- United States

- /

- Semiconductors

- /

- NasdaqGS:ALAB

Astera Labs (ALAB) Turns Profitable, Challenges Valuation Narratives With 27.1% Earnings Growth Forecast

Reviewed by Simply Wall St

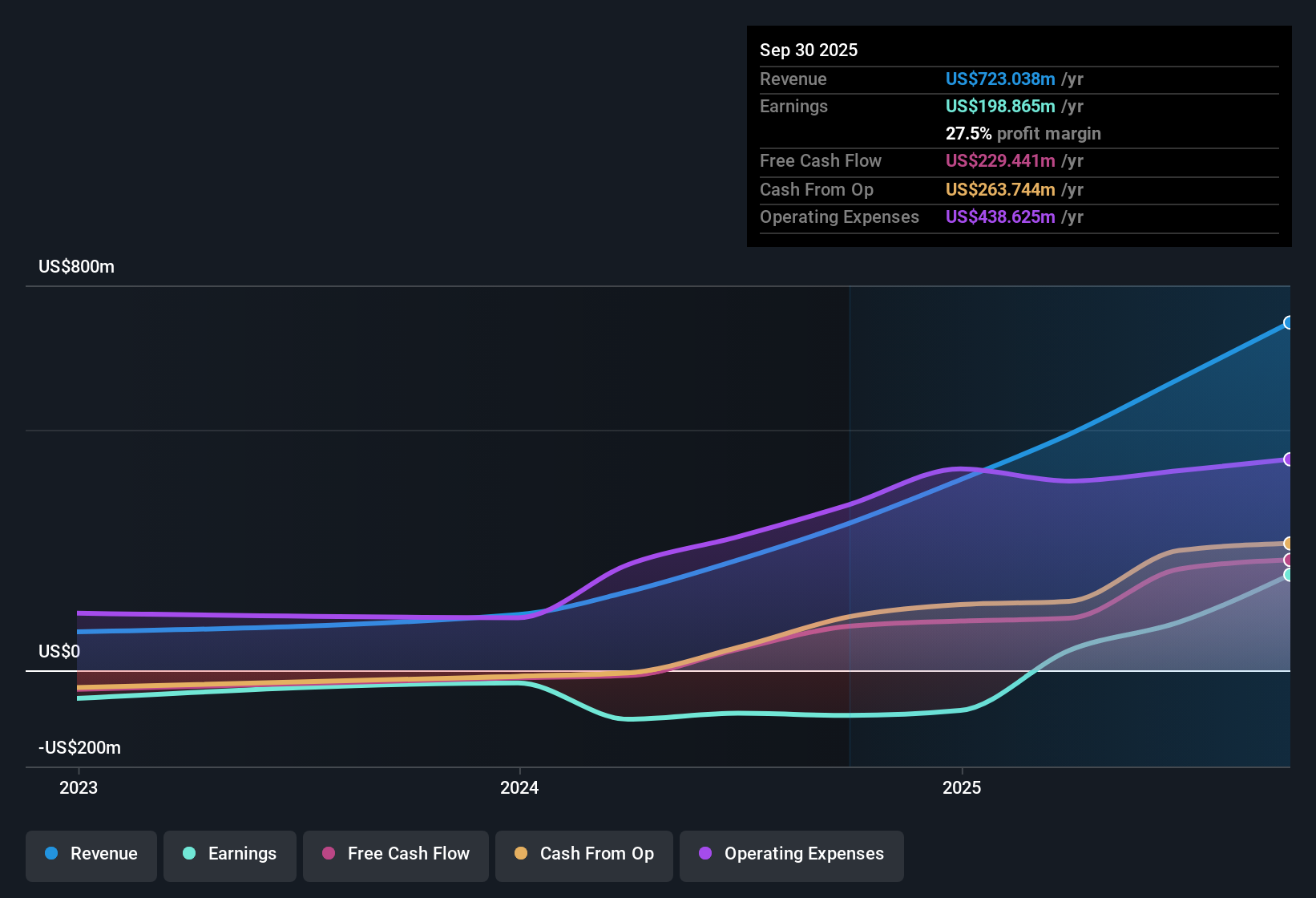

Astera Labs (ALAB) has just turned profitable, with forecasts calling for earnings to grow at 27.1% per year and revenue to rise 23.5% annually, both comfortably ahead of US market averages. The company’s net profit margin has flipped from negative to positive, and its high quality earnings profile comes as shares are trading at a remarkable premium: a Price-To-Sales ratio of 49.9x, well above both direct semiconductor peers and the industry average. With no major risks or insider selling detected recently, and a share price of $181.94 sitting far above estimated fair value, investors are now weighing this robust growth and profitability milestone against a lofty valuation.

See our full analysis for Astera Labs.Next, we'll see how these standout figures line up with the market narratives, highlighting where the latest numbers support investor optimism and where they might spark new debate.

See what the community is saying about Astera Labs

Margins Flip Positive: 16.5% Today, Targeting 26.9% in 3 Years

- Profit margins now stand at 16.5%, with analysts projecting a rise to 26.9% within three years. If achieved, this level could match or exceed top players in the semiconductor industry.

- Analysts' consensus view highlights that Astera Labs’ move to open standards, platform solutions, and steady diversification is expected to drive lasting expansion in high-margin data center deployments.

- Broader adoption across PCIe, Ethernet, CXL, and emerging UALink solutions is forecast to boost average margins and insulate earnings from customer concentration risks.

- Stepped attach rates from non-AI use cases, such as general CPU and memory expansion, are also positioned to provide stable leverage for expanding profitability beyond early AI infrastructure demand.

Consensus analysts anticipate a steady climb in margins and high-value deployments. Find out if broadening platform adoption keeps this trajectory on track with the full consensus perspective. 📊 Read the full Astera Labs Consensus Narrative.

PE Ratio 293x Hints at Lofty Expectations

- Astera Labs trades at a current price-to-earnings (PE) ratio of 293.1x, significantly higher than the US semiconductor industry average of 30.1x. This suggests that investors are factoring in long-term growth expectations far above typical sector norms.

- Analysts' consensus view suggests this high PE is based on the assumption that future earnings will scale dramatically as product adoption widens and margin targets are met.

- The company must reach $393.5 million in earnings by 2028 and justify a future PE of 113.5x, which remains almost four times the sector norm, to meet these expectations.

- If these forecasts are not met, the valuation could contract quickly, especially since share price is already well ahead of DCF fair value and peer multiples.

DCF Fair Value Lags: Shares Trade at Over 5x Model Estimate

- Despite recent profitability and robust projections, Astera Labs’ current share price of $181.94 is over five times higher than its DCF fair value estimate of $35.96. This underscores a major gap between market optimism and traditional valuation frameworks.

- Analysts' consensus view contends that this premium pricing can persist if Astera Labs hits ambitious growth targets and AI infrastructure themes remain strong, but it highlights significant downside if either earnings or revenue expansion slows materially.

- The analyst price target of $196.21 sits just above the current share price, implying modest expected upside if execution stays on track, but leaves little room for shortfalls.

- This tension between long-run opportunity and near-term valuation risk is likely to keep Astera Labs in the spotlight among both growth-focused and value-oriented investors.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Astera Labs on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot something in the figures that stands out to you? Share your perspective and shape your own narrative in just a few minutes by clicking Do it your way.

A great starting point for your Astera Labs research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Astera Labs’ valuation is under pressure as its share price outpaces both fair value estimates and sector norms. This raises the risk of a sharp pullback if expectations cool.

Concerned about paying too much? Scout these 840 undervalued stocks based on cash flows to target companies trading at compelling discounts with more convincing value upside right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALAB

Astera Labs

Designs, manufactures, and sells semiconductor-based connectivity solutions for cloud and AI infrastructure.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives