- United States

- /

- Retail Distributors

- /

- NYSEAM:DIT

Should AMCON Distributing (NYSEMKT:DIT) Be Disappointed With Their 12% Profit?

It hasn't been the best quarter for AMCON Distributing Company (NYSEMKT:DIT) shareholders, since the share price has fallen 10% in that time. On the other hand the share price is higher than it was three years ago. In that time, it is up 12%, which isn't bad, but not amazing either.

See our latest analysis for AMCON Distributing

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Over the last three years, AMCON Distributing failed to grow earnings per share, which fell 18% (annualized). Earnings per share have melted like a stack of ice cubes, in stark contrast to the share price. So we'll need to take a look at some different metrics to try to understand why the share price remains solid.

Languishing at just 1.1%, we doubt the dividend is doing much to prop up the share price. We severely doubt anyone is particularly impressed with the modest 2.1% three-year revenue growth rate. While we don't have an obvious theory to explain the share price rise, a closer look at the data might be enlightening.

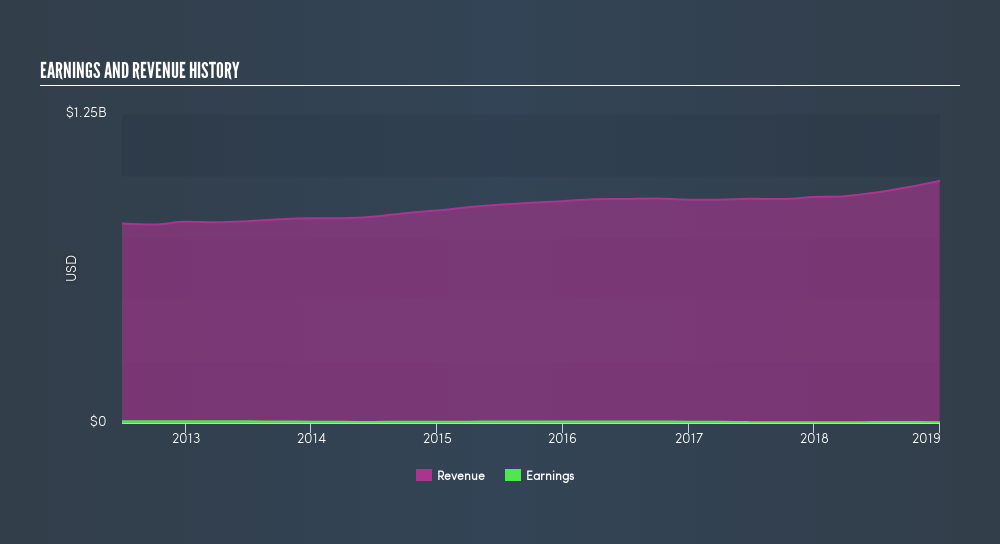

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

You can see how its balance sheet has strengthened (or weakened) over time in this freeinteractive graphic.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of AMCON Distributing, it has a TSR of 16% for the last 3 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

AMCON Distributing shareholders are up 5.5% for the year (even including dividends). But that was short of the market average. The silver lining is that the gain was actually better than the average annual return of 2.8% per year over five year. This could indicate that the company is winning over new investors, as it pursues its strategy. Before spending more time on AMCON Distributing it might be wise to click here to see if insiders have been buying or selling shares.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this freelist of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSEAM:DIT

AMCON Distributing

Engages in the wholesale distribution of consumer products in the Central, Rocky Mountain, and Mid-South regions of the United States.

Slight with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives