- United States

- /

- Specialty Stores

- /

- NYSE:RERE

ATRenew (RERE) Is Up 10.7% After Strong Q3 Earnings and Upgraded Full-Year Revenue Outlook

Reviewed by Sasha Jovanovic

- ATRenew Inc. recently reported third quarter 2025 financial results, showing net income of CNY 90.82 million and significant earnings per share growth compared to the previous year, along with robust revenue guidance for both the fourth quarter and full year 2025.

- In addition to these strong financials, the company completed a share buyback of 500,000 shares during the third quarter, reinforcing its capital management approach.

- We’ll examine how ATRenew’s upgraded full-year revenue outlook could influence the company’s investment narrative and sector positioning.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

ATRenew Investment Narrative Recap

To be an ATRenew shareholder, you need to believe that consumer adoption of device recycling in China will continue accelerating, driven by supportive government policies and rising demand for sustainable consumption. The company’s upgraded revenue outlook for 2025 provides more visibility on top-line growth, which could reinforce optimism around transaction volumes in the near term; however, it does not materially reduce the ongoing risks tied to government subsidy dependency and competitive margin pressures.

Among recent announcements, the new full-year and fourth-quarter revenue guidance stands out as most relevant to this catalyst: ATRenew’s projections for up to 28.5% year-over-year revenue growth reinforce its positioning to benefit from growing eco-conscious consumer trends and national trade-in incentives, though these same drivers leave it exposed if policy support wanes.

By contrast, one area investors must not overlook is the potential impact of subsidy changes on future revenue certainty...

Read the full narrative on ATRenew (it's free!)

ATRenew's outlook anticipates CN¥35.8 billion in revenue and CN¥1.1 billion in earnings by 2028. This implies a 24.5% annual revenue growth rate and a roughly CN¥890 million increase in earnings from the current level of CN¥210.4 million.

Uncover how ATRenew's forecasts yield a $6.61 fair value, a 45% upside to its current price.

Exploring Other Perspectives

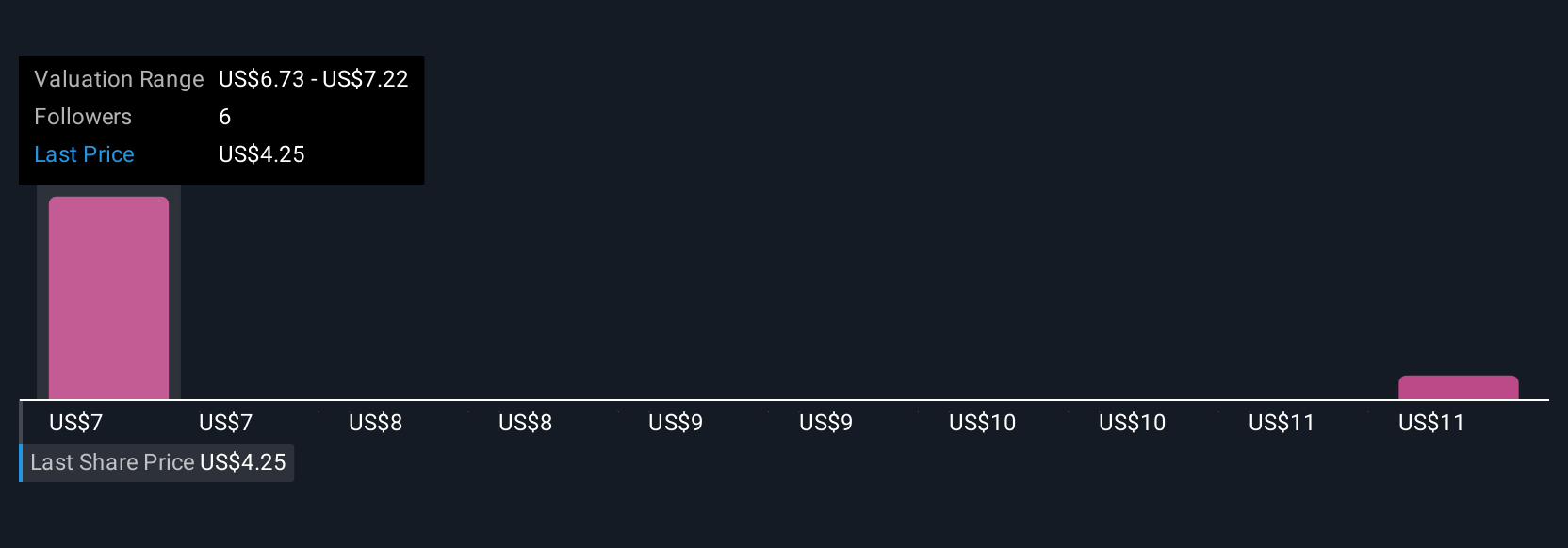

The Simply Wall St Community offers three fair value estimates for ATRenew, ranging from CN¥6.61 to CN¥11.64 per share. While opinions are wide ranging, many participants focus closely on the importance of China’s policy support, highlighting the risk that shifts in government stimulus could have broad performance implications.

Explore 3 other fair value estimates on ATRenew - why the stock might be worth over 2x more than the current price!

Build Your Own ATRenew Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ATRenew research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free ATRenew research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ATRenew's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RERE

ATRenew

Operates pre-owned consumer electronics transactions and services platform in the People’s Republic of China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026