- United States

- /

- Semiconductors

- /

- NasdaqGS:ADI

Will $1.5 Billion Bond Offering Change Analog Devices' (ADI) Narrative?

- Analog Devices completed two major fixed-income offerings, raising approximately US$1.50 billion through the issuance of callable senior unsecured notes maturing in 2028 and 2030 at fixed coupons of 4.25% and 4.5%, respectively.

- This influx of capital provides Analog Devices with greater flexibility for funding growth initiatives, refinancing, or navigating changes in the macroeconomic landscape.

- We'll examine how the added US$1.50 billion in liquidity could influence ADI's capacity for innovation and long-term expansion.

Outshine the giants: these 21 early-stage AI stocks could fund your retirement.

Analog Devices Investment Narrative Recap

To be a shareholder in Analog Devices, you'd need to believe in the company’s ability to convert trends like industrial automation and AI-driven demand into strong, sustainable growth. The recent US$1.50 billion fixed-income offering increases financial flexibility, but it hasn’t materially shifted the major short-term catalyst, which remains the demand for high-performance ICs in emerging markets, or mitigated the most significant risk, macroeconomic and geopolitical uncertainty that could affect revenue and earnings.

The most relevant recent announcement is Analog Devices' new US$3 billion revolving credit agreement. This, in combination with the recent bond offering, underscores the company’s focus on maintaining ample liquidity for growth, even as unpredictable semiconductor cycles continue to present near-term risks and opportunities for ADI’s operating performance.

By contrast, investors should be aware that heightened financial flexibility does not insulate the company from the effects of geopolitical tensions or trade restrictions...

Read the full narrative on Analog Devices (it's free!)

Exploring Other Perspectives

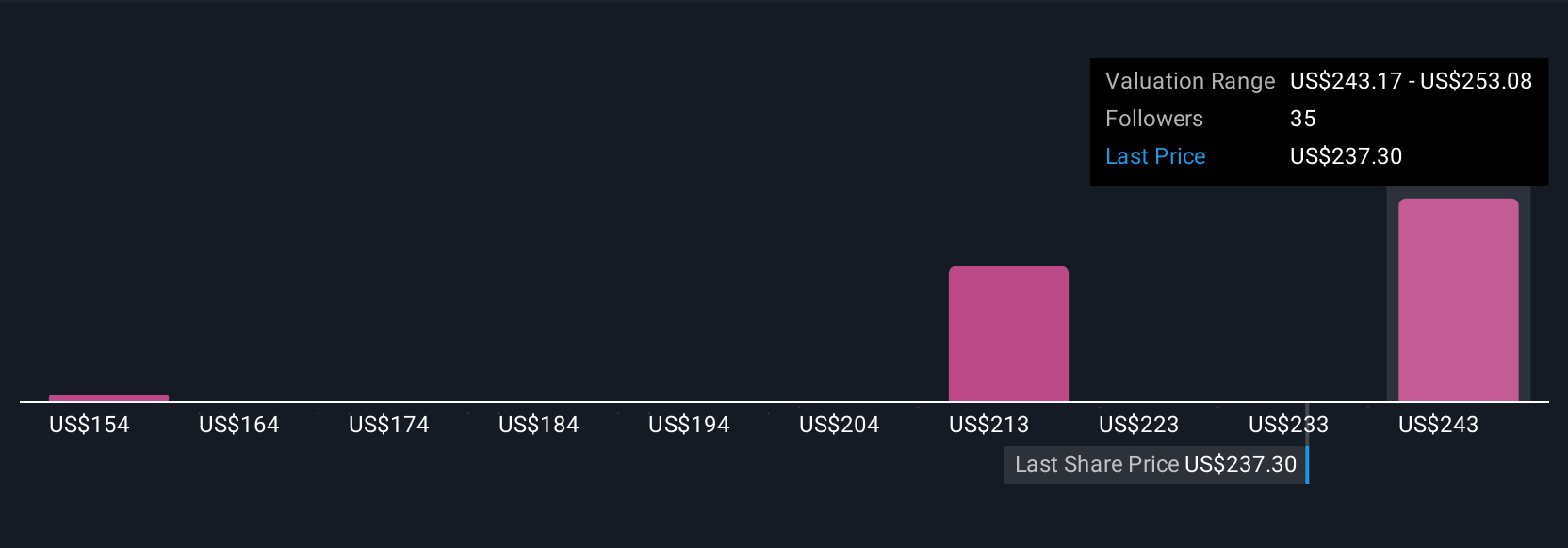

Eight Simply Wall St Community fair value estimates for Analog Devices range between US$154 and US$253.08. With global supply chain risks still present, consider how these varied outlooks may influence your view of ADI’s growth potential.

Build Your Own Analog Devices Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Analog Devices research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Analog Devices research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Analog Devices' overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

- Uncover 17 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Sasha Jovanovic

Sasha is an Equity Analyst at Simply Wall St with 15 years financial markets experience. He is a CFA Charterholder and holds Bachelor degrees in Mathematics and International Studies from the University of Technology, Sydney, Australia. He worked at CommSec Investment Management as an Investment Analyst from 2014 and later at Sequoia Financial Group as a Portfolio Analyst from 2018.

About NasdaqGS:ADI

Analog Devices

Engages in the design, manufacture, testing, and marketing of integrated circuits (ICs), software, and subsystems products in the United States, rest of North and South America, Europe, Japan, China, and rest of Asia.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026