Is MINISO a Bargain After Global Expansion and Recent Double-Digit Price Swings?

Reviewed by Bailey Pemberton

- Ever wondered whether MINISO Group Holding is truly a great deal or just riding the wave? Let’s pull back the curtain on the stock’s real value together.

- The share price has certainly been a wild ride lately, dropping 7.9% over the past week and 10.4% in the last month. However, there was also an impressive 19.0% gain over the past year and a significant 119.5% climb in the last three years.

- Recently, attention has turned to MINISO’s global expansion pushes and innovative collaborations, such as new store openings in overseas markets and partnerships with top entertainment brands. This has fueled both excitement and debate among investors about growth momentum versus sustainability.

- On the numbers front, MINISO checks every box for value, boasting a valuation score of 6 out of 6. This is an impressive start that shapes our upcoming breakdown of different valuation approaches. By the end, we will share an even more insightful angle on what this means for investors.

Approach 1: MINISO Group Holding Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used valuation approach that estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s value. This provides a bottom-up view of what the company could be worth based on expected performance rather than just market sentiment.

For MINISO Group Holding, the current Free Cash Flow sits at roughly CN¥1.15 billion. Analysts expect steady growth in the coming years, with Simply Wall St extending projections out to 2035. By 2027, Free Cash Flow is forecast to reach approximately CN¥4.48 billion. Extrapolating further, it could top CN¥6.06 billion by 2035. All cash flow figures are reported in Chinese Yuan (CN¥).

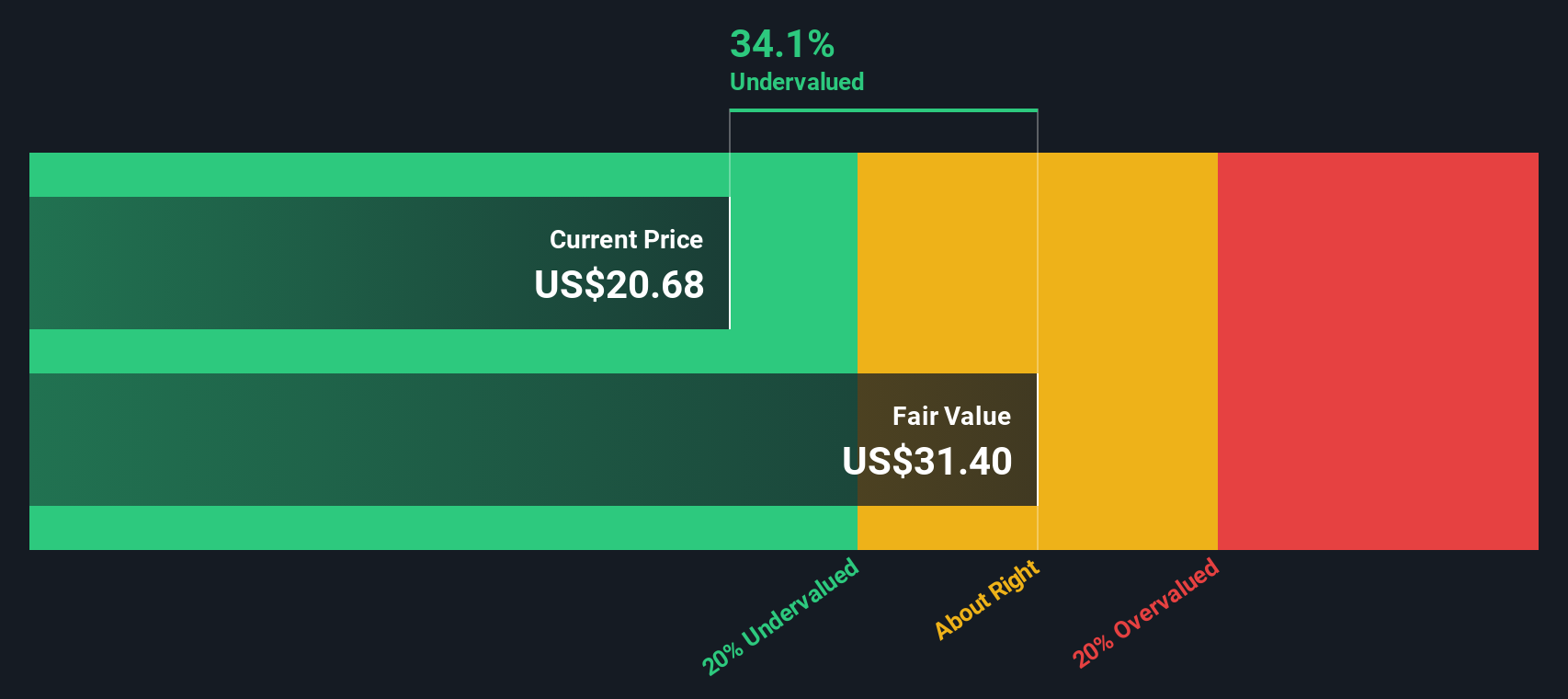

After applying the 2 Stage Free Cash Flow to Equity model and discounting those future cash flows to present value, the intrinsic value for MINISO is estimated at $31.58 per share. This implies the stock is trading at a 38.0% discount and is notably undervalued based on this method.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests MINISO Group Holding is undervalued by 38.0%. Track this in your watchlist or portfolio, or discover 921 more undervalued stocks based on cash flows.

Approach 2: MINISO Group Holding Price vs Earnings (P/E Ratio)

The price-to-earnings (P/E) ratio is a widely used method for valuing profitable companies like MINISO Group Holding because it directly compares the company’s share price to its per-share earnings. For steady earners, the P/E ratio helps investors balance what they are paying for each dollar of profit and is especially meaningful when a company has proven and recurring earnings streams.

What counts as a “fair” P/E ratio is influenced by factors such as growth expectations, profitability, and risk. Fast-growing and less risky companies typically justify a higher P/E multiple, while mature or volatile firms might trade at a discount.

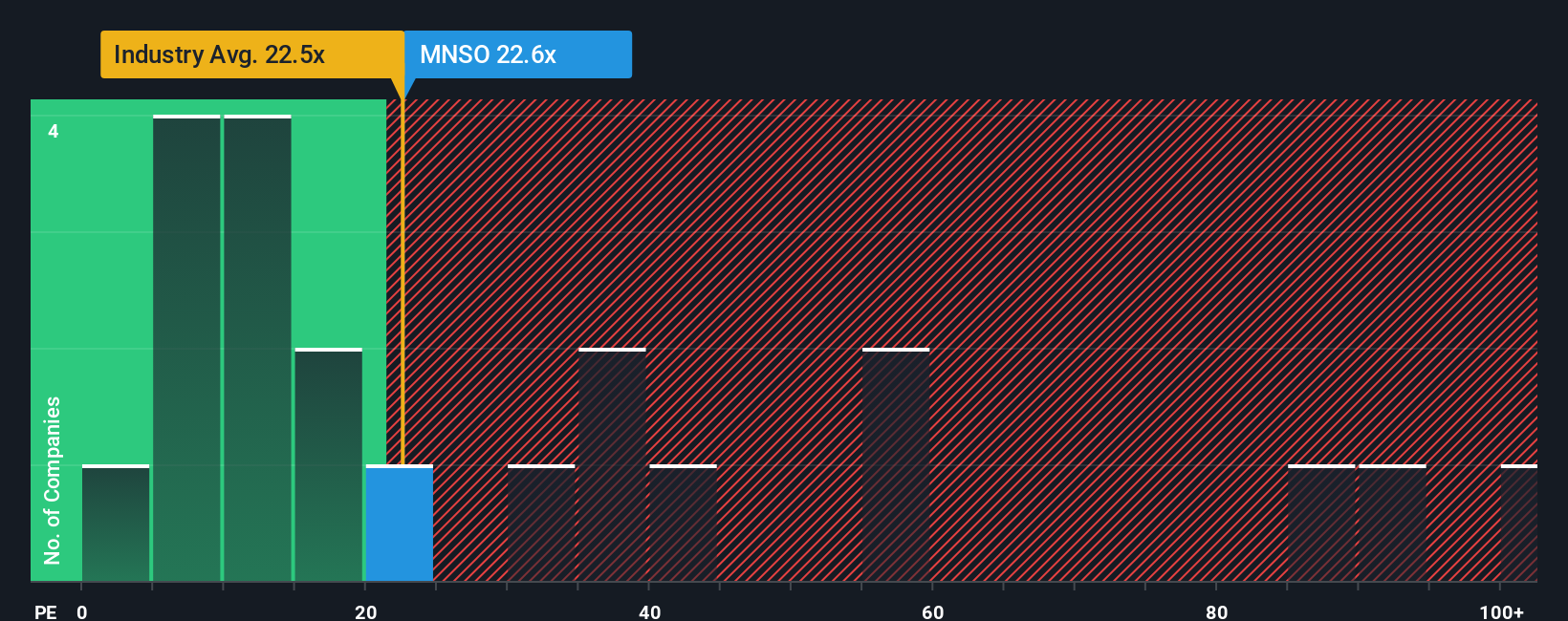

Currently, MINISO trades at a P/E ratio of 18.1x. That puts it slightly below the Multiline Retail industry average of 18.4x, and notably under the peer average of 20.6x. To provide a more tailored benchmark, Simply Wall St’s “Fair Ratio” methodology estimates MINISO’s fair P/E at 24.6x. Unlike traditional comparisons, this Fair Ratio incorporates factors unique to MINISO, including its expected growth, profitability, industry dynamics, and market cap, to set a more personalized bar for valuation.

By weighing all those factors, MINISO’s actual P/E is well below its Fair Ratio, signaling the market may be undervaluing its potential relative to its fundamentals and growth outlook.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1423 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your MINISO Group Holding Narrative

Earlier we mentioned that there's an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is your own story and outlook on a company, connecting what you believe about its strategy, growth, and risks to the numbers you expect for future revenue, earnings, and margins. These inputs then drive your personal fair value for the business.

Unlike traditional ratios and models, Narratives let you ground your investment decisions in both financial analysis and your perspective on the company's journey. Available right now on Simply Wall St's Community page, used by millions of investors, Narratives make it easy for anyone to create, compare, and update their valuations as new information emerges.

Narratives empower you to make actionable choices by comparing your calculated fair value against the current share price, helping you decide whether to buy, hold, or sell as the story and outlook change. Because they automatically update when earnings results, news, or industry data shifts, Narratives stay relevant so your decisions are always based on the latest context.

For MINISO Group Holding, some investors see ambitious earnings growth fueling a fair value as high as $44.06, while others take a more cautious stance at just $20.13, each reflecting their distinct beliefs about the company's future.

Do you think there's more to the story for MINISO Group Holding? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MNSO

MINISO Group Holding

An investment holding company, engages in the retail and wholesale of design-led lifestyle and pop toy products in Mainland China, the rest of Asia, North and Latin America, Europe, and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives