- United States

- /

- Specialty Stores

- /

- NYSE:LOW

Is Lowe's (LOW) Connected Home Expansion Setting the Stage for a New Growth Narrative?

Reviewed by Sasha Jovanovic

- Lowe's Companies recently raised its full-year 2025 sales guidance to US$86.0 billion following the release of its third-quarter results, which showed growth in quarterly and year-to-date sales but a year-over-year decline in earnings per share.

- Meanwhile, Aqara announced the launch of its Smart Lock B50, an advanced and accessible smart home security product, now available at over 500 Lowe's locations and online, highlighting the retailer's expanding assortment in connected home solutions.

- We'll examine how Lowe's higher sales outlook alongside smart home expansion could shape its investment narrative in the coming quarters.

Find companies with promising cash flow potential yet trading below their fair value.

Lowe's Companies Investment Narrative Recap

To justify owning Lowe's shares today, you need to believe the company can execute on its Pro market expansion and digital initiatives, even as housing turnover and home improvement demand remain limited by high mortgage rates. On this front, the recent addition of smart home solutions like the Aqara Smart Lock B50 showcases Lowe's focus on higher-growth categories, but the impact on immediate revenue or margins is not material enough to alter the primary near-term catalysts or risks, which still hinge on broader market demand and successful integration of acquisitions.

Of recent announcements, Lowe's decision to raise its full-year 2025 sales guidance to US$86.0 billion stands out. While new product offerings like the Aqara partnership may contribute to this outlook, the core driver remains Lowe's performance in core retail and Pro segments, which are central to whether it can achieve and sustain improved top-line growth.

In contrast, investors should be aware of how ongoing debt obligations from the FBM acquisition could...

Read the full narrative on Lowe's Companies (it's free!)

Lowe's Companies' projections anticipate $94.0 billion in revenue and $8.4 billion in earnings by 2028. This outlook requires a 4.0% annual revenue growth rate and forecasts an earnings increase of $1.6 billion from the current $6.8 billion.

Uncover how Lowe's Companies' forecasts yield a $278.56 fair value, a 17% upside to its current price.

Exploring Other Perspectives

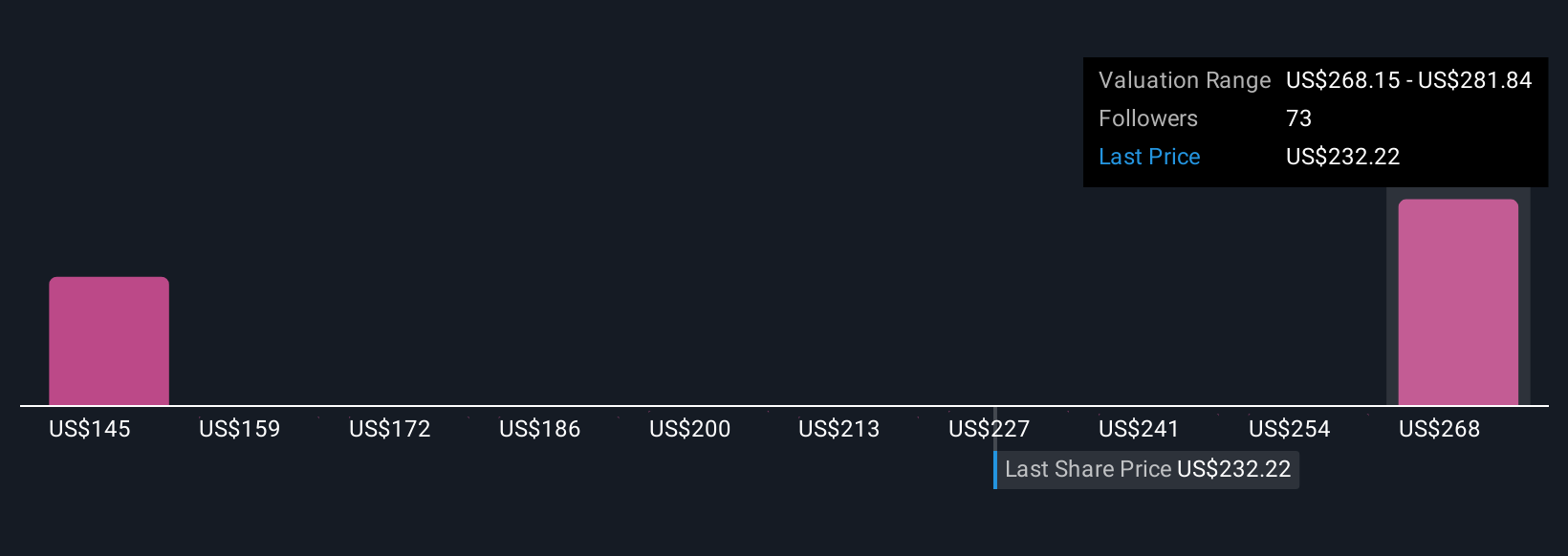

Simply Wall St Community members provided five fair value estimates for Lowe's, ranging from US$234 to US$278.56 per share. While the company’s integration of new product categories continues, the bigger question is whether housing market headwinds will weigh on sustained sales growth, consider exploring several viewpoints to inform your outlook.

Explore 5 other fair value estimates on Lowe's Companies - why the stock might be worth just $234.00!

Build Your Own Lowe's Companies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lowe's Companies research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Lowe's Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lowe's Companies' overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LOW

Lowe's Companies

Operates as a home improvement retailer in the United States.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success