- United States

- /

- Semiconductors

- /

- NasdaqGS:ADI

Analog Devices (ADI): Assessing Valuation After Strong Earnings and Upbeat AI & Automotive Outlook

Reviewed by Simply Wall St

Analog Devices (ADI) just posted results that caught the market’s eye, with revenue and earnings climbing solidly above expectations for both the fourth quarter and the full year. The update has investors taking notice.

See our latest analysis for Analog Devices.

Shares of Analog Devices have rallied strongly since the earnings update, with a 13.33% gain in the past month and a 25.55% year-to-date share price return. This reflects renewed confidence after upbeat results, bigger dividends, and robust business momentum in AI and automotive segments. Over the longer run, holders have enjoyed a 23.78% total return over the last year and a 65.17% return over three years, which underscores why momentum is building around the stock as the growth narrative gains traction.

If you’re interested in uncovering other promising players amid the latest semiconductor surge, this is a perfect moment to discover See the full list for free.

With share prices climbing, fundamentals looking strong, and guidance pointing to continued momentum, investors are now faced with a key question: is there real value left in Analog Devices, or is all the good news already reflected in the price?

Most Popular Narrative: 5.3% Undervalued

Analog Devices’ most popular narrative tags a fair value of $280.31 per share, which edges above the recent close at $265.34. The narrative anchors this higher fair value in long-term growth levers and future margin expansion potential, setting up a deeper look at the assumptions behind it.

The accelerating adoption of advanced robotics and automation across industrial and manufacturing sectors, including next-generation humanoid and dexterous robot systems, is expected to significantly expand ADI's addressable market and increase content per device. This supports sustained long-term revenue growth and higher average selling prices. Increasing proliferation of connected, sensor-heavy applications enabled by real-time edge AI, precision measurement, and automation positions ADI to benefit from rising global demand for high-margin analog and mixed-signal solutions. This may bolster net margins as industrial end markets recover and outpace broader sector seasonality.

Ever wonder what keeps analysts confident in a higher price? There’s a bold projection hiding in the fine print. Future earnings growth, margin expansion, and premium multiples all combine to justify this valuation. Want to know which financial assumptions create the upside? Dig into the full narrative and surprise yourself with the numbers driving this price target.

Result: Fair Value of $280.31 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, as rising competition in global markets or unpredictable trade tensions could challenge Analog Devices' growth and put pressure on margins moving forward.

Find out about the key risks to this Analog Devices narrative.

Another View: What Does Our DCF Model Say?

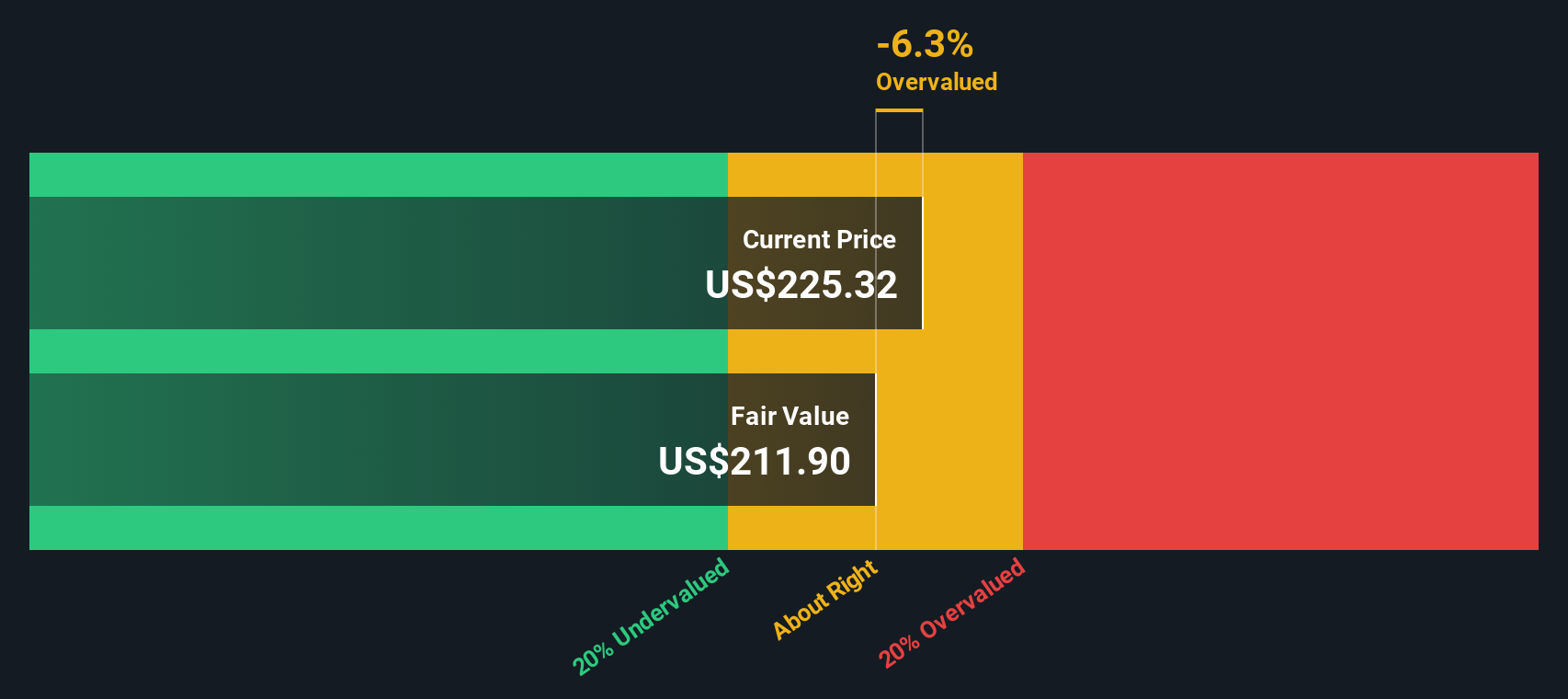

While the fair value estimate based on growth expectations points to upside, our SWS DCF model offers a different perspective. According to this discounted cash flow analysis, Analog Devices is currently trading above its intrinsic value, which may indicate potential overvaluation if cash flows do not meet projections. Which perspective will ultimately prove right?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Analog Devices for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Analog Devices Narrative

If you have a different perspective or prefer hands-on analysis, you can explore the data and craft your own view in just a few minutes. Do it your way

A great starting point for your Analog Devices research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Make your next move count and access hand-picked stock opportunities you won't want to overlook with the Simply Wall St. Screener.

- Uncover surprising income potential by tapping into these 15 dividend stocks with yields > 3%, which offers yields above 3% for your portfolio’s stability.

- Spot future tech leaders by exploring these 25 AI penny stocks, which focuses on artificial intelligence breakthroughs that are changing entire industries.

- Boost your returns with smart value plays, starting with these 914 undervalued stocks based on cash flows based on proven cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADI

Analog Devices

Engages in the design, manufacture, testing, and marketing of integrated circuits (ICs), software, and subsystems products in the United States, rest of North and South America, Europe, Japan, China, and rest of Asia.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026