- United States

- /

- Specialty Stores

- /

- NYSE:HD

Home Depot (HD): Exploring Valuation After Recent 14% Drop in Share Price

Reviewed by Simply Wall St

Home Depot (HD) shares have been under pressure lately, with the stock falling nearly 14% over the past three months. Investors are taking a closer look at what is driving this decline, especially given recent market moves.

See our latest analysis for Home Depot.

Home Depot’s recent share price slide comes after a tough stretch for many retailers, with short-term momentum fading. The stock is down nearly 16% over the past 90 days and has delivered a 1-year total shareholder return of -14.4%. Despite solid longer-term gains, that shift suggests investors are rethinking near-term growth prospects, even as the broader market remains driven by changing sentiment around consumer spending and inflation.

If retail’s volatility has you thinking about where else to look, now could be the perfect chance to broaden your scope and discover fast growing stocks with high insider ownership

With shares trading well below recent highs and analysts’ targets, the question now is whether Home Depot is undervalued at current levels or if the market has already priced in slower future growth, leaving little room for upside.

Most Popular Narrative: 22.8% Undervalued

The most widely followed narrative estimates Home Depot’s fair value at $433, which is notably above the last closing price of $334. This creates a significant gap between the current market view and what analysts expect, building expectations for share price movement if projections hold true.

Home Depot's sizable investments in advanced supply chain technologies, machine learning-based delivery optimization, and in-store digital enhancements are yielding faster delivery, higher customer satisfaction, and improved operational productivity. These trends are expected to boost net margins and drive long-term earnings growth.

Want to know the growth blueprint behind this high valuation? The key element of this narrative is record-breaking earnings and a future profit multiple usually associated with tech leaders. Interested in which bold financial projections support that price target? Dive deeper to see the surprising numbers that drive this fair value calculation.

Result: Fair Value of $433 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent softness in large remodeling projects or continued margin pressure from rising costs could quickly challenge even the most confident and bullish outlook.

Find out about the key risks to this Home Depot narrative.

Another View: What Do the Multiples Say?

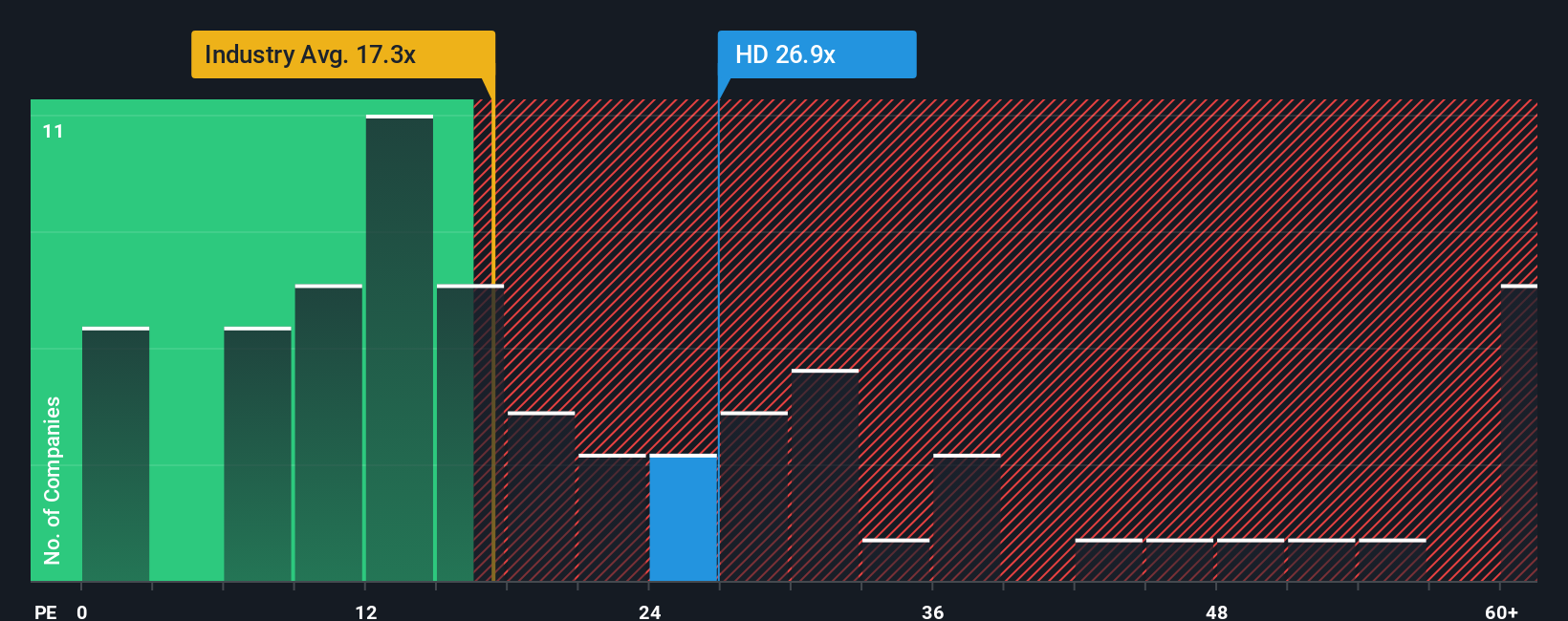

Looking at valuation through the lens of price-to-earnings, Home Depot trades at 22.8x earnings. That is above the US Specialty Retail industry average of 16.6x, and slightly higher than its fair ratio of 22.6x. This could indicate that shares already factor in significant optimism, which may give investors less margin for error if growth slows. Are the risks of expecting premium growth in a mature sector being overlooked?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Home Depot for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 898 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Home Depot Narrative

If you see Home Depot’s story differently or want to dig into the figures yourself, shaping your own view only takes a few minutes and you can Do it your way.

A great starting point for your Home Depot research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t miss your next big opportunity. Take charge of your portfolio and get ahead of the crowd by checking out these top picks right now:

- Unlock the potential of market leaders with robust cash flows and find out which companies stand out among these 898 undervalued stocks based on cash flows.

- Boost your passive income journey by targeting strong yields from these 15 dividend stocks with yields > 3% that consistently reward shareholders above 3%.

- Seize the surge in artificial intelligence by zeroing in on innovators among these 26 AI penny stocks who are shaping the digital transformation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Home Depot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HD

Home Depot

Operates as a home improvement retailer in the United States and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives