- United States

- /

- Specialty Stores

- /

- NYSE:SBH

Sally Beauty Holdings (SBH): How Does Its Recent 45% Rally Stack Up Against Current Valuation?

Reviewed by Simply Wall St

See our latest analysis for Sally Beauty Holdings.

Sally Beauty Holdings keeps turning heads, as its recent share price run has been even more impressive when you zoom out. With the stock up over 45% in the last three months, momentum is picking up, and while its short-term 30-day share price return was a modest dip, the overall picture is defined by strong gains, especially when you consider a 21% total shareholder return over the past year and more than 70% total return over five years. That kind of performance suggests investors are recognizing potential and rewarding progress.

If Sally’s continued climb has you wondering what other opportunities are gaining steam, now’s a great time to broaden your search and discover fast growing stocks with high insider ownership

But with shares up so sharply, the big question now is whether Sally Beauty Holdings remains undervalued or if the stock’s rally has already factored in the company’s next chapter of growth. Could there still be a buying opportunity?

Most Popular Narrative: 4.2% Overvalued

With Sally Beauty Holdings closing at $15.06 and the most popular narrative placing fair value at $14.45, there is a slight premium built into the latest price. This setup raises questions about what is driving this optimistic outlook and whether the recent rally is sustainable.

Ongoing cost structure optimization through the Fuel for Growth program is delivering significant SG&A and gross margin savings, enabling both reinvestment in growth initiatives and direct improvement to net margins and earnings over the next several years.

Wondering what is really powering this ambitious valuation? There is a decisive financial forecast at the core, hinging on profit margin expansion, a shrinking share count, and a future earnings multiple below the industry norm. Interested in discovering what assumptions could tip the balance? The full narrative unpacks the boldest projections that back up this fair value.

Result: Fair Value of $14.45 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing softness in certain categories and lagging digital adoption could challenge the optimistic outlook and put future revenue growth for Sally Beauty Holdings at risk.

Find out about the key risks to this Sally Beauty Holdings narrative.

Another View: Discounted Cash Flow Tells a Different Story

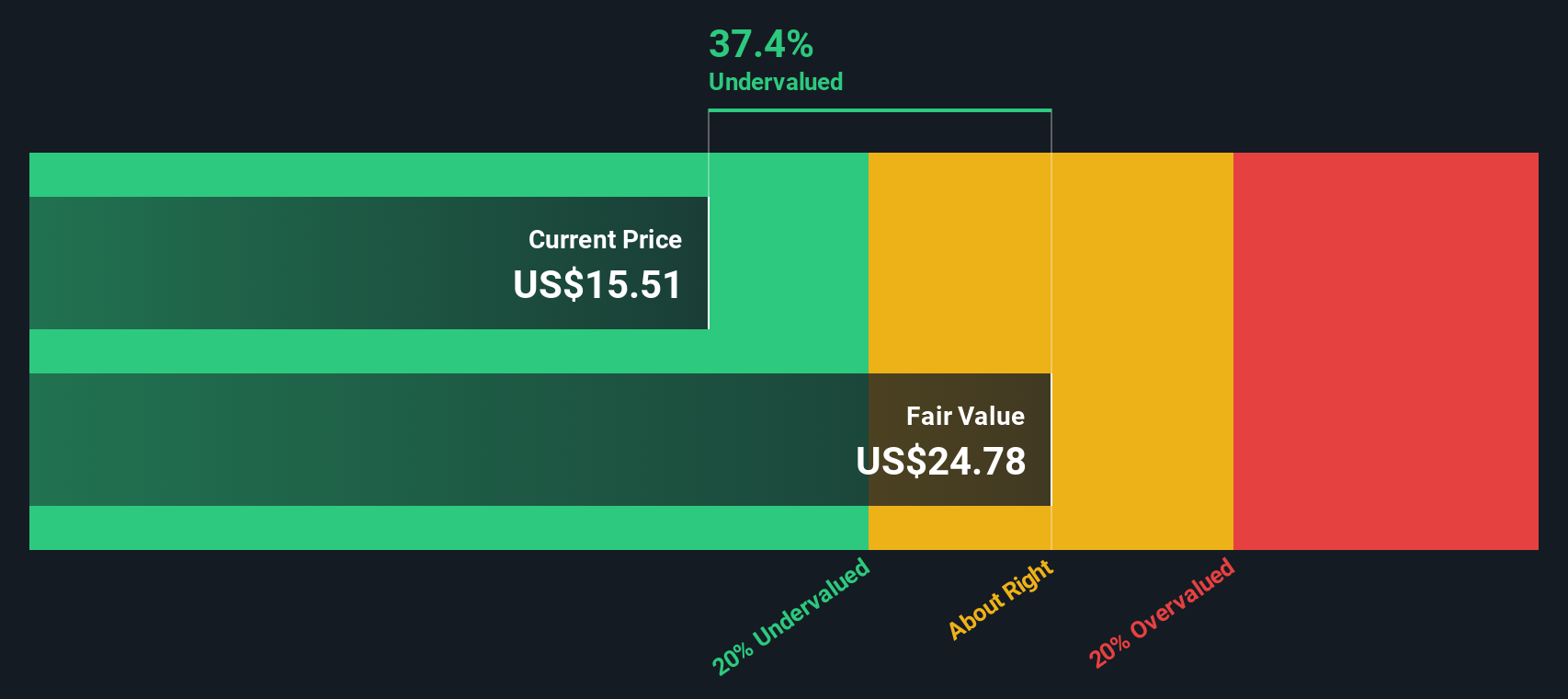

While the current market price and analyst targets suggest Sally Beauty Holdings is slightly overvalued, our SWS DCF model shows a notable contrast. The DCF approach estimates a fair value of $24.81 per share, indicating the stock could be significantly undervalued by nearly 40 percent if these future cash flow assumptions hold. Could the true opportunity be hiding in overlooked fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Sally Beauty Holdings Narrative

If you think there’s a different angle or want to dig into the details yourself, you can craft your own Sally Beauty Holdings story in just a few minutes. Do it your way

A great starting point for your Sally Beauty Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Take the lead and position yourself for the next big opportunity by using the Simply Wall Street Screener. These handpicked stock ideas can give your portfolio an extra edge before the crowd catches up. Smart investors never wait on the sidelines.

- Seize hard-to-find value by tracking these 875 undervalued stocks based on cash flows and uncover companies priced below their true worth based on real cash flows.

- Tap into reliable income streams by finding these 17 dividend stocks with yields > 3% that deliver attractive yields above 3 percent for your long-term strategy.

- Ride the surge in next-generation computing with these 27 quantum computing stocks at the forefront of innovation and technological breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SBH

Sally Beauty Holdings

Operates as a specialty retailer and distributor of professional beauty supplies.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives