- United States

- /

- Semiconductors

- /

- NasdaqGS:ACLS

Axcelis Technologies (ACLS): Assessing Valuation Following Recent Share Price Declines

Reviewed by Kshitija Bhandaru

See our latest analysis for Axcelis Technologies.

After a strong start to the year, Axcelis Technologies’ share price has been under pressure lately, dropping 6.4% in the last day and 10.7% over the past week. Still, its 1-year total shareholder return sits at -21.7%, despite a robust 3-year total return of 53% and a remarkable 235% over the past five years. This shows that investors have enjoyed significant long-term gains even with recent volatility.

If you're watching the semiconductor sector’s momentum and want to expand your search, you can discover other promising names using our tech and AI stocks screener: See the full list for free.

Given Axcelis Technologies' recent declines but impressive long-term record, the key question is whether these lower prices reveal an undervalued opportunity or if the market has already accounted for the company’s future prospects.

Most Popular Narrative: 16.8% Undervalued

The most popular narrative sees Axcelis Technologies trading at $79.19, with a fair value of $95.20 based on analysts’ forward-looking projections. This suggests there could be considerable upside, according to prevailing market expectations.

Ongoing R&D investments and next-generation Purion platform enhancements are driving increased customer engagement, particularly around advanced node processes (trench and super junction devices). This enables Axcelis to win share in premium market segments and supports future gross margin improvement.

Are you curious which bold forecasts and next-level earnings expectations fuel this valuation? Only the full narrative reveals the specific profit, margin, and growth projections that underpin the current fair value. Unlock the surprising assumptions analysts are using to set the price target. This is not just another market story.

Result: Fair Value of $95.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on Chinese customers and slower adoption of new technologies could challenge Axcelis’s growth and introduce unpredictability to future earnings.

Find out about the key risks to this Axcelis Technologies narrative.

Another View: What Do Valuation Ratios Say?

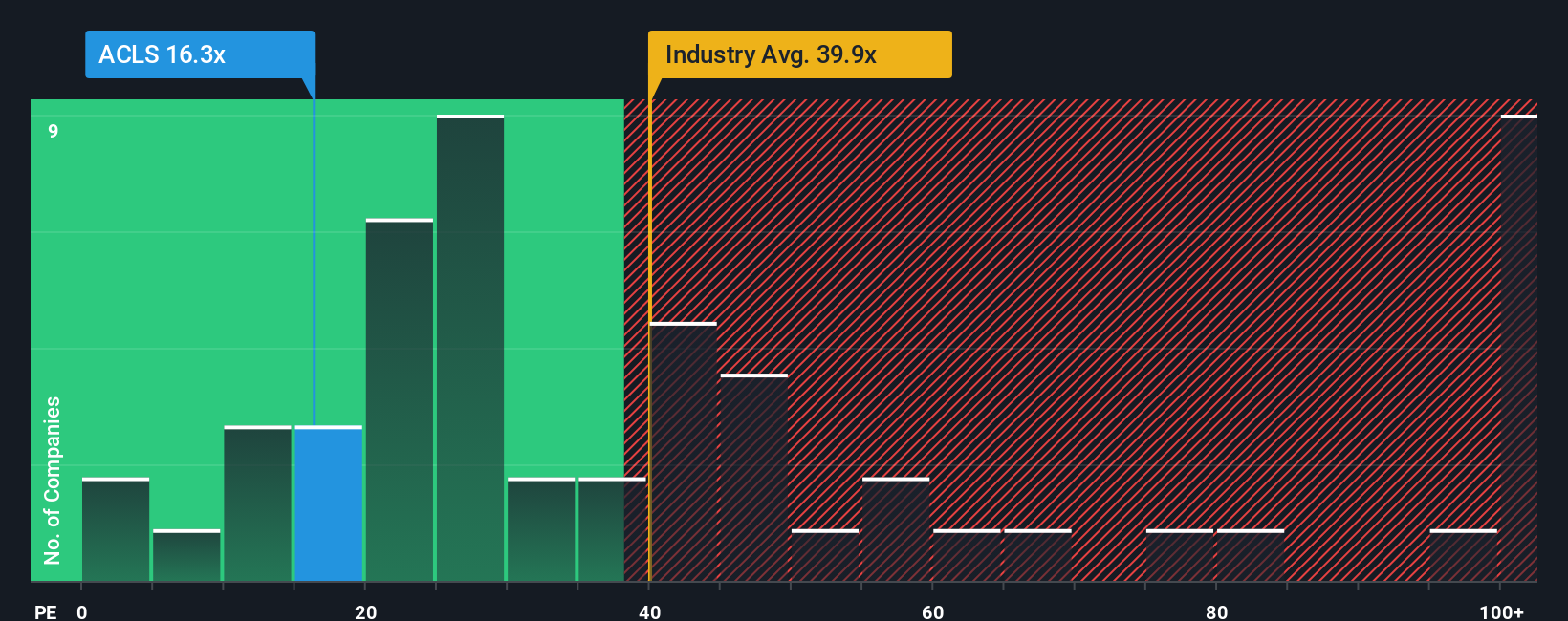

Looking at the price-to-earnings ratio, Axcelis Technologies trades at 15.5x, which is well below both the US semiconductor industry average of 35.3x and the peer average of 31.8x. However, this remains above the stock's own fair ratio of 12.2x, suggesting some valuation risk if the market reverts to the mean. Could the share price still have room to fall, even as it appears cheaper than its peers?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Axcelis Technologies Narrative

If you want to challenge the consensus or prefer to dig into the details yourself, you can craft a personal take on Axcelis Technologies' story in just a few minutes. Do it your way.

A great starting point for your Axcelis Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investing is all about knowing where the next big opportunities are hiding. Give yourself an edge by checking out a few handpicked lists on Simply Wall Street that target distinct angles and fresh potential.

- Get ahead of market trends and gain early access to innovation by backing trailblazing companies using these 24 AI penny stocks.

- Maximize your returns with a lineup of these 891 undervalued stocks based on cash flows that are priced below their cash flow potential and could be ready to pop.

- Supercharge your portfolio income and stability by tapping into these 19 dividend stocks with yields > 3% offering reliable yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ACLS

Axcelis Technologies

Designs, manufactures, and services ion implantation and other processing equipment used in the fabrication of semiconductor chips in the United States, Europe, and the Asia Pacific.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion