Is MINISO Fairly Priced After Global Expansion and 20.8% Stock Surge?

Reviewed by Bailey Pemberton

- Ever wondered if MINISO Group Holding’s stock is fairly priced or hiding untapped value? You’re not alone. Investors everywhere are keeping a close eye on its potential.

- Despite a slight dip of 0.1% this week and a 1.8% drop over the past month, MINISO has surged 20.8% in the past year and has achieved a 261.4% return over three years.

- Recent news highlights MINISO’s continued global expansion and strong brand partnerships. Both of these factors help fuel market optimism and help explain the stock’s recent momentum and shifts. Updates about the company’s aggressive store rollout and collaborations with major franchises are drawing increased attention from both analysts and the market.

- MINISO earns a valuation score of 5 out of 6, which means it passes nearly every check for being undervalued. Next, we will break down these valuation methods, but keep reading for a smarter and more holistic approach to understanding what MINISO is really worth.

Find out why MINISO Group Holding's 20.8% return over the last year is lagging behind its peers.

Approach 1: MINISO Group Holding Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its expected future cash flows and then discounting those amounts back to today’s terms. This provides a data-driven baseline for assessing if the stock price accurately reflects the company’s true worth.

For MINISO Group Holding, the most recent free cash flow reported was approximately CN¥1.15 billion. Analysts provide estimates up to five years, after which future cash flows are extrapolated. According to these projections, MINISO’s free cash flow could climb to roughly CN¥4.48 billion by 2027 and reach about CN¥6.0 billion by 2035. This steady increase highlights expectations for robust, ongoing business growth.

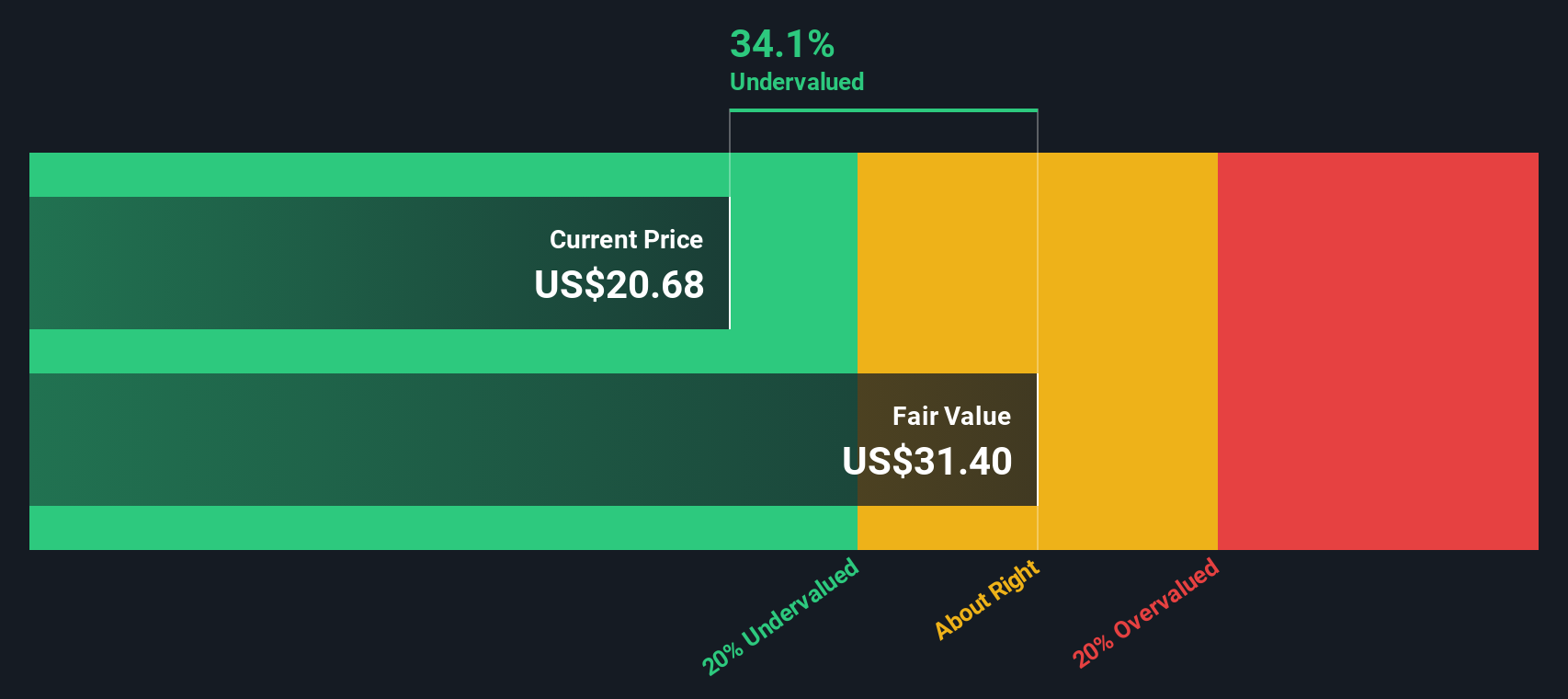

Based on the DCF analysis, the estimated intrinsic value for MINISO is $31.47 per share. This calculation suggests that the stock is trading at a 31.7% discount compared to its fair value, making it appear significantly undervalued at current prices.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests MINISO Group Holding is undervalued by 31.7%. Track this in your watchlist or portfolio, or discover 835 more undervalued stocks based on cash flows.

Approach 2: MINISO Group Holding Price vs Earnings

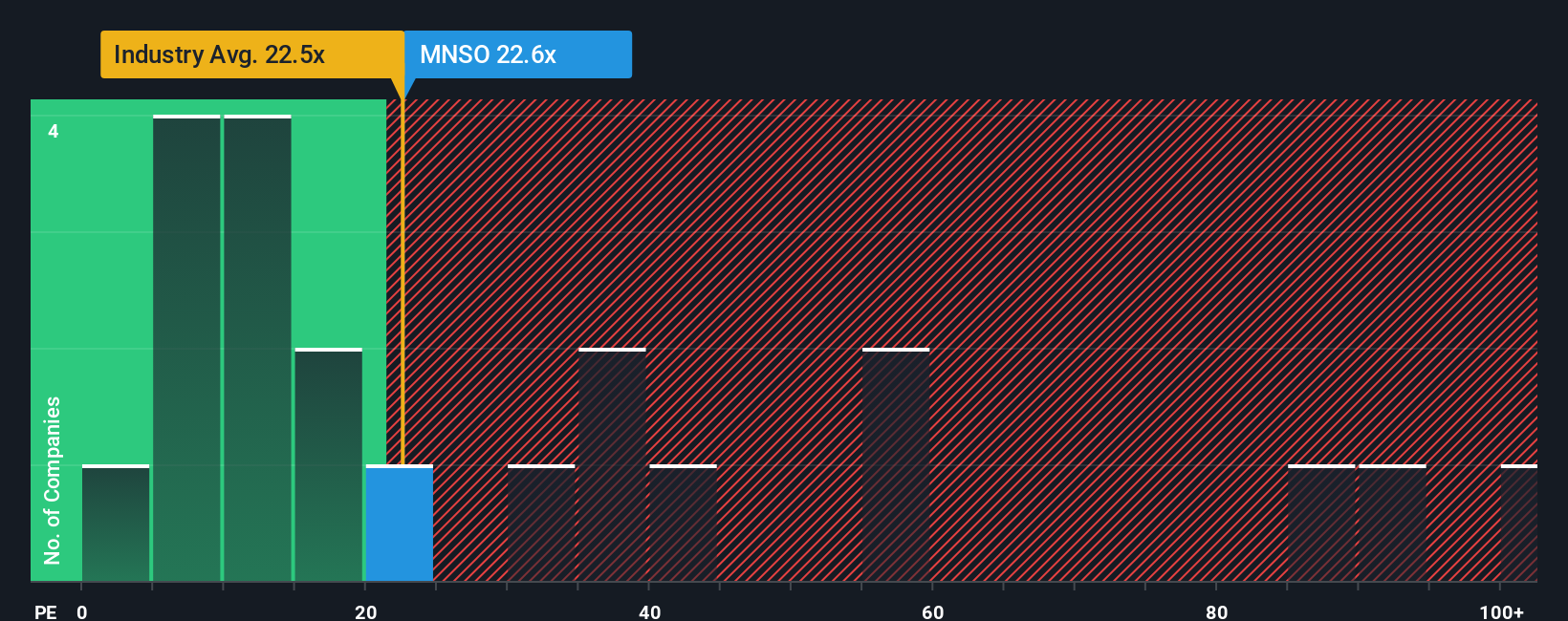

The Price-to-Earnings (PE) ratio is a popular method to value companies that are profitable, like MINISO Group Holding, because it directly relates the company’s current share price to its earnings. This makes it easier to compare across companies in the same sector. Generally, a higher PE ratio can signal greater future growth expectations or lower risk, while a lower PE often suggests more risk or slower expected growth.

MINISO currently trades at a PE ratio of 19.9x. When compared with the Multiline Retail industry average of 19.9x and the peer average of 22.2x, MINISO’s valuation appears very much in line with its direct competitors. However, benchmarks like the industry average and peer PE give only a limited view, as they do not adjust for company-specific growth prospects, risk profile, or margins.

This is where Simply Wall St’s proprietary "Fair Ratio" comes in. It is a more tailored benchmark that estimates what PE multiple is appropriate for a particular company, considering its unique earnings growth, profit margin, market cap, risks, and industry landscape. For MINISO, this Fair Ratio is 24.8x, which is noticeably higher than its current PE. This suggests that the market might be undervaluing the stock, given its growth outlook and profitability. In essence, compared to what would be considered fair for a company like MINISO, the current price looks attractive.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your MINISO Group Holding Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple way to tell your story about a company by connecting your specific expectations around future revenue, earnings, and margins with your assessment of fair value. Instead of focusing only on formulas or ratios, Narratives merge the company’s business story with a financial forecast and a clear sense of what the stock is really worth.

Narratives are an intuitive tool available on Simply Wall St's Community page, used by millions of investors worldwide, making investing more actionable and accessible for everyone. They let you forecast what you believe will happen, see how that affects fair value, and decide whether a stock is overpriced or set for growth. This helps you know exactly when to buy or sell. Best of all, Narratives update automatically whenever big news or earnings are released, so your view stays relevant and informed.

For example, on the platform, one investor's Narrative for MINISO forecasts strong global expansion and robust margins, estimating a fair value as high as $44, while another expects greater risks and lower growth, with a fair value just above $27. This highlights how Narratives bring your unique perspective into smarter investment decisions.

Do you think there's more to the story for MINISO Group Holding? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MNSO

MINISO Group Holding

An investment holding company, engages in the retail and wholesale of design-led lifestyle and pop toy products in Mainland China, the rest of Asia, North and Latin America, Europe, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives