- United States

- /

- Semiconductors

- /

- NasdaqCM:AEHR

Aehr Test Systems' (NASDAQ:AEHR) 27% Share Price Surge Not Quite Adding Up

Despite an already strong run, Aehr Test Systems (NASDAQ:AEHR) shares have been powering on, with a gain of 27% in the last thirty days. But the last month did very little to improve the 67% share price decline over the last year.

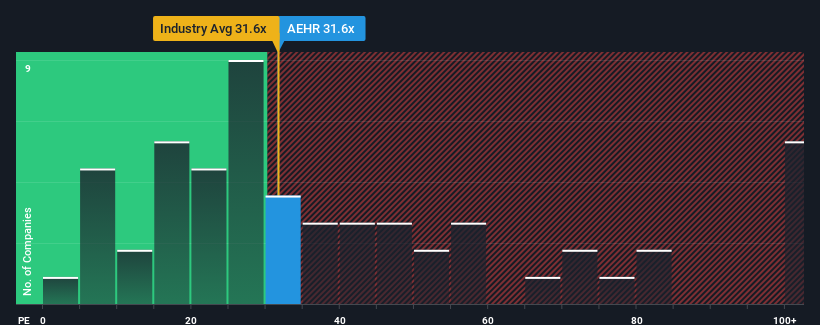

Following the firm bounce in price, Aehr Test Systems may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 31.6x, since almost half of all companies in the United States have P/E ratios under 18x and even P/E's lower than 10x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Aehr Test Systems has been doing a decent job lately as it's been growing earnings at a reasonable pace. It might be that many expect the reasonable earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Aehr Test Systems

Is There Enough Growth For Aehr Test Systems?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Aehr Test Systems' to be considered reasonable.

If we review the last year of earnings growth, the company posted a worthy increase of 3.4%. Still, EPS has barely risen at all in aggregate from three years ago, which is not ideal. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 12% shows it's noticeably less attractive on an annualised basis.

In light of this, it's alarming that Aehr Test Systems' P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Key Takeaway

Aehr Test Systems' P/E is flying high just like its stock has during the last month. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Aehr Test Systems currently trades on a much higher than expected P/E since its recent three-year growth is lower than the wider market forecast. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Plus, you should also learn about these 4 warning signs we've spotted with Aehr Test Systems (including 2 which are significant).

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:AEHR

Aehr Test Systems

Provides test solutions for testing, burning-in, and semiconductor devices in wafer level, singulated die, package part form, and installed systems in the United States, Asia, and Europe.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026