- United States

- /

- Insurance

- /

- NYSE:HMN

Discovering US Undiscovered Gems This October 2025

Reviewed by Simply Wall St

In October 2025, the U.S. stock market has been navigating a complex landscape marked by renewed U.S.-China trade tensions and mixed earnings reports, leading to declines in major indices such as the Nasdaq, Dow Jones Industrial Average, and S&P 500. Amidst this backdrop of uncertainty and fluctuating investor sentiment, identifying promising small-cap stocks can offer unique opportunities for those looking to uncover potential growth avenues in less-explored corners of the market.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Southern Michigan Bancorp | 117.38% | 8.87% | 4.89% | ★★★★★★ |

| Tri-County Financial Group | 82.51% | 3.15% | -17.04% | ★★★★★★ |

| Sound Financial Bancorp | 34.70% | 2.11% | -11.08% | ★★★★★★ |

| Morris State Bancshares | 9.38% | 4.01% | 3.59% | ★★★★★★ |

| Senstar Technologies | NA | -18.50% | 29.50% | ★★★★★★ |

| Affinity Bancshares | 43.51% | 4.54% | 8.05% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| Valhi | 44.30% | 1.10% | -1.40% | ★★★★★☆ |

| ASA Gold and Precious Metals | NA | 13.18% | 16.77% | ★★★★★☆ |

| Greenfire Resources | 35.48% | -1.31% | -25.79% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Slide Insurance Holdings (SLDE)

Simply Wall St Value Rating: ★★★★★☆

Overview: Slide Insurance Holdings, Inc. operates in the United States property and casualty industry by underwriting single family and condominium policies, with a market capitalization of approximately $1.86 billion.

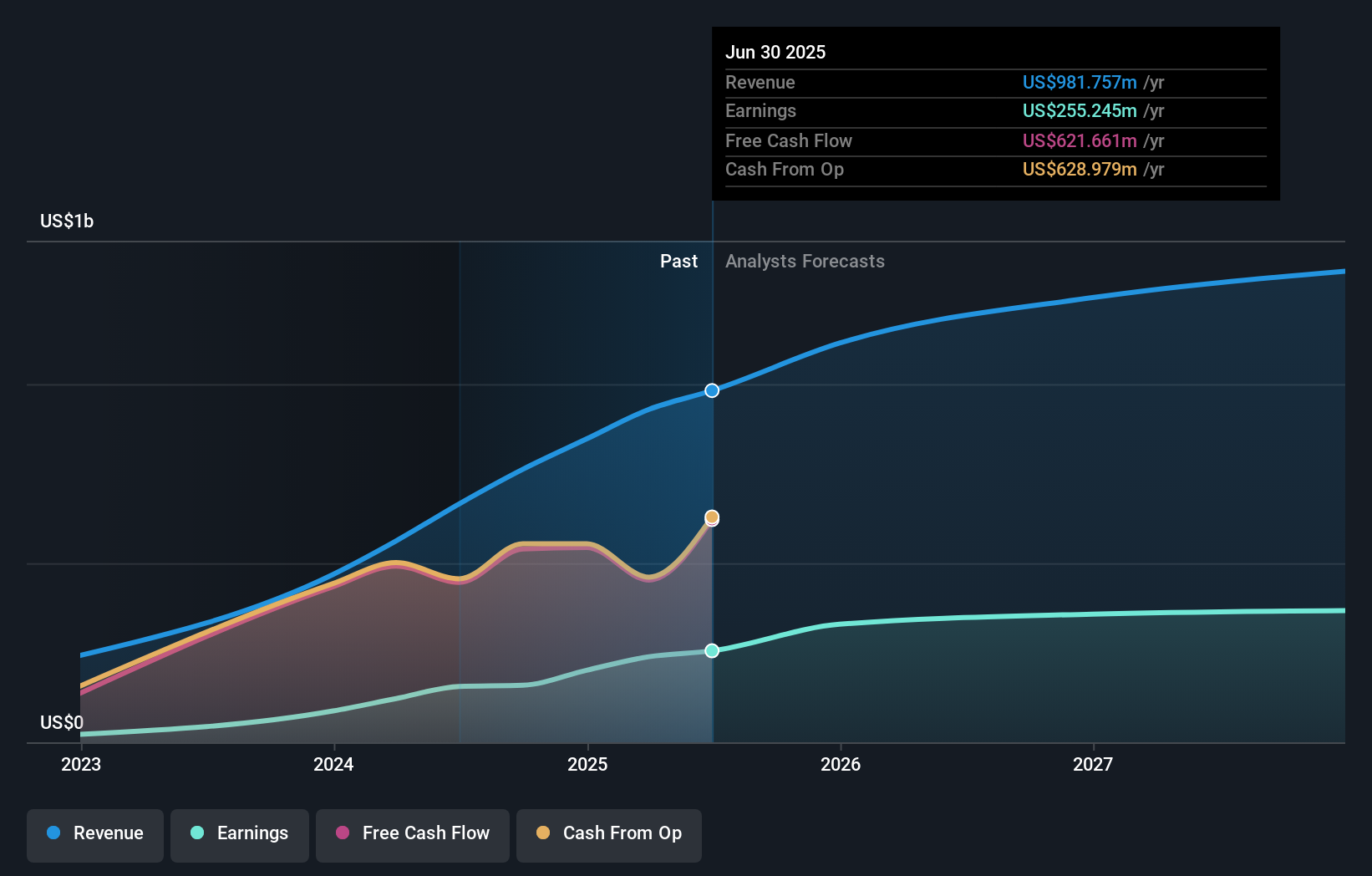

Operations: Slide generates revenue primarily from underwriting single family and condominium insurance policies, amounting to $981.76 million.

Slide Insurance Holdings, a nimble player in the insurance sector, has been making waves with its remarkable earnings growth of 63.9% over the past year, significantly outpacing the industry's 6%. Its financial health is robust, with EBIT covering interest payments by an impressive 87.4 times and more cash than total debt. Recently added to multiple indices like the S&P TMI and Russell 2000 Growth Index, Slide seems poised for increased visibility. The company also announced a US$75 million share repurchase program, signaling confidence in its valuation which trades at 86.2% below estimated fair value.

Horace Mann Educators (HMN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Horace Mann Educators Corporation, with a market cap of approximately $1.82 billion, operates as an insurance holding company in the United States through its subsidiaries.

Operations: Horace Mann Educators generates revenue primarily from its Property & Casualty segment at $827.90 million and Life & Retirement segment at $552.50 million. The Supplemental & Group Benefits segment contributes $296.20 million, while the Corporate and Other segment adds $5.70 million to the total revenue.

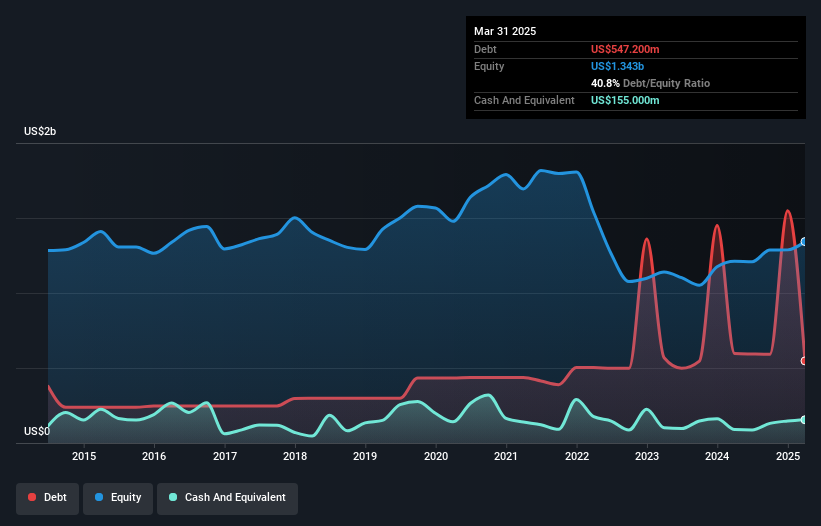

Horace Mann Educators, a nimble player in the insurance sector, is making strides with its digital initiatives and strategic partnerships aimed at boosting agent productivity and customer engagement. The company's net debt to equity ratio stands at a satisfactory 26%, while earnings have surged by 71.9% over the past year, outpacing industry growth. Trading at a price-to-earnings ratio of 13x, it offers good value compared to the US market average of 18.9x. Recent moves include redeeming $298 million in senior notes and completing share repurchases totaling $30.98 million since May 2022, reflecting robust financial management strategies.

ATRenew (RERE)

Simply Wall St Value Rating: ★★★★★★

Overview: ATRenew Inc. operates a pre-owned consumer electronics transactions and services platform in the People’s Republic of China, with a market cap of approximately $902.18 million.

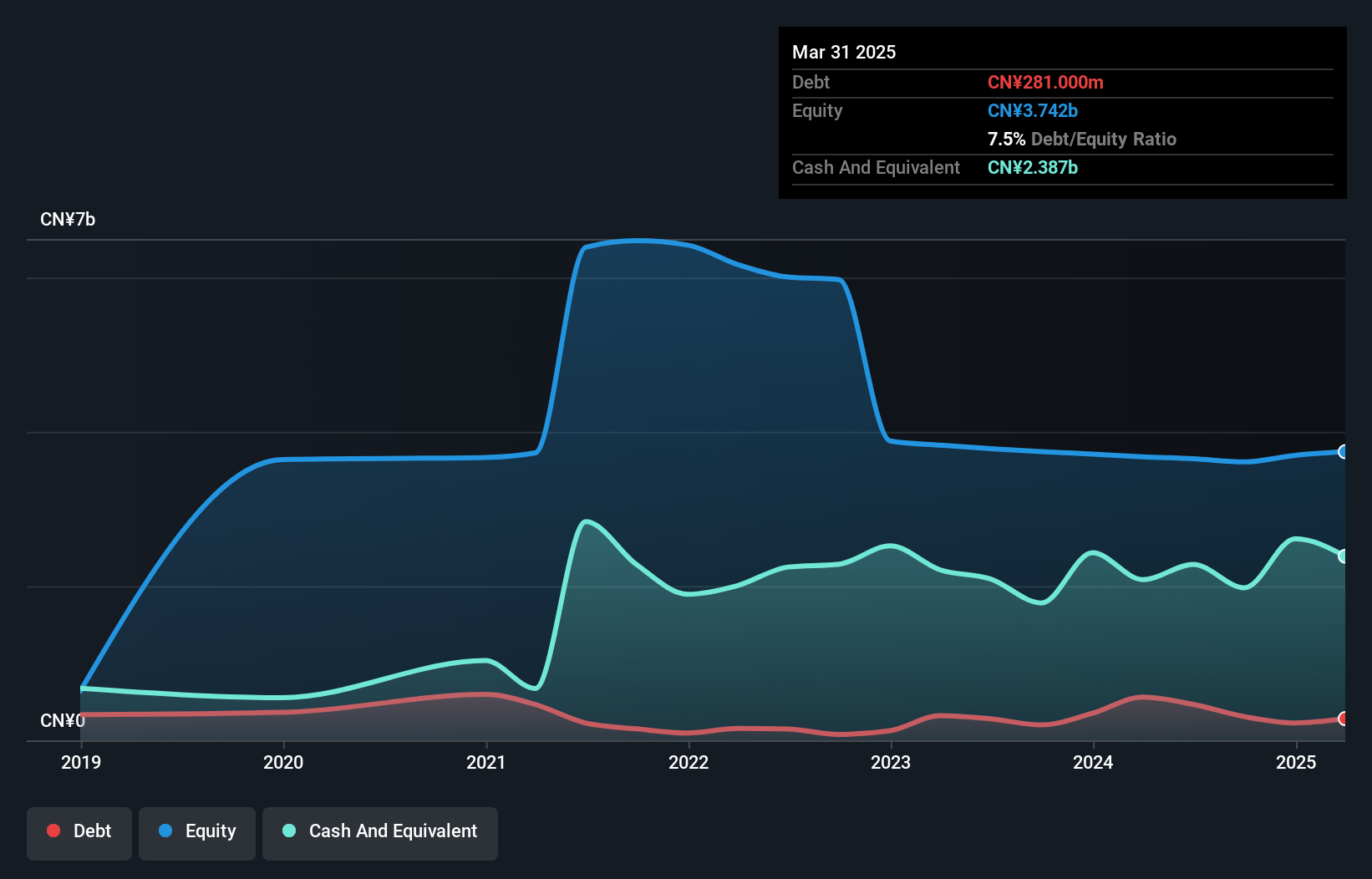

Operations: The company generates revenue primarily from its retail electronics segment, which reported CN¥18.55 billion.

ATRenew, a nimble player in the device recycling space, has recently turned profitable, showcasing a net income of CNY 115.14 million for the first half of 2025 compared to a loss last year. The company repurchased over 12 million shares for $30.25 million, reflecting confidence in its valuation. With earnings forecasted to grow at an impressive 64% annually and trading at 40% below estimated fair value, ATRenew's strategic partnerships and refurbishment investments are key drivers behind its growth potential. However, challenges like reliance on government subsidies and regulatory pressures remain critical factors to monitor closely.

Make It Happen

- Unlock our comprehensive list of 293 US Undiscovered Gems With Strong Fundamentals by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Horace Mann Educators might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HMN

Horace Mann Educators

Operates as an insurance holding company in the United States.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives