- United States

- /

- Specialty Stores

- /

- NYSE:VVV

Valvoline (VVV): Evaluating Valuation After Recent Share Price Decline

Reviewed by Simply Wall St

Valvoline (VVV) has caught some attention recently as its shares tracked lower over the past month, declining around 11%. Investors might be curious about what is driving the movement and whether it reflects broader trends for the company.

See our latest analysis for Valvoline.

It’s been a rough patch for Valvoline, with the share price down 10.7% over the past month and 20% over the last quarter. This drop continues a longer trend, as the 1-year total shareholder return now sits at -25.7%. Short-term momentum is definitely fading. However, with the five-year total shareholder return still positive at 44.6%, long-term holders have seen solid gains despite recent volatility.

If you want to look beyond the recent dip and see what other standout stocks are capturing attention right now, why not broaden your search and discover fast growing stocks with high insider ownership

With the stock recently slipping and still trading nearly 39% below the average analyst price target, do these levels signal a buying opportunity for Valvoline, or is the market already pricing in expected growth?

Most Popular Narrative: 28.7% Undervalued

With Valvoline's fair value pegged at $44.12 and shares recently closing at $31.44, there is a wide gap between expectations and current market sentiment. The following excerpt highlights a major business transformation shaping this valuation.

Strategic store expansion, acquisitions, and premium service offerings are fueling broader geographic reach, higher service capacity, and stronger long-term revenue growth. Operational efficiencies and rising demand for professional, convenient maintenance are expanding margins and bolstering overall profitability.

Want to know the ambitious growth plan behind this bold fair value? Analysts are building their forecast on a surge in revenue, profitability levers, and premium-focused business bets. See which future margins and multiples drive this market-beating price target. Dive in; the numbers might surprise you.

Result: Fair Value of $44.12 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, accelerating electric vehicle adoption and rising labor costs present real challenges that could undermine these optimistic growth projections for Valvoline's business.

Find out about the key risks to this Valvoline narrative.

Another View: Multiples Paint a Different Picture

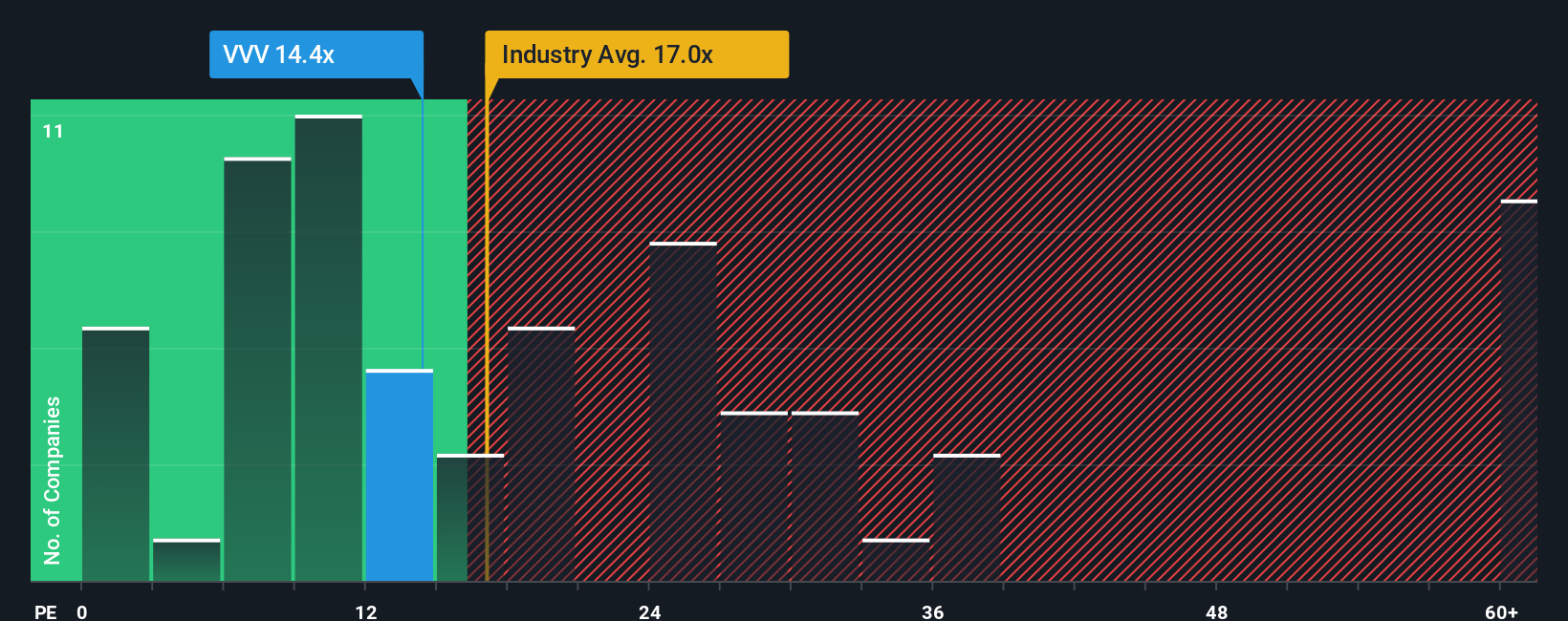

Looking at valuation through the lens of the price-to-earnings ratio, Valvoline trades at 14.4x earnings. This is lower than the US Specialty Retail industry average of 17.6x, suggesting relative value in its sector. However, it is above its own fair ratio of 13.6x and higher than the peer average of 9.6x, indicating the risk of a market correction if sentiment shifts. Is this a hidden bargain or a sign the market has already priced in growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Valvoline Narrative

If you see the story differently or want to shape your own perspective, it's quick and easy to dive into the numbers yourself and share insights. Do it your way

A great starting point for your Valvoline research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Stock market opportunities never wait, so don’t let them pass you by. Challenge your perspective and power up your watchlist with these dynamic themes you might be overlooking:

- Recharge your portfolio with reliable returns by targeting these 16 dividend stocks with yields > 3% offering yields above 3% in today’s income-hungry market.

- Seize the potential in cutting-edge healthcare advancements with these 31 healthcare AI stocks making waves amid the AI revolution in medicine.

- Ride the momentum of digital transformation by scouting these 82 cryptocurrency and blockchain stocks pioneering breakthroughs in blockchain and alternative finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VVV

Valvoline

Engages in the operation and franchising of vehicle service centers and retail stores in the United States and Canada.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives