- United States

- /

- Specialty Stores

- /

- NYSE:VSCO

Victoria's Secret (VSCO): Exploring Valuation Following Recent 37% Share Price Surge

Reviewed by Simply Wall St

Victoria's Secret (VSCO) shares have gained ground over the past month, climbing nearly 37%. Investors are likely weighing the company’s recent operating performance and valuation, especially as return trends far outpace the S&P 500.

See our latest analysis for Victoria's Secret.

Victoria's Secret has staged a remarkable rebound over the past quarter, with the 1-month share price return surging 36.8%. This run extends a recent wave of momentum and puts its 1-year total shareholder return at 25%, a clear shift from what had been a lackluster longer-term trend. Recent upward moves suggest that the market is warming up to the stock’s growth prospects, reflecting improving sentiment and new expectations about value.

If you’re curious what else is catching investors’ attention, now is a perfect time to explore fast growing stocks with high insider ownership. Discover fast growing stocks with high insider ownership

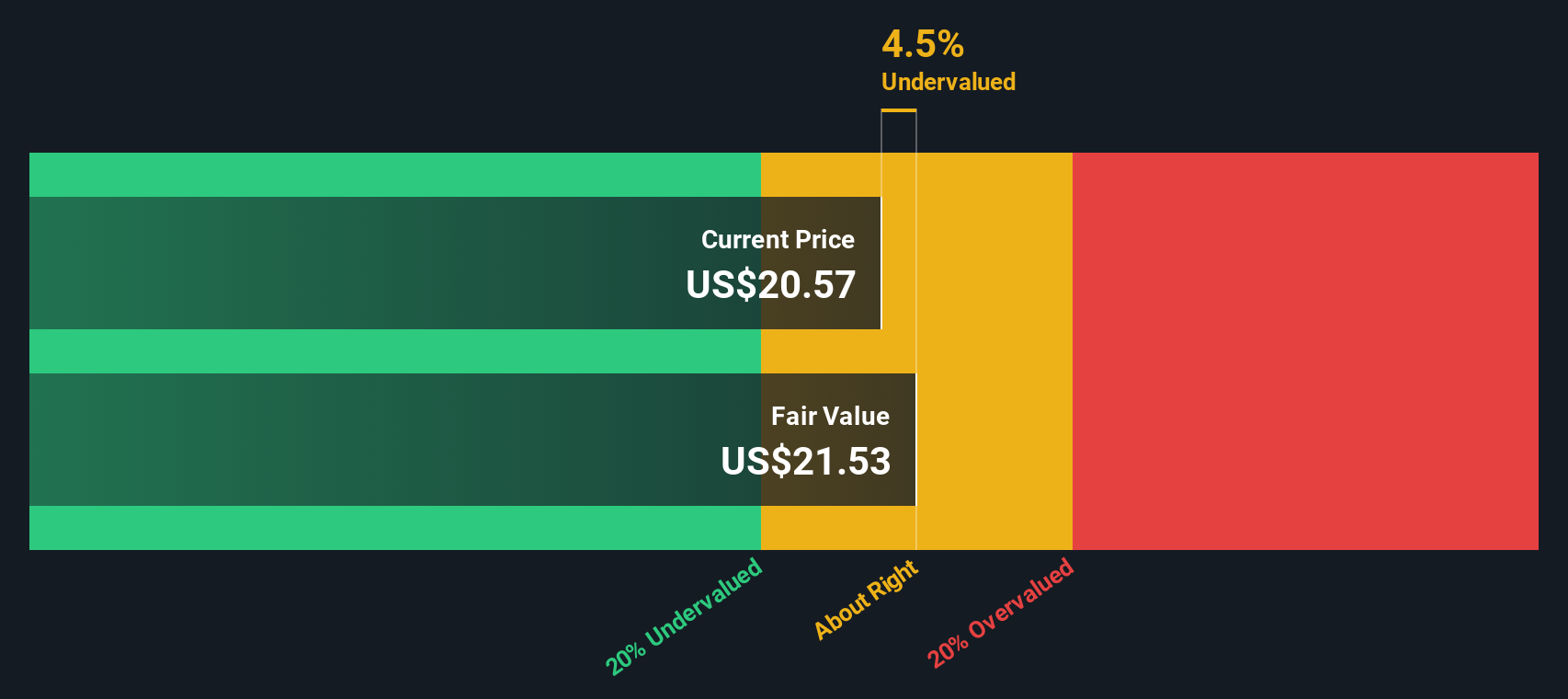

With shares gaining so much ground in a short span, investors must decide whether Victoria's Secret stock still trades at a discount or if the recent rally means future growth is already reflected in the price.

Most Popular Narrative: 42.6% Overvalued

Victoria's Secret’s widely followed narrative suggests its fair value is well below the last close of $36.23, highlighting a significant valuation gap. This dynamic sets the scene for a closer look at the assumptions fueling such a stance and what could be driving sentiment behind the current price.

Momentum in omnichannel growth, including robust international expansion (notably in China and other emerging markets) and digital channel strength, positions the brand to benefit from rising global middle-class demand, leading to higher topline revenue and improved operating leverage. Continuous innovation through shorter product lead times, rapid product cycles, and more frequent fashion and cultural collaborations is enabling Victoria's Secret to better respond to consumer preferences and cultural trends, resulting in higher regular-priced sales and mitigating promotional markdowns, supporting gross margin improvement.

Want to know why the fair value sits so far below the market price? This narrative relies on bullish growth bets, evolving channels, and an ambitious profit multiple. What bold assumptions separate perception from price? See which critical financial leaps underpin this controversial calculation.

Result: Fair Value of $25.40 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent tariff exposure and shrinking mall traffic could quickly derail Victoria's Secret’s growth momentum. This may put earnings and margins under renewed pressure.

Find out about the key risks to this Victoria's Secret narrative.

Another View: SWS DCF Model Points to Undervaluation

While analysts argue Victoria's Secret is overvalued relative to their price targets, the SWS DCF model offers a sharply different picture. This approach estimates fair value at $43.65, which is around 17% above the current share price. If the cash flow forecasts hold up, is the market missing a potential opportunity?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Victoria's Secret for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Victoria's Secret Narrative

If you'd rather dig into the data yourself or want to craft your own investment perspective, you can shape your narrative in just a few minutes: Do it your way

A great starting point for your Victoria's Secret research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always keep an eye on what’s next. Miss out on these fresh opportunities and you could easily overlook the market’s next big winner.

- Secure reliable income streams by checking out these 21 dividend stocks with yields > 3% with strong yields and consistent payouts that boost your returns.

- Capitalize on the artificial intelligence revolution by evaluating these 26 AI penny stocks that are driving breakthroughs in automation, data analysis, and predictive insights.

- Spot potential market bargains by comparing these 854 undervalued stocks based on cash flows trading below their intrinsic value based on cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VSCO

Victoria's Secret

Operates as a specialty retailer of women’s intimate, and other apparel and beauty products worldwide.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives