- United States

- /

- Specialty Stores

- /

- NYSE:TJX

TJX Companies (TJX): Evaluating Valuation After Analysts Reaffirm Bullish Outlook Following Strong Earnings Beat

Reviewed by Simply Wall St

TJX Companies (TJX) is attracting attention after delivering quarterly results that topped earnings estimates, supported by consistent sales growth and expanding margins. This positive performance has led analysts to reaffirm their optimistic outlook on the stock.

See our latest analysis for TJX Companies.

Following the upbeat quarterly report, TJX Companies’ share price sits at $142.05, capping off a strong stretch for long-term investors. The 1-year total shareholder return stands at an impressive 26.45%, and the stock’s robust five-year total return of 145% shows consistent momentum as optimism continues to build for the off-price giant.

If you’re curious what other fast-moving opportunities are out there, this is a great moment to discover fast growing stocks with high insider ownership.

Yet with the stock delivering strong gains over the past year and analysts reiterating bullish price targets, the key question remains: is there still untapped value here, or has the market already factored in TJX Companies’ future growth?

Most Popular Narrative: 6.2% Undervalued

With TJX Companies closing at $142.05 and the narrative’s fair value set at $151.37, the valuation conversation has shifted. Investors are recalibrating as the spread between current price and narrative fair value broadens the debate.

The company's uniquely flexible, discovery-driven in-store experience is driving higher store traffic from a wide demographic range, including increased engagement from younger customers. This approach capitalizes on consumer desire for experiential shopping and repeat visits, supporting both top-line revenue and frequency of purchases.

What’s fueling this price target? The entire fair value argument pivots on data-backed profit expansion and a bullish stance on future margins, growth, and share buybacks. Curious just how ambitious the core forecasts are? Unlock the narrative to dissect the projections that could move the market.

Result: Fair Value of $151.37 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, an accelerated consumer shift toward e-commerce or changes in merchandise sourcing could quickly challenge today's positive narrative for TJX Companies.

Find out about the key risks to this TJX Companies narrative.

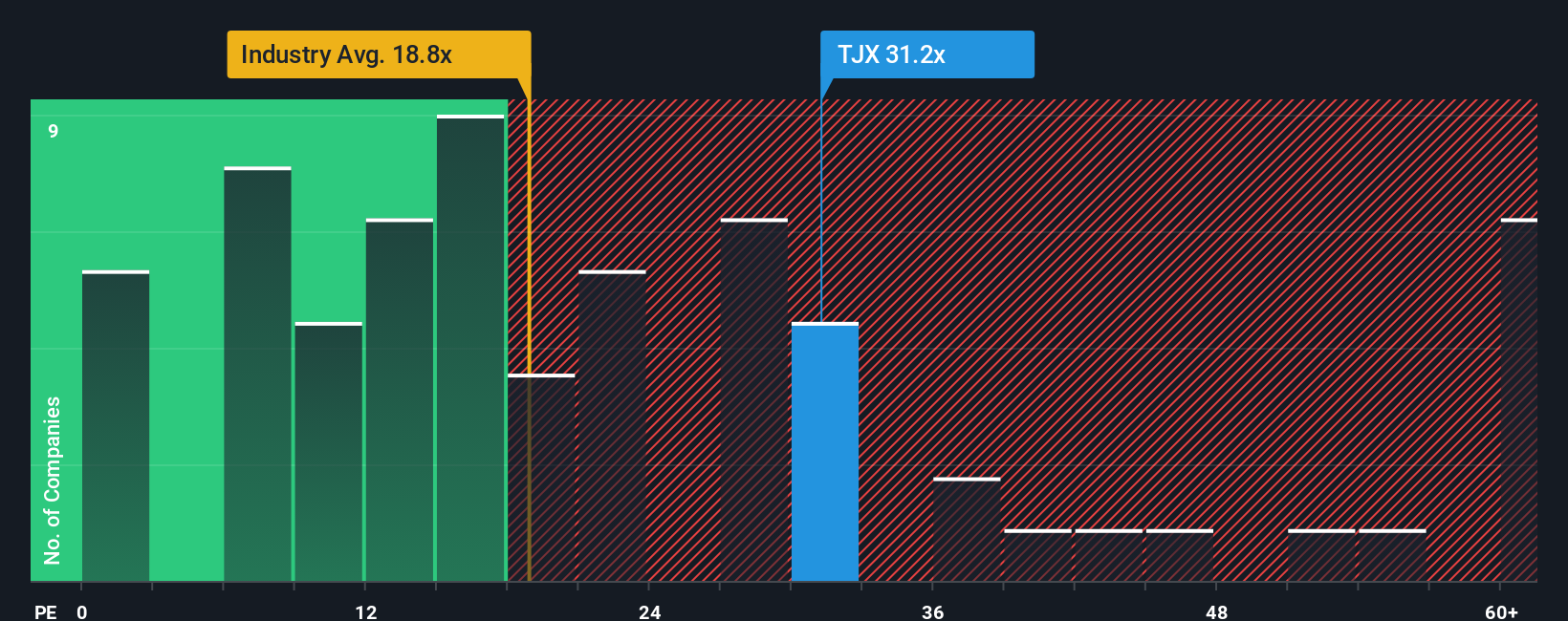

Another View: Multiples Raise a Red Flag

While the fair value estimate suggests upside, the latest market multiples paint a more cautious picture. TJX Companies' price-to-earnings ratio sits at 31.8x, making it notably pricier than both the US Specialty Retail industry average of 16.6x and its peer average of 19.5x. Even compared to the fair ratio of 20.7x, the stock looks expensive. This suggests investors pay a premium for its proven consistency and profitability. Does this premium signal future outperformance, or is it a warning flag about limited room for error?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TJX Companies Narrative

If you see things differently or want hands-on experience with the numbers, it takes just a few minutes to craft your own perspective. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding TJX Companies.

Looking for More Investment Ideas?

Why limit your potential? Take charge of your portfolio by targeting unique stock opportunities most investors overlook. You might just find your next winner here.

- Capitalize on the momentum of companies at the forefront of AI breakthroughs by starting your search with these 27 AI penny stocks.

- Boost your income stream with robust yields by checking out these 20 dividend stocks with yields > 3%, featuring stocks that reward shareholders with generous payouts.

- Seize undervalued prospects in the market before others catch on by exploring these 844 undervalued stocks based on cash flows for hidden gems based on cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TJX Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TJX

TJX Companies

Operates as an off-price apparel and home fashions retailer worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives