- United States

- /

- Specialty Stores

- /

- NYSE:WRBY

Warby Parker (WRBY): Evaluating Valuation After Strong Q3 Profit and Raised Outlook

Reviewed by Simply Wall St

Warby Parker (WRBY) posted its third quarter earnings, marking a swing from last year's net loss to a net profit as revenue climbed. The company also raised its full-year revenue outlook, pointing to continuing momentum.

See our latest analysis for Warby Parker.

Despite this turnaround in profit and optimism for the year ahead, Warby Parker’s share price return tells a more cautious story. The stock is down 32% year-to-date, and the 1-year total shareholder return is also negative at -25.6%. While the company has made strides operationally, recent momentum suggests that investor confidence may take time to rebuild.

If strong quarterly results have you wondering what else is out there, now could be a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares trading well below analyst price targets despite improved profitability and raised revenue guidance, the question now is whether Warby Parker’s current valuation offers real upside or if the market has already factored in future gains.

Most Popular Narrative: 31.6% Undervalued

Analyst expectations place Warby Parker’s fair value well above its last close, suggesting the market may not be fully appreciating its long-term catalysts yet. This gap hints at intriguing projections driving the narrative’s optimistic outlook.

*The partnership with Google to develop AI-powered intelligent eyewear positions Warby Parker to enter a substantially larger market. Leveraging advancements in wearable technology and artificial intelligence could drive new, higher-margin revenue streams in the future. Expansion of the retail footprint, including new shop-in-shops with Target and densification in underpenetrated suburban markets, supports continued growth in active customers and higher average revenue per customer. This directly impacts top-line revenue and long-term market share.*

Want to know the ambitious numbers powering this bullish valuation? There is a bold leap between today’s profits and future targets, including a high-multiple bet on record earnings growth. Unlock the full blueprint and see the financial forecasts that set this narrative apart.

Result: Fair Value of $25.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing e-commerce growth or setbacks in unproven AI ventures could quickly challenge the upbeat outlook and change the direction of Warby Parker’s rerating story.

Find out about the key risks to this Warby Parker narrative.

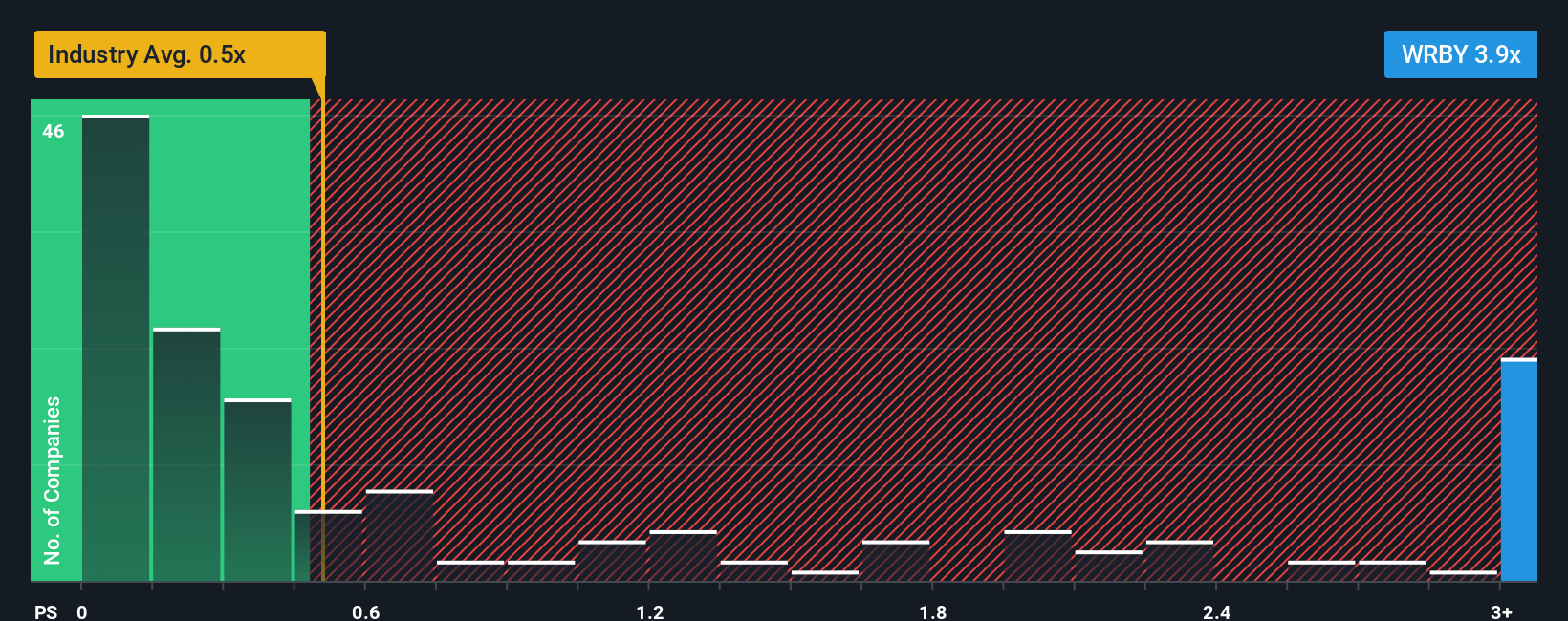

Another View: Trading Multiples Send a Caution Signal

Looking at Warby Parker's price-to-sales ratio, the story changes. Shares trade at 2.5 times sales, much higher than the industry average of 0.4 and above what the fair ratio suggests (1.4x). This signals the market could be pricing in more growth and risk than peers. Does this make the shares riskier, or is the brand's potential worth the premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Warby Parker Narrative

If you see the story differently or want to dive into the numbers yourself, you can build your perspective in just a few minutes, and Do it your way.

A great starting point for your Warby Parker research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Stay a step ahead and seize smart opportunities beyond Warby Parker by checking out these top picks tailored for growth, value, and innovation.

- Tap into tomorrow’s breakthroughs and ride the next big wave in artificial intelligence by following the leaders behind these 27 AI penny stocks.

- Get ahead of the crowd and uncover remarkable value among these 908 undervalued stocks based on cash flows, often overlooked by the broader market.

- Boost your passive income with stability and strong yields by reviewing these 18 dividend stocks with yields > 3%, offering regular payouts above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Warby Parker might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WRBY

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives