- United States

- /

- Specialty Stores

- /

- NYSE:HD

Home Depot (HD) Valuation in Focus as Protests and Supply Chain Concerns Weigh on Sentiment

Reviewed by Simply Wall St

Home Depot (HD) is finding itself in the spotlight, as protests tied to immigration enforcement actions at its stores have surfaced in addition to operational challenges. Investors are watching closely as questions about reputation and supply chain resilience arise.

See our latest analysis for Home Depot.

Despite strong long-term results, Home Depot’s recent headlines around protests and supply chain hurdles have cast a shadow, with its 1-year total shareholder return slipping nearly 2%. In contrast, the 5-year total return stands at an impressive 57%. While momentum has faded in the short run, the company’s track record suggests resilience through market swings and changing headlines.

If you’re watching how retail stocks react to shifting consumer trends and economic pressures, it’s a good moment to broaden your search and discover fast growing stocks with high insider ownership

With recent setbacks and headlines weighing on sentiment, investors may wonder if Home Depot’s share price now fully reflects all these risks, or if the current dip represents a buying opportunity before the market recognizes the company’s growth potential.

Most Popular Narrative: 12.5% Undervalued

With Home Depot’s fair value set at $437.81 according to the most widely followed narrative, the last traded price of $383.08 puts the stock well below what analysts believe it should be. This discrepancy highlights a valuation gap rooted in the company’s projected growth and operational advancements.

Home Depot's sizable investments in advanced supply chain technologies, machine learning-based delivery optimization, and in-store digital enhancements are yielding faster delivery, higher customer satisfaction, and improved operational productivity. These trends are expected to boost net margins and drive long-term earnings growth.

Eager to see why Home Depot’s potential is commanding such a premium? The centerpiece of this narrative is a bold forecast for profit margin expansion and future earnings power. Which game-changing upgrades and surprising analyst assumptions are powering this aggressive fair value? Dig into the full narrative for all the crucial details behind this compelling estimate.

Result: Fair Value of $437.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in large renovation demand and rising inventory levels could undermine Home Depot’s upbeat outlook and stall expected margin improvements.

Find out about the key risks to this Home Depot narrative.

Another View: What Do Multiples Say?

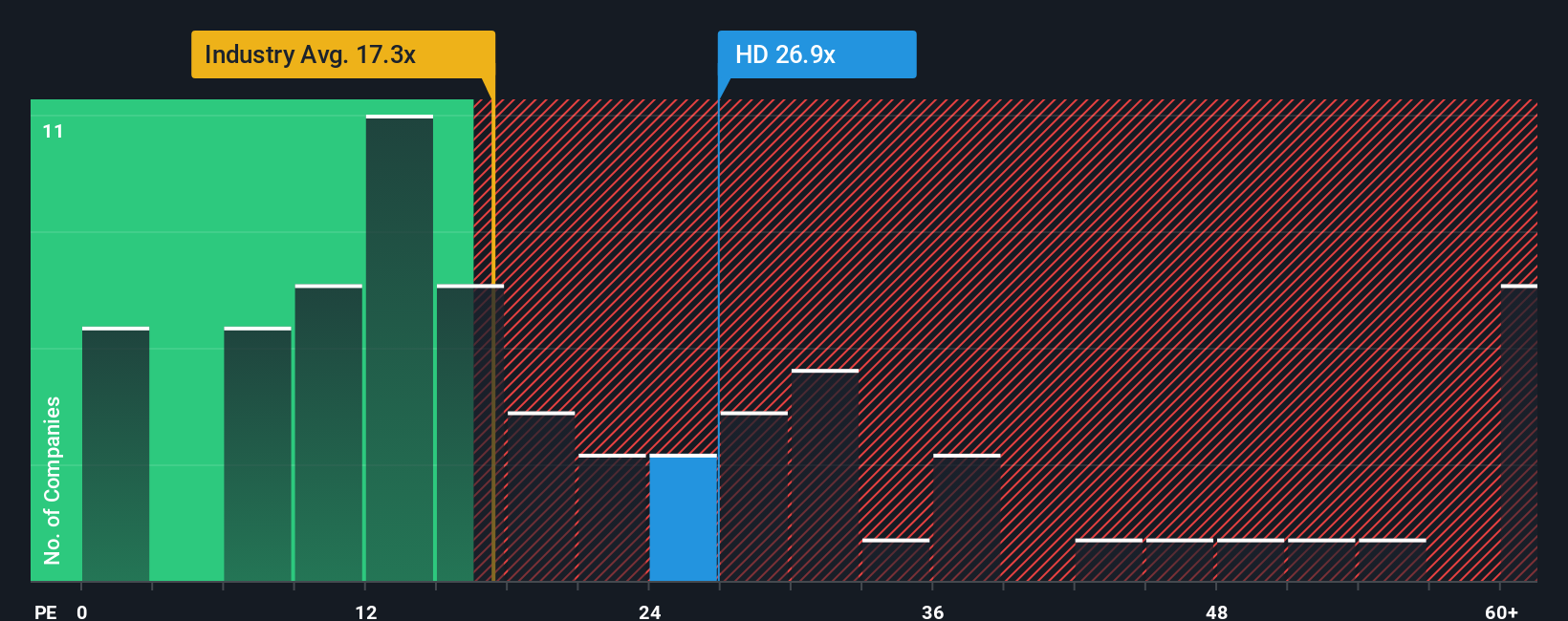

While analyst narratives argue Home Depot is undervalued, a glance at its price-to-earnings ratio tells a different story. Shares trade at 26.1 times earnings, which is noticeably higher than both the peer average of 24.9 and the US Specialty Retail industry’s 16.4. Notably, this is also above the fair ratio of 23. If the market adjusts toward this lower benchmark, it could spell risk for valuation. Can the company’s operational strengths defy this cautious signal?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Home Depot Narrative

If you’re not sold on the consensus or want to investigate further, you can quickly analyze the numbers yourself and craft a unique perspective, all in just a few minutes. Do it your way

A great starting point for your Home Depot research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let your search stop here, when standout opportunities are just a click away. Turn your curiosity into action and stay ahead of the market with innovative investing ideas from Simply Wall Street’s smart screeners.

- Uncover high-potential companies backed by solid fundamentals when you tap into these 3614 penny stocks with strong financials that are poised for dynamic growth in competitive markets.

- Capitalize on the rise of artificial intelligence by targeting these 27 AI penny stocks featuring real-world applications and expansion potential across industries.

- Boost your portfolio stability with steady income by selecting from these 20 dividend stocks with yields > 3% which offer yields above 3% and robust financial health.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Home Depot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HD

Home Depot

Operates as a home improvement retailer in the United States and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives