- United States

- /

- Semiconductors

- /

- NasdaqGS:ACLS

Assessing Axcelis Technologies After Recent 14% Drop and Industry Partnerships in 2025

Reviewed by Bailey Pemberton

If you have been wondering what to do with your Axcelis Technologies shares, or if you are thinking about jumping in, this is the perfect moment to take a step back and look at the bigger picture. It is no secret that Axcelis has been on quite a ride, with the stock climbing an impressive 18.7% year-to-date but slipping 14.3% over the past month. These quick shifts are often a sign of shifting risk perceptions or changes in how investors are viewing the company’s growth potential, especially after the semiconductor sector faced renewed scrutiny recently.

Over the last five years, Axcelis has absolutely crushed it with a 277.5% gain. But even with that kind of long-term growth, the last year saw a dip of 7.3%. Is this a temporary pause, or a more significant shift? A recent uptick in industry focus on advanced chip manufacturing has brought new attention to Axcelis, as the company’s ion implantation technology became increasingly relevant for customers chasing more efficient production processes. Some recent partnerships and technology advances have put Axcelis back on investors’ radars, highlighting both the opportunities and potential risks that come with growth.

Of course, valuation is where it all comes together. On a standard valuation check, Axcelis scores 2 out of 6 in terms of being undervalued. This is a cautious signal for bargain hunters but far from a dealbreaker for growth investors. In the next section, we will dig into what those valuation numbers truly mean, and later share a perspective that could offer an even better way to weigh the company’s value for your portfolio.

Axcelis Technologies scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Axcelis Technologies Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model projects future cash flows that a company is expected to generate, and then discounts those cash flows back to today’s value. This process helps estimate what the business is intrinsically worth right now, based on its long-term cash-producing ability.

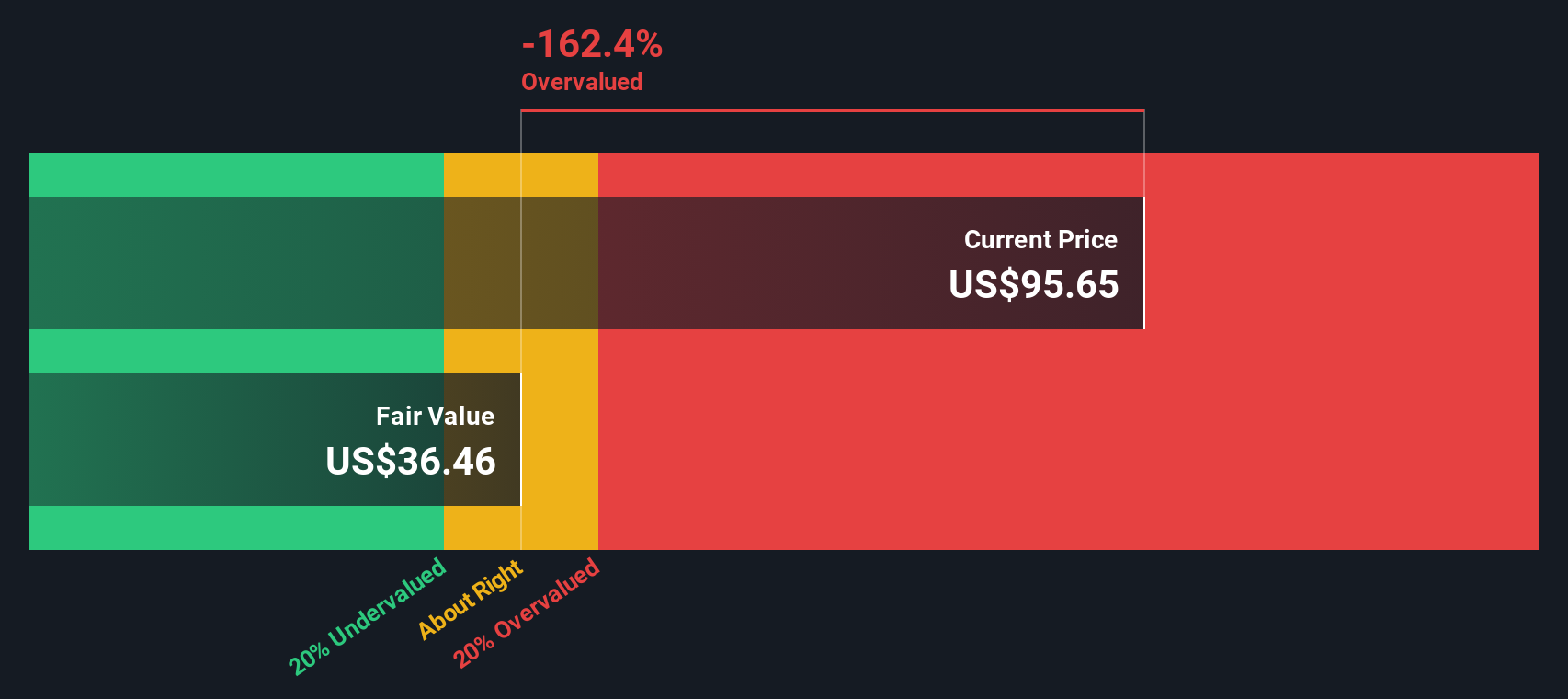

For Axcelis Technologies, the most recent reported Free Cash Flow stands at $124.1 Million. Looking out to 2035, analyst and extrapolated projections suggest annual FCF will fluctuate but overall remain around the $98.2 Million mark in 10 years, with some modest growth and contraction throughout the forecast period. For reference, only the first five years are anchored by analyst estimates, and Simply Wall St uses extrapolation for years beyond that.

Based on this 2 Stage Free Cash Flow to Equity model, Axcelis Technologies’ estimated intrinsic value comes in at $36.40 per share. At current market prices, this puts the stock about 128.9% above its fair value according to the DCF model, which suggests that Axcelis may be significantly overvalued by this metric.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Axcelis Technologies may be overvalued by 128.9%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Axcelis Technologies Price vs Earnings

The Price-to-Earnings (PE) ratio is one of the most widely used metrics for valuing profitable companies, as it directly measures how much investors are willing to pay for each dollar of earnings. It is especially useful for companies like Axcelis Technologies that consistently generate positive net income, providing a quick way to compare valuation across peers and the sector.

In theory, higher growth and stronger profit stability typically justify a higher "normal" PE ratio. On the other hand, greater risks or volatility push it lower. Market expectations for future earnings growth, margins, and industry cyclicality all play a role in what PE investors will accept.

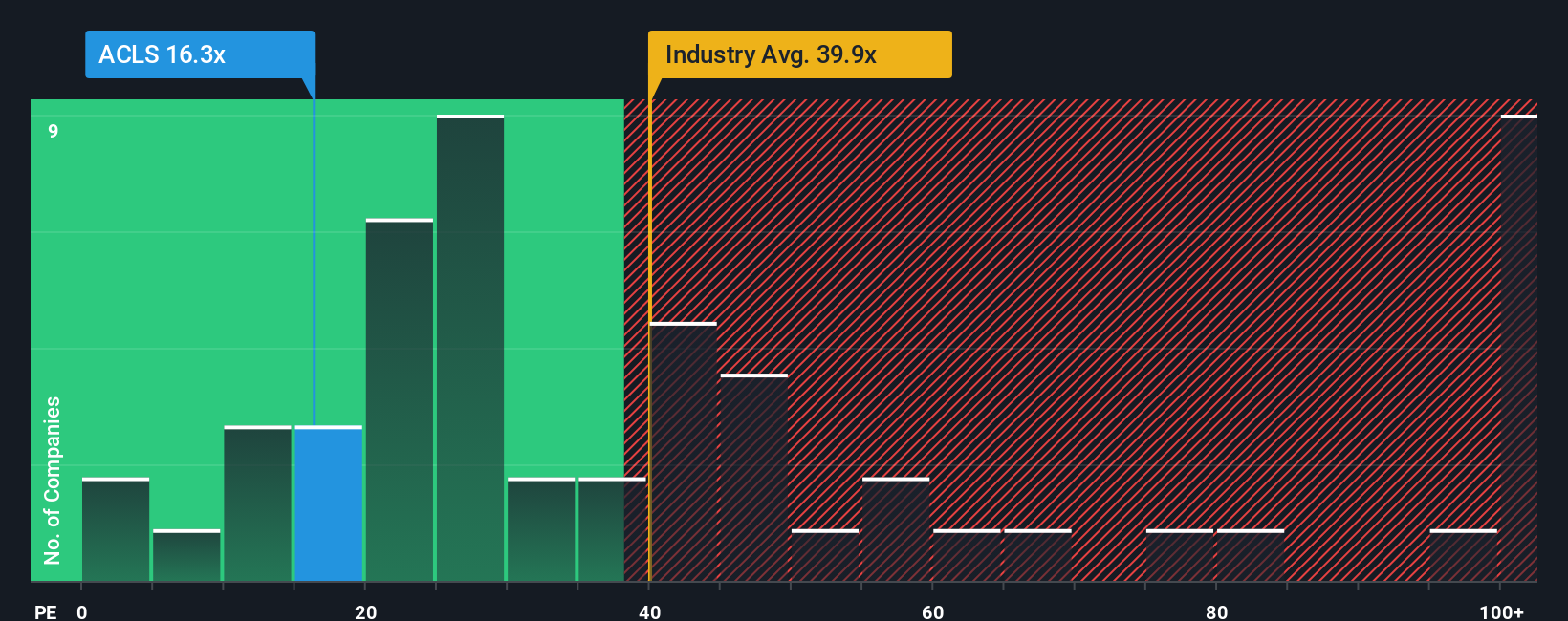

Axcelis Technologies is currently trading at a PE ratio of 16.3x. This is well below the Semiconductor industry average of 39.5x and the peer group average of 35.4x. While this might look like a bargain, it's important to go a step further.

Simply Wall St's "Fair Ratio" uses a proprietary model to estimate what the PE should be, given Axcelis’s growth outlook, profitability, risk profile, industry classification, and market cap. Unlike basic peer or sector comparisons, the Fair Ratio gives a more tailored and nuanced perspective. For Axcelis, this Fair Ratio is estimated at 12.1x, lower than the company’s current PE.

Since Axcelis is trading above its Fair Ratio by a notable margin, this suggests that the stock may be slightly overvalued based on its earnings, risk, and growth profile.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Axcelis Technologies Narrative

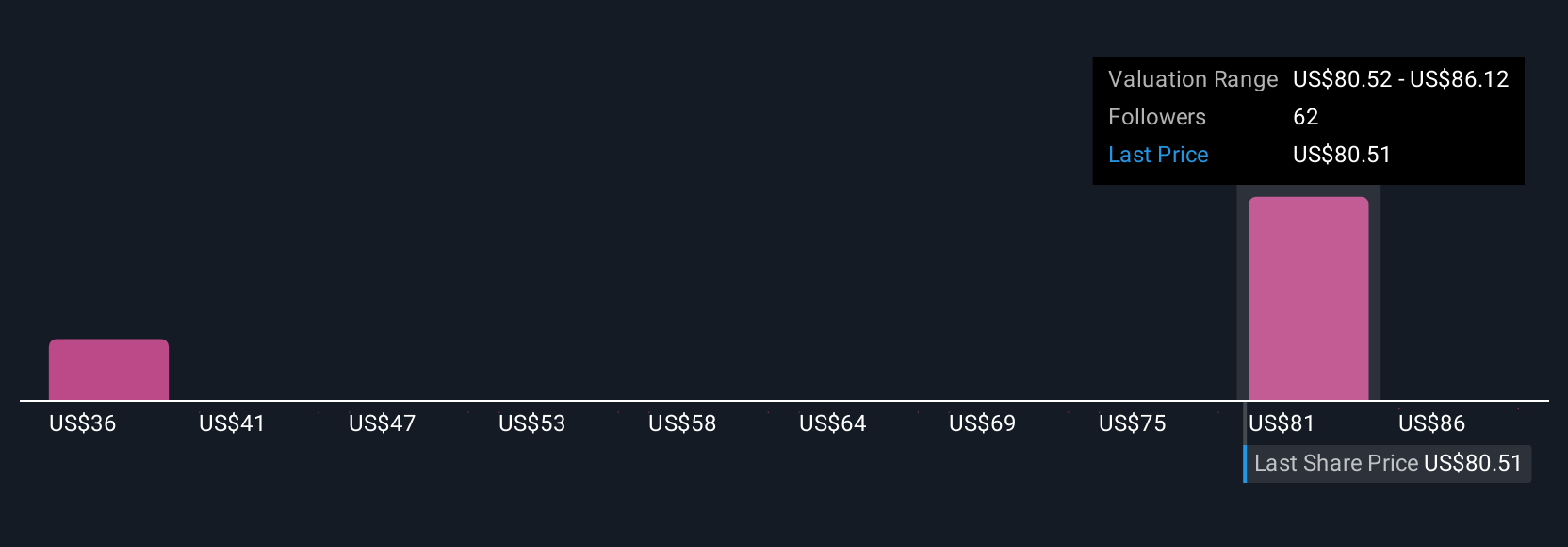

Earlier, we mentioned there is an even better way to understand valuation. Let’s introduce you to Narratives, a tool that empowers investors to link their view of a company’s story, its potential, and the numbers that matter most. A Narrative connects your perspective about where Axcelis Technologies is headed with actual forecasts for revenue, earnings, and margins. It translates them into a fair value, giving context to every buy or sell decision.

Narratives are simple, interactive, and available on Simply Wall St’s Community page, used by millions of investors worldwide. By defining your expectations and updating them as new information emerges, such as earnings releases or semiconductor news, Narratives adapt dynamically and always reflect the latest outlook. This approach goes beyond static models, helping you compare your own view of fair value against the current share price and decide with confidence.

For example, some Axcelis Narratives expect sustained industry leadership and growing recurring revenue, setting a fair value well above $97. Others focus on risks tied to China exposure and margin pressure, arriving at a much lower estimate. By choosing or customizing your Narrative, you align your investing decision with the story you believe in and have the numbers to back it up.

Do you think there's more to the story for Axcelis Technologies? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ACLS

Axcelis Technologies

Designs, manufactures, and services ion implantation and other processing equipment used in the fabrication of semiconductor chips in the United States, Europe, and the Asia Pacific.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion