- United States

- /

- Specialty Stores

- /

- NYSE:LOW

Does an AI Supply Chain Partnership With NVIDIA and Palantir Shift the Bull Case for Lowe's (LOW)?

Reviewed by Sasha Jovanovic

- In October 2025, NVIDIA announced a collaboration with Palantir Technologies to develop an integrated AI technology stack, with Lowe's Companies pioneering its use for optimizing supply chain logistics.

- This partnership places Lowe's at the forefront of applying advanced AI-driven solutions to operational efficiency, signaling ongoing innovation in large-scale retail operations.

- We'll now explore how Lowe's early adoption of advanced AI supply chain technology could influence its current investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Lowe's Companies Investment Narrative Recap

Owning Lowe's Companies stock means believing in its ability to capitalize on long-term growth in home improvement, driven by expansion into the Pro contractor market and gains in operational efficiency. While the company's pioneering adoption of advanced AI for supply chain logistics could enhance inventory productivity in the short term, the most immediate catalyst remains successful integration of recent acquisitions like FBM, and the largest challenge remains the elevated debt load resulting from those acquisitions. At this stage, the impact of the AI partnership has not yet materially shifted the balance on these key factors.

One recent announcement tying into these catalysts is Lowe’s update in August 2025, revising total sales guidance for fiscal 2025 to US$84.5 to US$85.5 billion and forecasting operating margins between 12.1 percent and 12.2 percent. This reset, coming soon after the FBM acquisition and amid rising financial leverage, reflects how the company is managing both opportunity and risk as it executes its growth strategy. Still, for investors, the biggest near-term concern is...

Read the full narrative on Lowe's Companies (it's free!)

Lowe's Companies is projected to deliver $94.0 billion in revenue and $8.4 billion in earnings by 2028. This outlook assumes a 4.0% annual revenue growth rate and an increase in earnings of $1.6 billion from the current $6.8 billion.

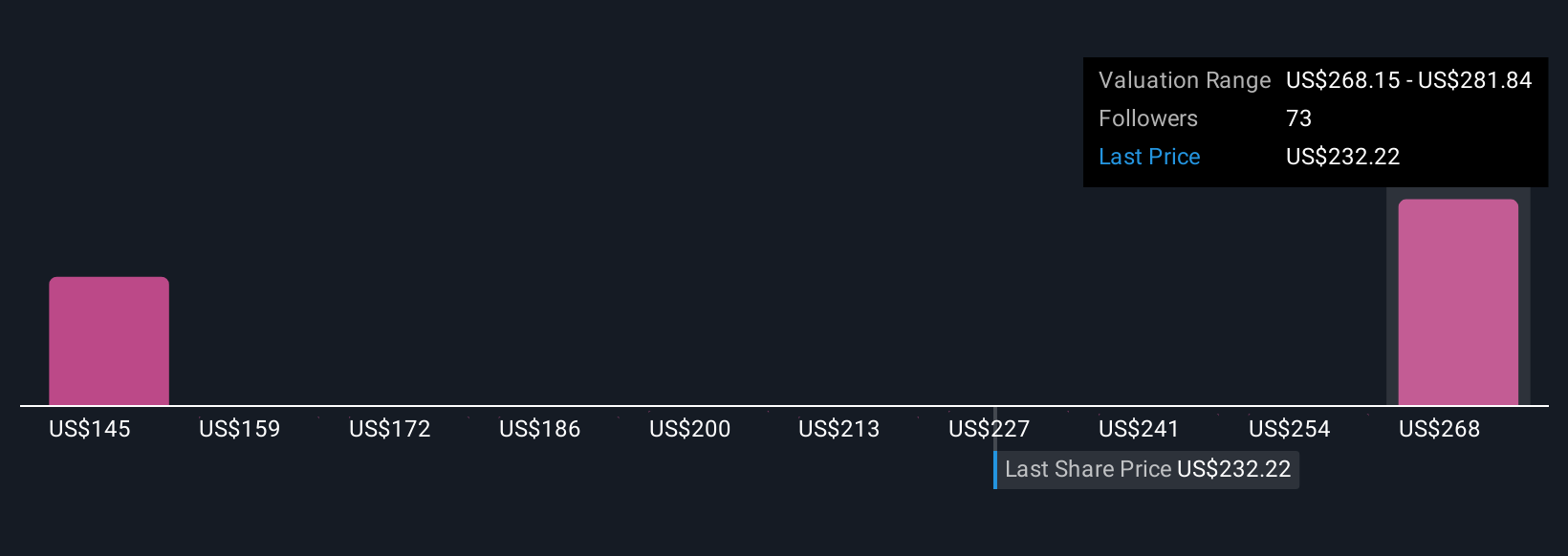

Uncover how Lowe's Companies' forecasts yield a $281.84 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have set fair values for Lowe’s between US$147.03 and US$281.84, across seven independent estimates. This breadth of opinion comes as Lowe’s balances new AI-driven supply chain ambitions with the real test of integrating major acquisitions.

Explore 7 other fair value estimates on Lowe's Companies - why the stock might be worth as much as 18% more than the current price!

Build Your Own Lowe's Companies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lowe's Companies research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Lowe's Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lowe's Companies' overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LOW

Lowe's Companies

Operates as a home improvement retailer in the United States.

Established dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives