- United States

- /

- Specialty Stores

- /

- NYSE:WRBY

Warby Parker (WRBY): Assessing Valuation After New Google Smart Glasses Partnership and Analyst Outperform Rating

Reviewed by Simply Wall St

Warby Parker (WRBY) shares saw a 4% boost after Telsey Advisory Group reaffirmed its Outperform rating. This came alongside news of a new strategic partnership with Google focused on Smart Glasses.

See our latest analysis for Warby Parker.

While Warby Parker’s latest pop has caught attention, it comes after a tough stretch, with a 30-day share price return of -25% and a year-to-date decline of nearly -23%. Even so, long-term investors are still up, with a solid 12-month total shareholder return of 11.5% and a three-year total return of 34.7%. Recent volatility hints that momentum could be shifting as the market digests both challenges and new growth initiatives.

If you’re interested in the next wave of innovation beyond eyewear, now might be a good time to broaden your perspective and discover fast growing stocks with high insider ownership

With analyst optimism building and fresh partnerships on the table, the big question for investors now is whether Warby Parker’s shares are trading at a bargain or if the market has already priced in its next chapter of growth.

Most Popular Narrative: 25% Undervalued

Warby Parker’s most followed narrative sets a fair value well above the last close, painting a bullish outlook as the company enters a new chapter.

The partnership with Google to develop AI-powered intelligent eyewear positions Warby Parker to enter a substantially larger market. This leverages advancements in wearable technology and artificial intelligence to drive new, higher-margin revenue streams in the future.

Curious what’s driving this ambitious price target? The narrative builds on aggressive growth assumptions, bold margin improvements, and a high future profit multiple rarely seen in retail. Which core forecast is the linchpin behind all of this? Peel back the layers to uncover the financial leap that underpins this valuation.

Result: Fair Value of $26.23 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution risk around the Google AI eyewear partnership and slowing e-commerce growth could quickly challenge these optimistic growth assumptions.

Find out about the key risks to this Warby Parker narrative.

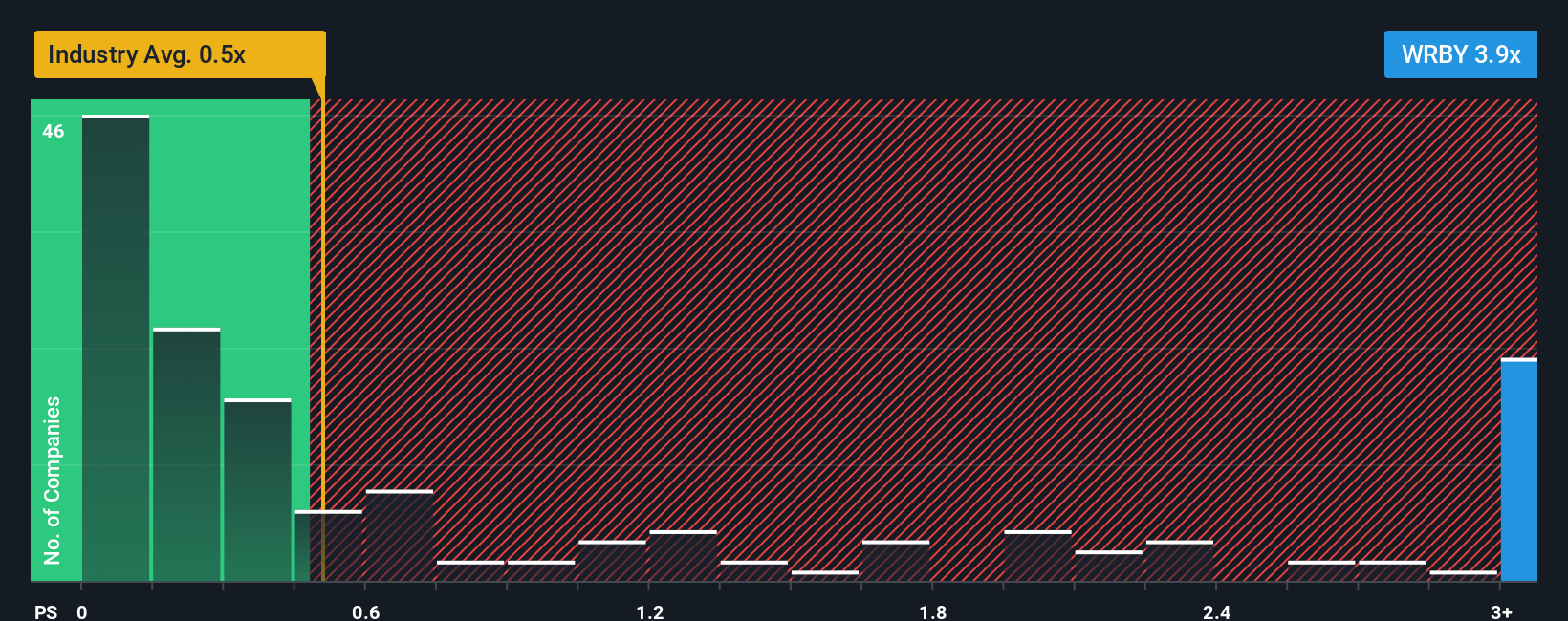

Another View: Looking at Valuation Multiples

While analyst models suggest Warby Parker could be undervalued, the company's price-to-sales ratio stands at 2.9x, which is significantly higher than both the specialty retail industry average of 0.4x and its fair ratio of 1.6x. This premium exposes investors to valuation risk if expectations do not play out as hoped. Would the market adjust if sales growth slows, or is there enough momentum to justify the higher multiple?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Warby Parker Narrative

If you see Warby Parker’s story differently or want to run your own numbers, you can build a personal take on the facts in just minutes with Do it your way.

A great starting point for your Warby Parker research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Make your next big move and don’t let prime opportunities pass you by. Use the Simply Wall St Screener to find companies breaking boundaries in tomorrow’s hottest sectors.

- Jumpstart your portfolio with stable income by checking out these 20 dividend stocks with yields > 3% boasting strong yields above 3%.

- Spot tomorrow’s tech giants early by browsing these 27 AI penny stocks and get in on the artificial intelligence transformation while it’s gaining momentum.

- Uncover value picks trading below their true worth with these 845 undervalued stocks based on cash flows and position yourself ahead of the crowd.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Warby Parker might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WRBY

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives