener.

Astera Labs (ALAB)

Simply Wall St Growth Rating: ★★★★★★

Overview: Astera Labs, Inc. designs, manufactures, and sells semiconductor-based connectivity solutions for cloud and AI infrastructure, with a market cap of $31.03 billion.

Operations: The company's revenue is primarily derived from its semiconductor segment, totaling $605.55 million.

Insider Ownership: 12.1%

Astera Labs is experiencing significant growth, with earnings forecasted to rise 31.1% annually, outpacing the US market. Despite recent insider selling, the company remains attractive due to its robust revenue growth projections of 24% per year and recent profitability. Strategic collaborations, such as with Arm Total Design for AI infrastructure development, enhance its market position. Recent earnings show substantial improvements in sales and net income compared to the previous year, underscoring strong operational performance.

- Click here to discover the nuances of Astera Labs with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Astera Labs is priced higher than what may be justified by its financials.

AST SpaceMobile (ASTS)

Simply Wall St Growth Rating: ★★★★★★

Overview: AST SpaceMobile, Inc. designs and develops the BlueBird satellite constellation in the United States, with a market cap of $29.47 billion.

Operations: The company generates revenue from its Wireless Communications Equipment segment, amounting to $4.89 million.

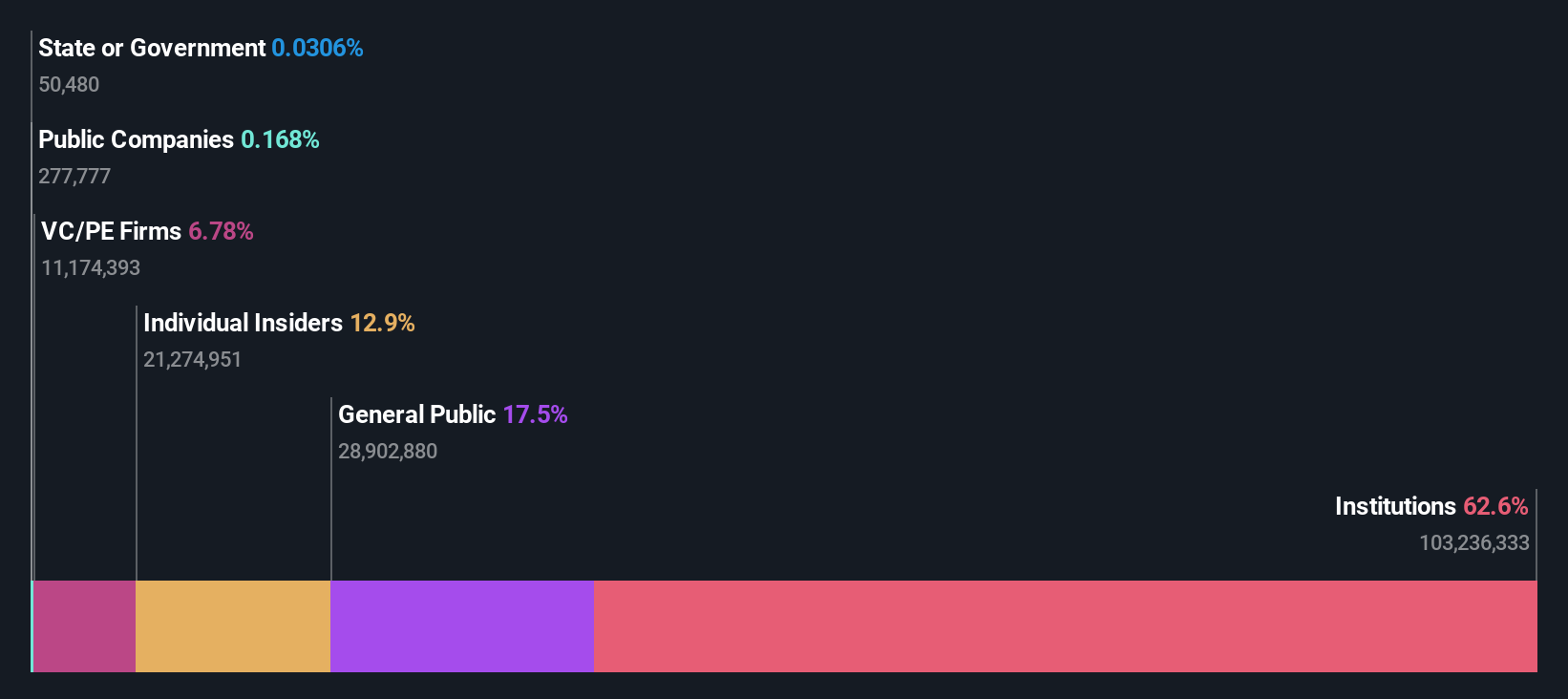

Insider Ownership: 11.9%

AST SpaceMobile is poised for substantial growth, with revenue expected to rise 55.9% annually, significantly outpacing the US market. The company recently secured a 10-year commercial agreement with stc group, including a $175 million prepayment, enhancing its prospects in the Middle East and Africa. Despite recent volatility and insider selling, AST SpaceMobile's strategic partnerships and innovative satellite technology position it well for future profitability within three years.

- Click here and access our complete growth analysis report to understand the dynamics of AST SpaceMobile.

- According our valuation report, there's an indication that AST SpaceMobile's share price might be on the expensive side.

Roku (ROKU)

Simply Wall St Growth Rating: ★★★★☆☆

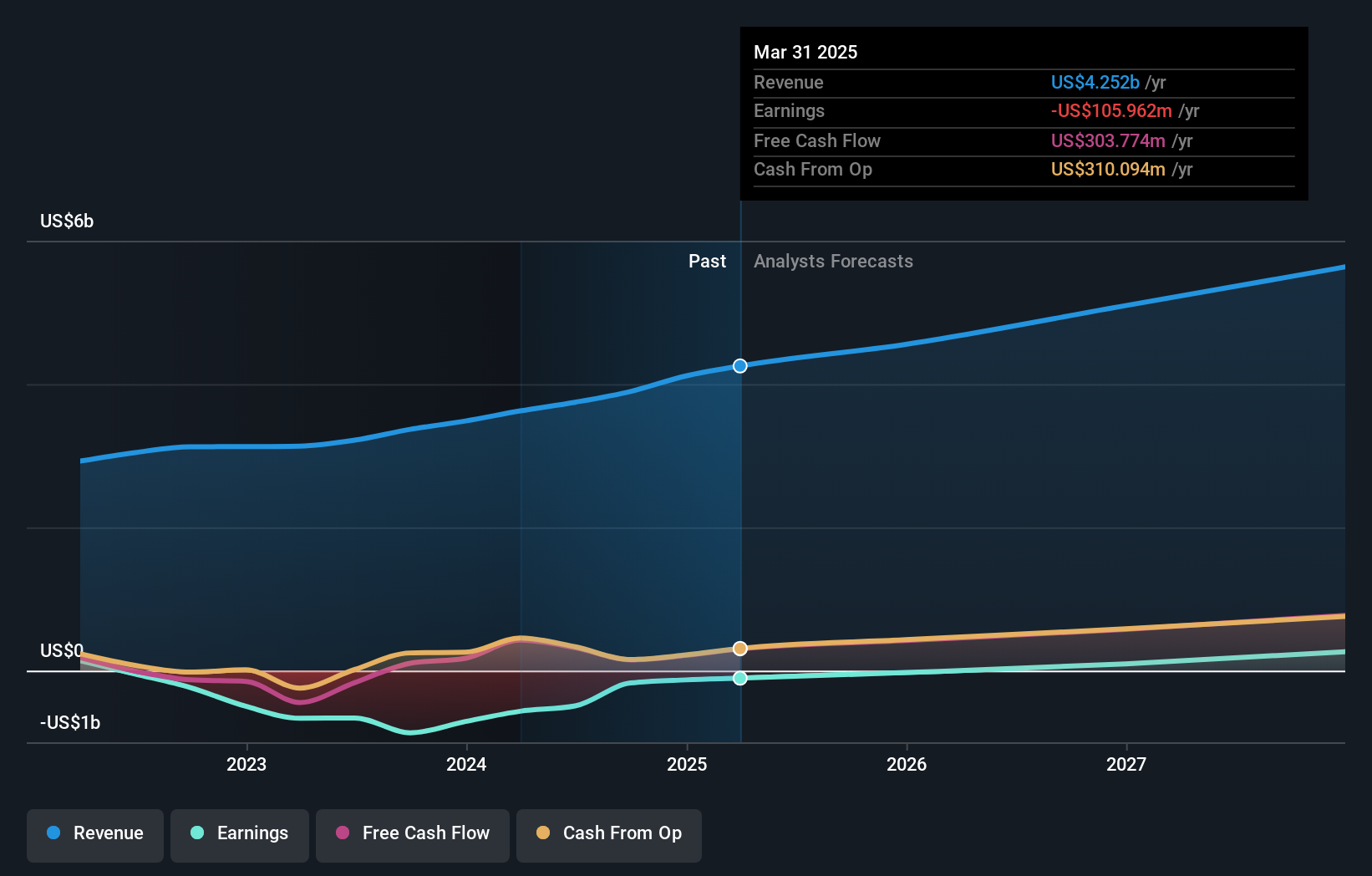

Overview: Roku, Inc. operates a TV streaming platform both in the United States and internationally, with a market cap of approximately $15.68 billion.

Operations: Roku generates revenue through two main segments: Devices, contributing $587.13 million, and Platform, which accounts for $3.96 billion.

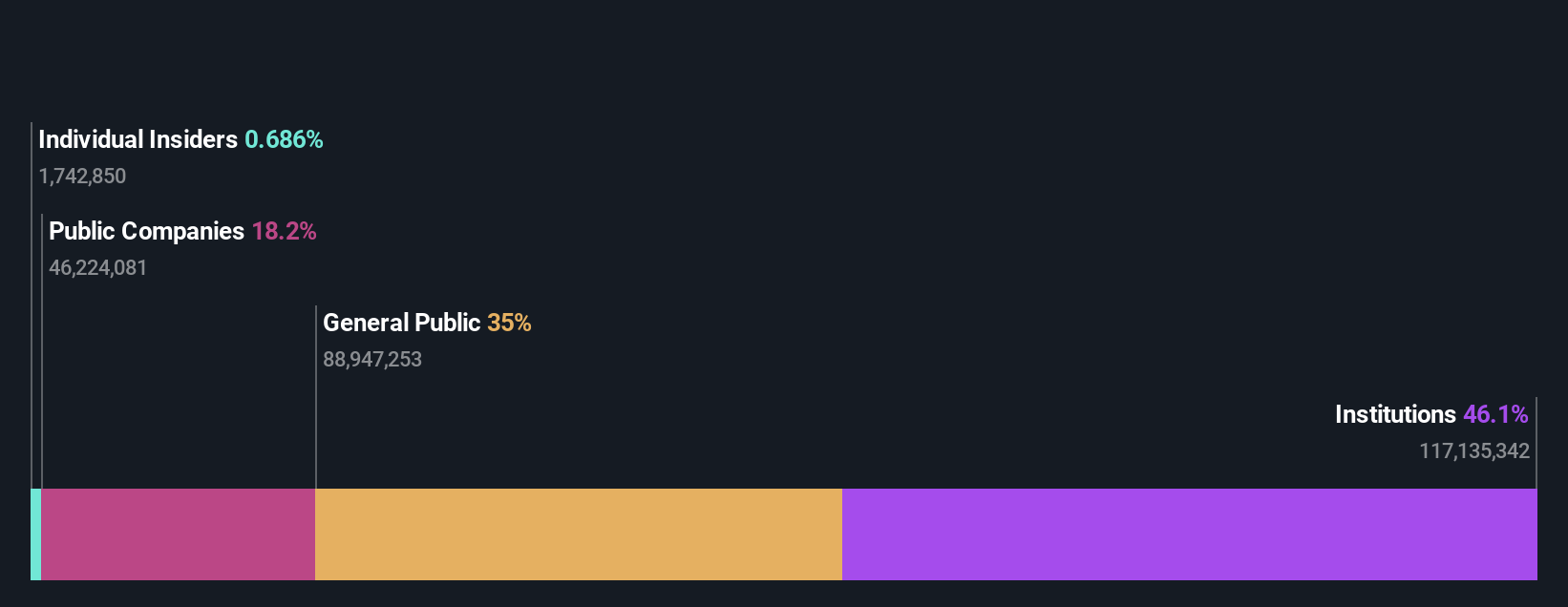

Insider Ownership: 11.9%

Roku demonstrates potential for growth, with earnings projected to rise 58.51% annually and profitability expected within three years. Recent Q3 results showed a turnaround with US$24.81 million net income, highlighting operational improvements. Despite trading below estimated fair value, insider buying remains modest over the past months. Strategic partnerships like the FreeWheel expansion and innovative product launches such as the Philips Roku TV enhance Roku's market position, though revenue growth forecasts remain moderate at 10.7% annually.

- Navigate through the intricacies of Roku with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, Roku's share price might be too pessimistic.

Taking Advantage

- Explore the 204 names from our Fast Growing US Companies With High Insider Ownership screener here.

- Looking For Alternative Opportunities? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ASTS

AST SpaceMobile

Designs and develops the constellation of BlueBird satellites in the United States.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives