- United States

- /

- Specialty Stores

- /

- NYSE:VSCO

Victoria's Secret (VSCO): Evaluating Valuation After Boardroom Battle With Activist Investor

Reviewed by Simply Wall St

Victoria's Secret (VSCO) finds itself in the spotlight after BBRC International went public with demands for board changes, including the removal of the current Chair. The company quickly responded, defending its approach and recent results.

See our latest analysis for Victoria's Secret.

Victoria’s Secret’s recent activist drama comes on the heels of some dramatic swings for investors. In spite of calls for boardroom change, shares have staged a strong comeback lately, with a 17.5% 1-month share price return and an eye-catching 59.8% jump over the past 90 days. Still, the 1-year total shareholder return sits at -2.7%, reflecting the longer-term volatility and shifting sentiment. Momentum has clearly picked up recently as the governance debate intensifies and management highlights operational improvements.

If you’re curious what other stocks might be gaining momentum beyond the headlines, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

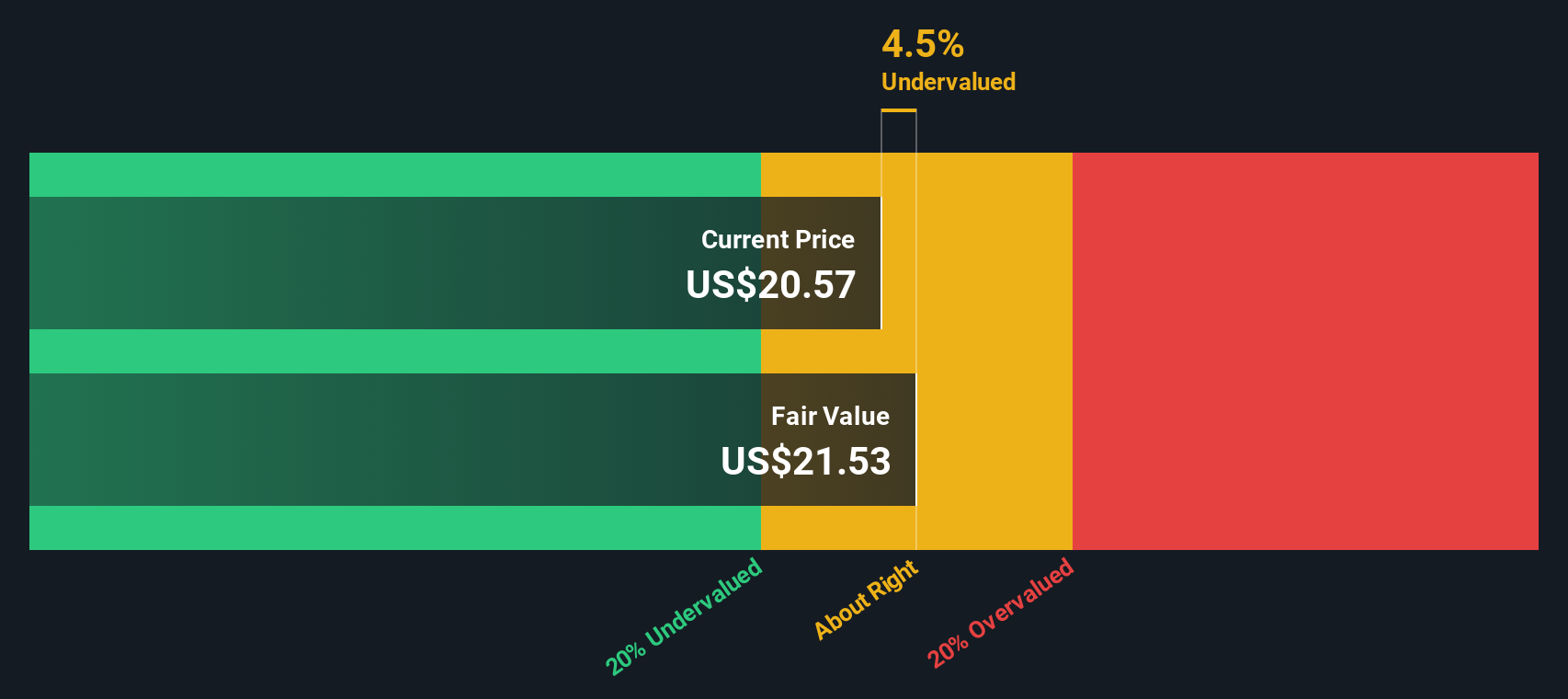

With volatility and activism swirling, the big question now is whether Victoria’s Secret shares present genuine value after their rebound or if Wall Street has already priced in a turnaround, leaving little room for further upside.

Most Popular Narrative: 23% Overvalued

Victoria’s Secret’s most widely followed narrative sets its fair value well below the current price, reflecting doubts about whether recent business improvements can fully translate into future earnings power. This viewpoint hinges on the interplay between slow profit growth and ambitious future valuation multiples.

Continuous innovation through shorter product lead times, rapid product cycles, and more frequent fashion and cultural collaborations is enabling Victoria's Secret to better respond to consumer preferences and cultural trends, resulting in higher regular-priced sales and mitigating promotional markdowns. This supports gross margin improvement.

What is really fueling this downside call? The narrative banks on profit margins staying tight, topline growth being steady but not spectacular, and analysts baking in a future earnings multiple far above today's market average. Want to know which aggressive projections are driving the sharp gap between fair value and price? Find out what numbers the crowd is betting on and why.

Result: Fair Value of $29 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent tariff pressures and ongoing reliance on brick-and-mortar stores could dampen margin improvements and slow the pace of any sustained turnaround.

Find out about the key risks to this Victoria's Secret narrative.

Another View: SWS DCF Model Suggests Undervaluation

While analyst targets imply Victoria’s Secret shares are overvalued, our SWS DCF model finds the stock trades about 20% below its fair value, at $35.70 compared to a calculated fair value of $44.93. Two different methods, two very different signals. Which one will guide the market next?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Victoria's Secret for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 879 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Victoria's Secret Narrative

If you see things differently or want to dig into the numbers yourself, you can shape your own Victoria’s Secret story in a matter of minutes: Do it your way

A great starting point for your Victoria's Secret research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Act now to uncover markets where others aren’t looking. Your next opportunity could be waiting among stocks with powerful momentum, unique innovation, or hidden value. Don’t let it pass you by.

- Supercharge your search by targeting growth stories with upside through these 879 undervalued stocks based on cash flows that reveal discounted businesses overlooked by the crowd.

- Pinpoint tomorrow’s healthcare breakthroughs by checking out these 31 healthcare AI stocks packed with the latest in AI-driven medical advances and strong fundamentals.

- Unlock monthly cash flow and portfolio income by tapping into these 16 dividend stocks with yields > 3%, featuring companies with yields above 3% and a track record of rewarding shareholders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VSCO

Victoria's Secret

Operates as a specialty retailer of women’s intimate, and other apparel and beauty products worldwide.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives