- United States

- /

- Specialty Stores

- /

- NYSE:RVLV

Revolve Group (RVLV) Earnings Growth Rebounds, Premium Valuation Raises Expectations vs Market Narratives

Reviewed by Simply Wall St

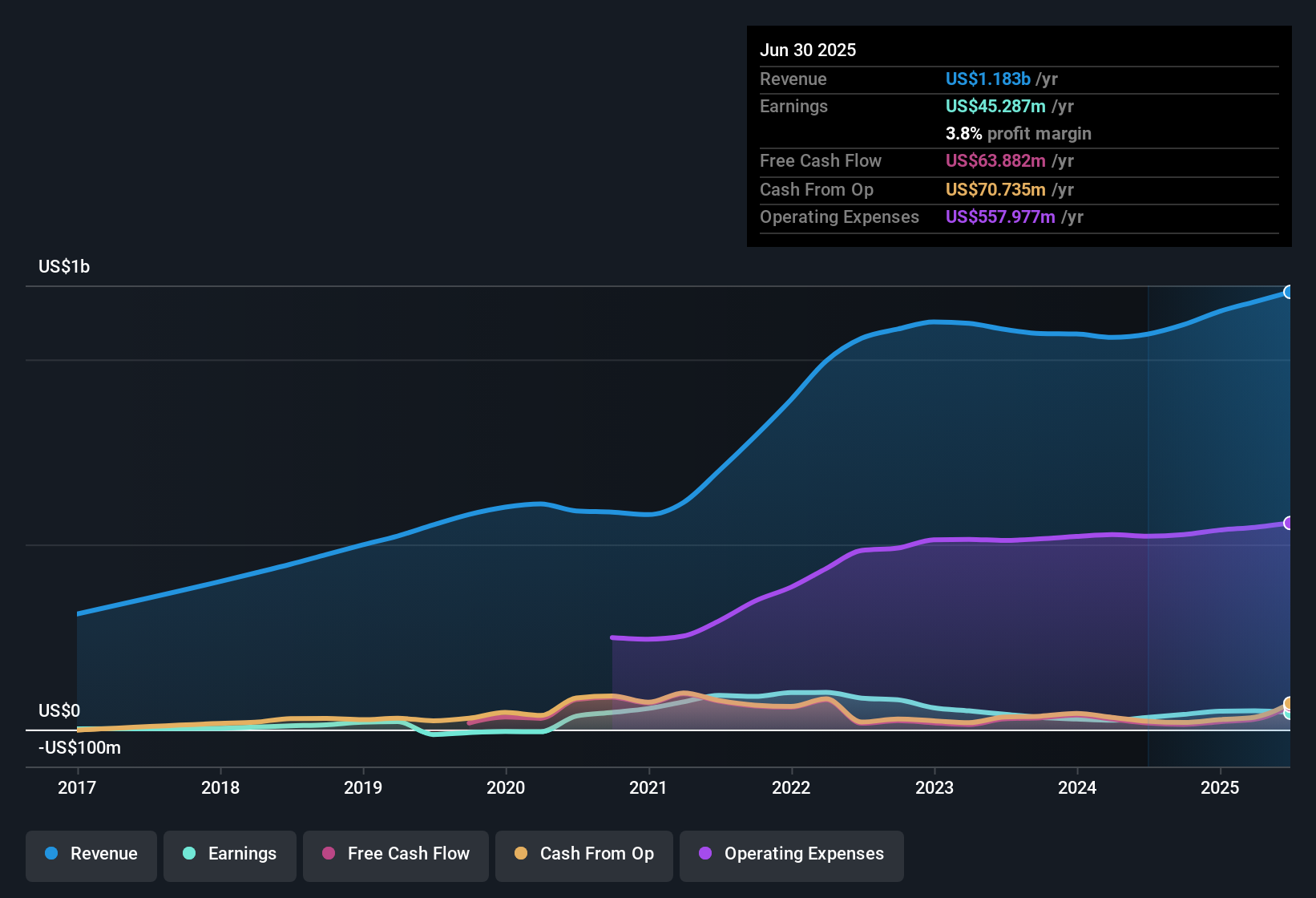

Revolve Group (RVLV) posted revenue growth of 7% per year, trailing the US market’s expected 10.5% pace. EPS rose in line with a sharp earnings turnaround, up 37.6% from last year and reversing the company’s five-year average annual decline of 17.1%. Net profit margins climbed to 3.8%, compared to 3.1% a year ago, and earnings are projected to grow 15% annually, just shy of the US market’s 16% forecast. As shares trade above fair value at $22.18 and the Price-To-Earnings ratio stands at 34.9x, investors will be weighing double-digit growth against premium valuations this earnings season.

See our full analysis for Revolve Group.The next step is setting these headline numbers against the most widely followed narratives to see which expectations are confirmed and which get upended.

See what the community is saying about Revolve Group

Margins Trending Up to 4.6% by 2028

- Analysts expect net profit margins to rise from 3.8% today to 4.6% within three years, signaling anticipated improvement in profitability over the medium term.

- According to the analysts' consensus view, better inventory management, more exclusive brands, and tighter supply chains are driving this margin uplift.

- Gains are tied to optimizing markdowns and reduced cost of goods sold, which support the margin forecast despite international expansion costs.

- If these improvements hold, net profits are projected to reach $65.4 million by 2028 compared to $45.3 million currently.

- Growing international investments should support long-term profitability if supply chain risks are managed as expected.

Valuation Premium versus Industry

- Revolve trades at a Price-to-Earnings ratio of 34.9x, more than double the US Specialty Retail industry average of 16.4x. The current share price of $22.18 sits above its DCF fair value of $18.60.

- The consensus narrative suggests the premium multiple reflects investor confidence in Revolve’s potential but also leaves little room for disappointment.

- To justify today’s pricing, the stock must meet or beat consensus forecasts for revenue to grow at 6.6% per year with margins reaching 4.6%.

- The narrow gap between the current share price and the $25.50 analyst price target indicates most analysts see the stock as fairly valued given its outlook and risks.

Tariff and Inventory Risks Could Pressure Margins

- Risks identified in the consensus narrative focus on margin vulnerability from tariff changes and inventory missteps as international operations expand.

- Consensus narratives caution that international growth, especially in China, may expose Revolve to volatile tariffs and potential inventory markdowns if demand trends shift or supply chain strategies miss the mark.

- If margin improvement from 3.8% to 4.6% falters, analysts warn earnings and valuation expectations would quickly become stretched at current multiples.

- Heavier investments in owned brands might amplify these risks, raising the stakes if consumer trends move unexpectedly.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Revolve Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Thinking about the numbers from another angle? Share your perspective and build your own narrative in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Revolve Group.

See What Else Is Out There

Revolve’s high valuation and reliance on achieving ambitious margin and revenue targets leave little room for error if growth expectations are missed.

If you want more value for your money, discover these 839 undervalued stocks based on cash flows where companies are trading below their fair value versus optimistic forecasts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RVLV

Revolve Group

Operates as an online fashion retailer for millennial and generation z consumers in the United States and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives