- United States

- /

- Specialty Stores

- /

- NYSE:SIG

A Fresh Look at Signet Jewelers (SIG) Valuation After Recent Share Price Pullback

Reviewed by Simply Wall St

See our latest analysis for Signet Jewelers.

Signet’s share price has seen some turbulence lately, dipping nearly 9% over the past month after a stretch of strong momentum earlier this year. Even with short-term volatility, long-term investors are still well ahead, with a total shareholder return of over 50% for the past three years and more than triple their money over five years.

If retail market swings have you thinking bigger, this could be your signal to discover fast growing stocks with high insider ownership

With shares pulling back and valuations showing a notable discount to analyst targets, investors are left asking whether Signet Jewelers is trading below its true value or if the market has already factored in the company’s future growth potential.

Most Popular Narrative: 16.9% Undervalued

With the most widely followed narrative setting fair value at $113.14, Signet's last close of $93.98 leaves plenty of room for upside if those optimistic projections hold true. Investors are monitoring whether the catalysts being credited with this valuation actually play out in coming quarters.

Ongoing investment in omnichannel capabilities, digital marketing, and data-driven personalization, combined with new leadership hires with digital and brand expertise, is set to improve customer engagement, increase conversion rates, and support operating margin expansion.

Want to know the financial assumptions fueling this bullish valuation? The most popular narrative is expecting a level of profit growth and margin transformation rarely seen in retail. Curious about the bold levers analysts are pulling for this target? Dive into the full story to see the projections that could change everything.

Result: Fair Value of $113.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent industry headwinds, such as higher tariffs from India and ongoing softness in jewelry unit sales, could challenge the optimistic outlook if they persist.

Find out about the key risks to this Signet Jewelers narrative.

Another View: Looking Through the Earnings Lens

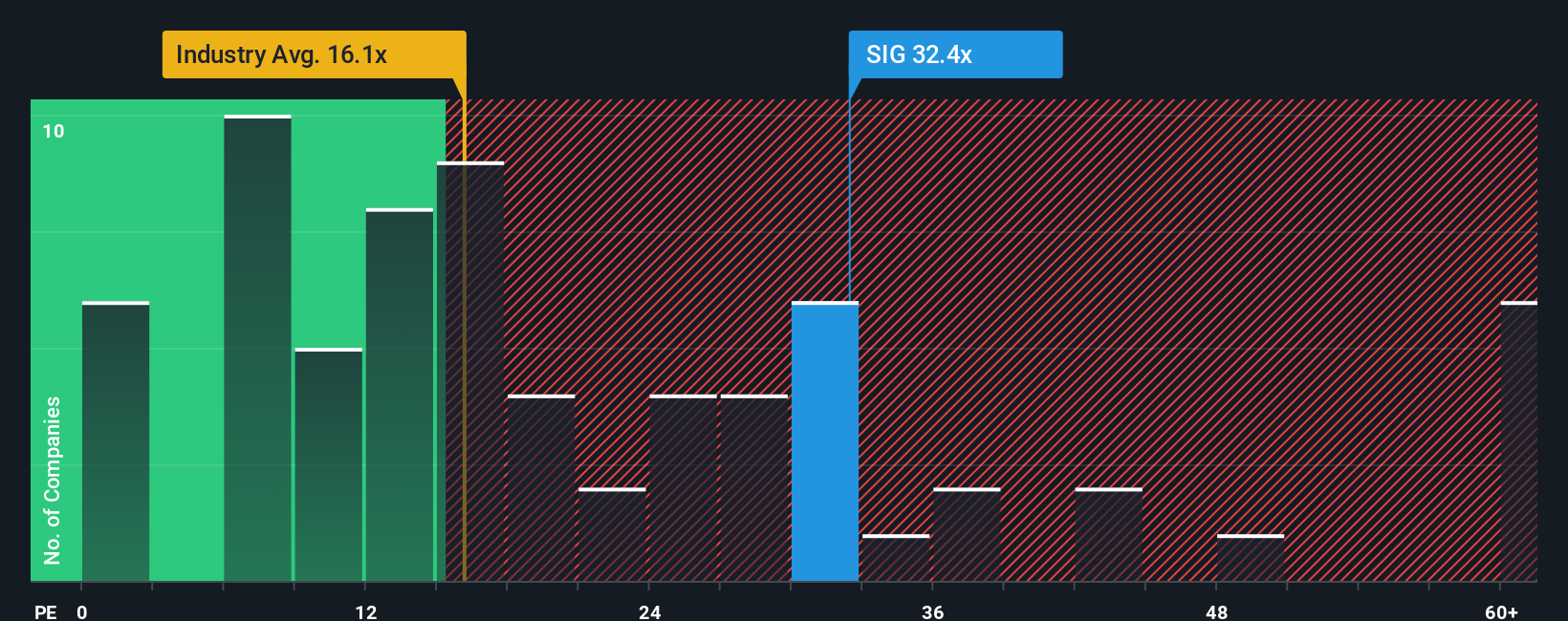

While optimistic price targets suggest upside for Signet Jewelers, a glance at the company’s current price-to-earnings ratio raises caution. Trading at 29.5 times earnings, Signet looks significantly pricier than its industry peers at 16.6 times, as well as the fair ratio of 28. In practice, this means investors are paying a larger premium than the broader market, which could add risk if growth does not accelerate. Could this valuation gap signal future disappointment, or is it justified by Signet’s turnaround momentum?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Signet Jewelers Narrative

If you want to dig into the numbers and form your own independent view, it only takes a few minutes to build your own Signet Jewelers outlook. Do it your way

A great starting point for your Signet Jewelers research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investing Opportunities?

Don’t let a single stock define your portfolio. There are fresh high-potential ideas waiting. Jump in now and see what you might be missing.

- Accelerate your search for tomorrow's most innovative breakthroughs by checking out these 27 AI penny stocks as you tap into artificial intelligence for real market results.

- Start building passive income with confidence by targeting these 18 dividend stocks with yields > 3% which offers yields that can boost your returns above 3%.

- Take a bold step toward the forefront of technology with these 26 quantum computing stocks driving exciting advancements in quantum computing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SIG

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives