- United States

- /

- Specialty Stores

- /

- NYSE:WRBY

Could Warby Parker’s (WRBY) Google Partnership Reveal a New Path in Wearable Innovation?

Reviewed by Sasha Jovanovic

- Recently, several analysts have reinforced or boosted their outlook on Warby Parker, highlighting sustained revenue growth and the company’s collaboration with Google to develop Smart Glasses.

- This combination of constructive analyst sentiment and expansion into advanced wearable technology signals a potential shift in Warby Parker’s business model and product reach.

- To assess the implications for investors, we'll explore how the Google Smart Glasses partnership could enhance Warby Parker's investment narrative.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Warby Parker Investment Narrative Recap

Owning Warby Parker stock today means believing in its ability to transform from a direct-to-consumer eyewear retailer into a technology-enabled brand that captures new growth through innovation, particularly in smart eyewear. While the new partnership with Google and recent positive analyst sentiment have brought optimism around future opportunities, neither has fully resolved the biggest short-term catalyst or the main risk, the challenge of scaling high-tech products profitably without losing focus on improving store productivity and operational efficiency. The potential for margin pressure due to aggressive store expansion remains in focus, so the impact of this news on profitability still appears limited.

The May 2025 announcement of Warby Parker’s partnership with Google to develop AI-powered glasses is arguably the most relevant catalyst at the moment. This development gives Warby Parker access to Google’s expertise and financing, positioning the company to enter a market with the potential for higher growth and better margins. However, execution risk and the company’s ability to balance retail operations with innovation will be closely watched in light of ongoing expansion efforts.

On the other hand, investors should be alert to how rapid store growth could stress the company’s margins if...

Read the full narrative on Warby Parker (it's free!)

Warby Parker's narrative projects $1.2 billion in revenue and $85.4 million in earnings by 2028. This requires 14.8% yearly revenue growth and a $94.6 million increase in earnings from the current level of -$9.2 million.

Uncover how Warby Parker's forecasts yield a $26.23 fair value, a 34% upside to its current price.

Exploring Other Perspectives

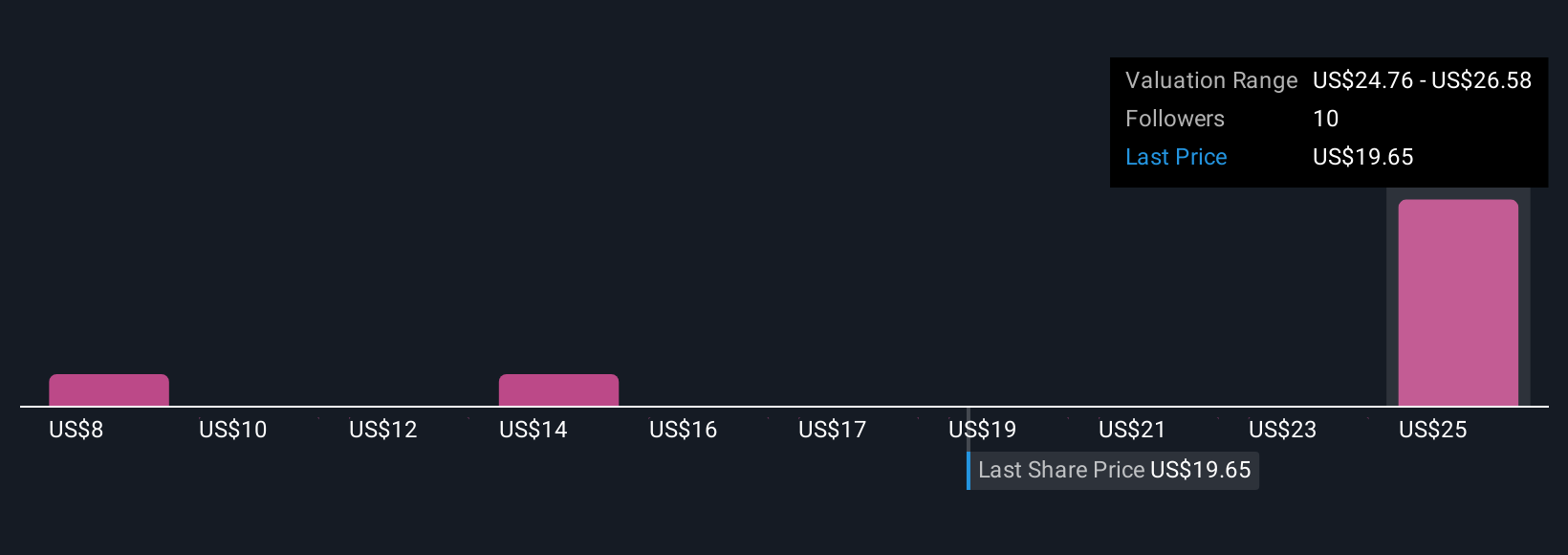

Six community members on Simply Wall St have fair value estimates for Warby Parker from as low as US$5.28 to US$26.58 per share. While many believe potential lies in the Google partnership, some caution that execution risk could weigh on financial results for years to come, consider these diverse community viewpoints to broaden your research.

Explore 6 other fair value estimates on Warby Parker - why the stock might be worth as much as 36% more than the current price!

Build Your Own Warby Parker Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Warby Parker research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Warby Parker research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Warby Parker's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Warby Parker might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WRBY

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives