- United States

- /

- Specialty Stores

- /

- NYSE:VVV

Chief Financial Officer of Valvoline John Willis Buys 73% More Shares

Potential Valvoline Inc. (NYSE:VVV) shareholders may wish to note that the Chief Financial Officer, John Willis, recently bought US$314k worth of stock, paying US$31.41 for each share. We reckon that's a good sign, especially since the purchase boosted their holding by 73%.

The Last 12 Months Of Insider Transactions At Valvoline

Notably, that recent purchase by Chief Financial Officer John Willis was not the only time they bought Valvoline shares this year. They previously made an even bigger purchase of US$502k worth of shares at a price of US$39.42 per share. So it's clear an insider wanted to buy, even at a higher price than the current share price (being US$31.62). While their view may have changed since the purchase was made, this does at least suggest they have had confidence in the company's future. We always take careful note of the price insiders pay when purchasing shares. It is generally more encouraging if they paid above the current price, as it suggests they saw value, even at higher levels.

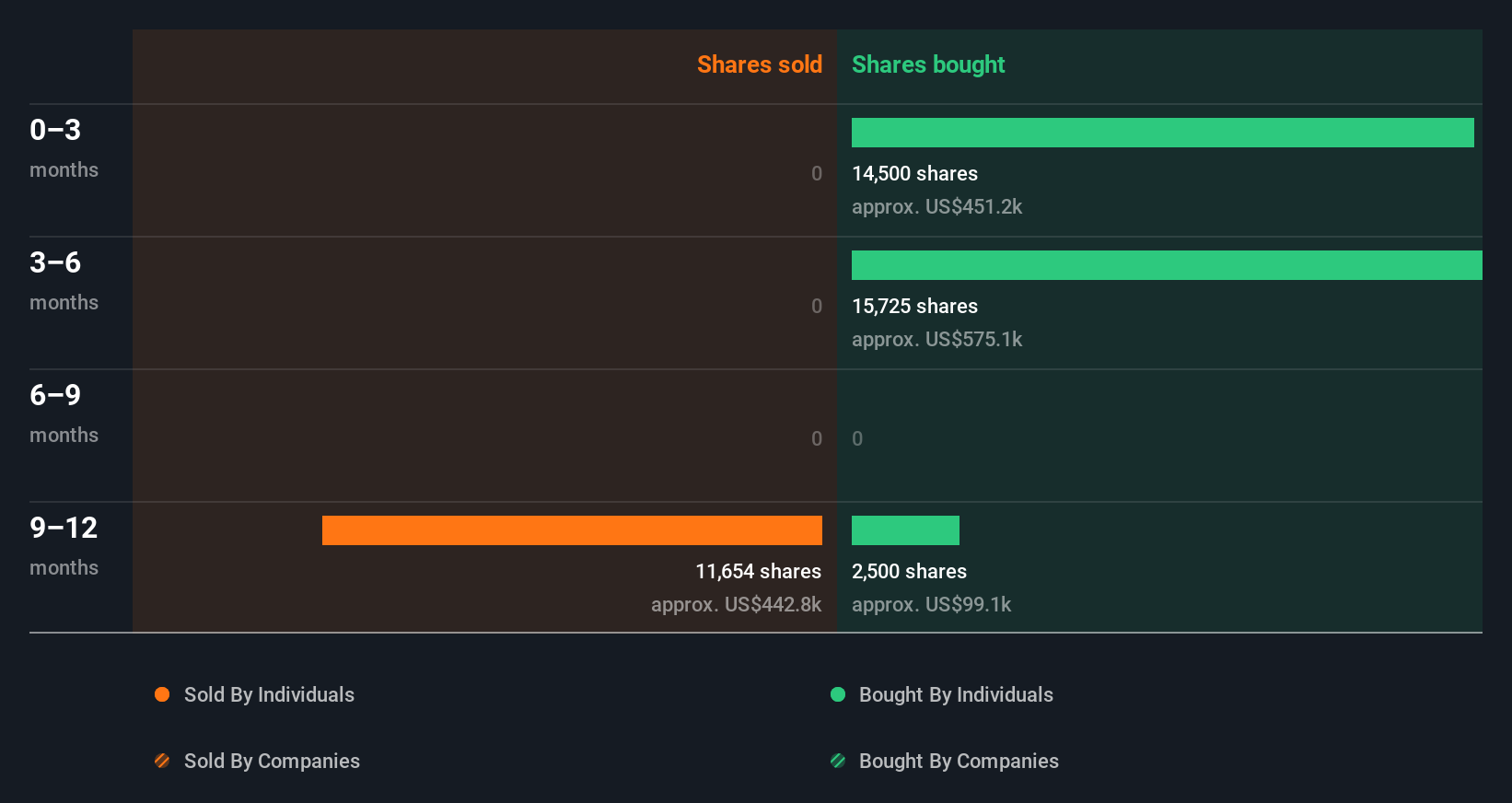

Over the last year, we can see that insiders have bought 32.73k shares worth US$1.2m. But insiders sold 11.65k shares worth US$438k. In the last twelve months there was more buying than selling by Valvoline insiders. Their average price was about US$35.29. These transactions suggest that insiders have considered the current price attractive. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

Check out our latest analysis for Valvoline

Valvoline is not the only stock insiders are buying. So take a peek at this free list of under-the-radar companies with insider buying.

Insider Ownership

For a common shareholder, it is worth checking how many shares are held by company insiders. A high insider ownership often makes company leadership more mindful of shareholder interests. It appears that Valvoline insiders own 0.3% of the company, worth about US$12m. This level of insider ownership is good but just short of being particularly stand-out. It certainly does suggest a reasonable degree of alignment.

What Might The Insider Transactions At Valvoline Tell Us?

It's certainly positive to see the recent insider purchases. And an analysis of the transactions over the last year also gives us confidence. Given that insiders also own a fair bit of Valvoline we think they are probably pretty confident of a bright future. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. At Simply Wall St, we found 2 warning signs for Valvoline that deserve your attention before buying any shares.

But note: Valvoline may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:VVV

Valvoline

Provides automotive preventive maintenance through its retail stores in the United States and Canada.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success