- United States

- /

- Specialty Stores

- /

- NYSE:HD

Home Depot (HD): A Fresh Look at Valuation After Recent Sector Pullback

Reviewed by Simply Wall St

Home Depot (HD) shares have edged down slightly over the past week, with investors watching for signs of shifting consumer demand in the home improvement sector. The recent performance reflects broader patterns in the retail landscape.

See our latest analysis for Home Depot.

Looking at the bigger picture, Home Depot’s share price has pulled back over the past month. However, its 3-year total shareholder return of 40% shows plenty of long-term wealth creation for investors, even as short-term momentum fades a little. Recent price moves seem influenced by shifting consumer spending patterns and broader sector trends rather than company-specific setbacks.

If you’re keeping an eye on what’s moving beyond the usual suspects in retail, now could be a smart time to broaden your search and discover fast growing stocks with high insider ownership

With Home Depot’s solid long-term returns but recent slower momentum, investors may wonder whether the current pullback signals an undervalued opportunity or if the market has already accounted for the company’s future growth prospects.

Most Popular Narrative: 12% Undervalued

Home Depot’s narrative fair value is set at $437.81, which is materially above the last close at $385.27, highlighting a bullish outlook from the most prominent narrative in the market. The difference signals that, in analysts’ eyes, current performance and sector headwinds may have overshot to the downside.

Home Depot's sizable investments in advanced supply chain technologies, machine learning-based delivery optimization, and in-store digital enhancements are yielding faster delivery, higher customer satisfaction, and improved operational productivity. These trends are expected to boost net margins and drive long-term earnings growth.

Want to know the logic fueling this premium price tag? One core driver relies on aggressive revenue and margin expansion projections. For reference, it challenges the industry norm. Curious which assumptions are fueling that target? Your deep dive into the narrative reveals the full story behind these bold forecasts.

Result: Fair Value of $437.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent softness in big-ticket remodeling projects or continued cost pressures could challenge Home Depot’s ability to deliver on bullish growth projections.

Find out about the key risks to this Home Depot narrative.

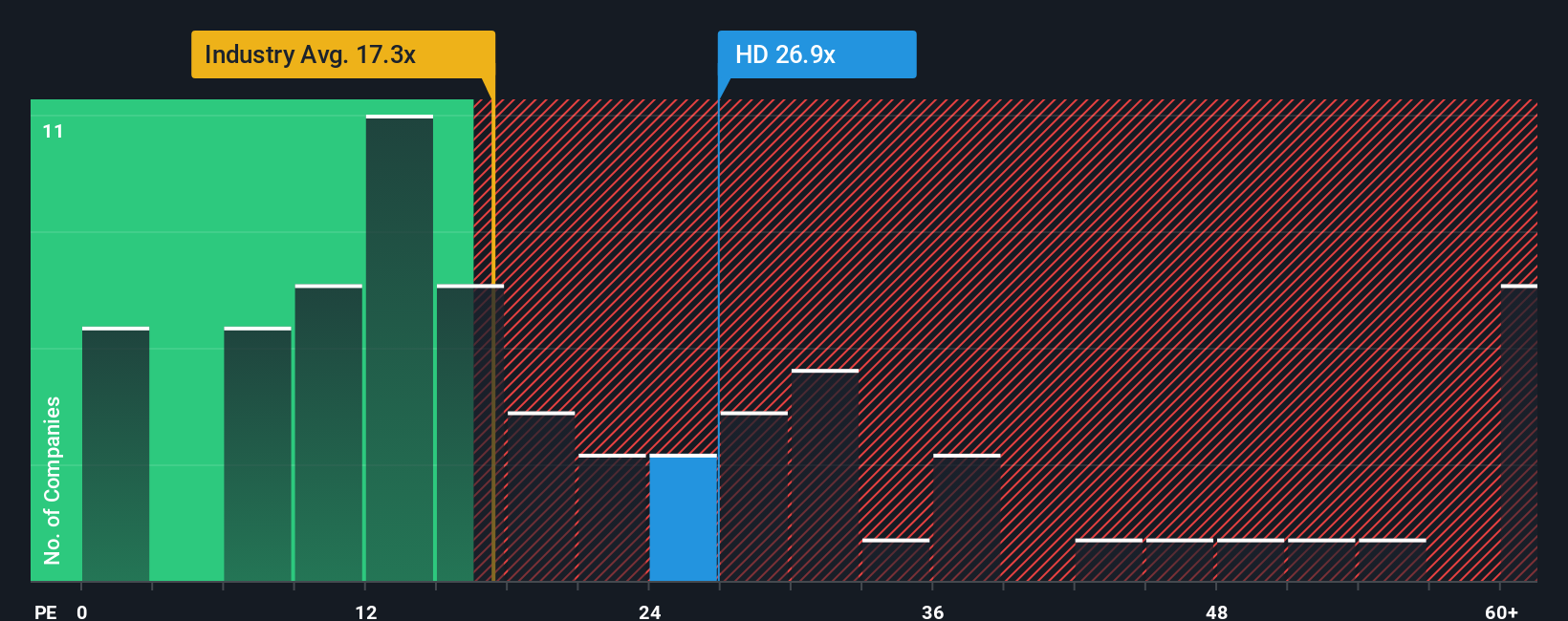

Another View: Price-to-Earnings Signals Caution

While the narrative fair value suggests Home Depot is undervalued, a closer look at its price-to-earnings ratio offers a more cautious perspective. Shares trade at 26.2 times earnings, higher than both the US Specialty Retail industry average of 16.8x and the fair ratio of 23.6x. This premium might reflect heightened expectations. However, it could also signal downside risk if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Home Depot for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Home Depot Narrative

If you’re curious to draw your own conclusions or want to test your own investment thesis, you can create a personalized narrative in just a few minutes. Do it your way.

A great starting point for your Home Depot research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let opportunities pass you by when tomorrow’s winners are just a few clicks away on Simply Wall Street. Put your money to work smarter today.

- Tap into future-defining innovation by checking out these 27 AI penny stocks, which are at the forefront of artificial intelligence advances transforming entire industries.

- Secure growing income streams by exploring these 19 dividend stocks with yields > 3%, offering high yields and robust dividend histories you can count on.

- Ride the wave of finance disruption and investigate these 80 cryptocurrency and blockchain stocks, leading adoption of blockchain and digital asset technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Home Depot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HD

Home Depot

Operates as a home improvement retailer in the United States and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives