- United States

- /

- Specialty Stores

- /

- NYSE:HD

Does Home Depot’s 8.6% Share Price Dip Signal an Opportunity in 2025?

Reviewed by Bailey Pemberton

- Wondering if Home Depot’s stock is a bargain right now? You’re not alone, especially with the way the market has been moving lately.

- After peaking earlier this year, Home Depot’s share price has slipped by 3.3% over the last week and is down 8.6% in the past month. This has nudged the stock into negative territory for the year so far at -7.8%.

- Recent headlines have highlighted consumers tightening their wallets and slowing home improvement spending, especially as higher interest rates and economic uncertainty persist. These factors are fueling debate among investors about whether the stock’s recent slide reflects temporary caution or signals a longer-term shift in Home Depot’s prospects.

- Looking at the numbers, Home Depot only scores 1 out of 6 on our standard value checks. This suggests a lot of optimism is already priced in, but relying on a single method can miss the full picture. Let’s break down what that really means and introduce a fresh approach to valuation that could give an even clearer answer by the end of this article.

Home Depot scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Home Depot Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to today's dollars. This approach helps investors assess what a company is truly worth based on expected performance, rather than just its market price.

For Home Depot, the current Free Cash Flow stands at $14.3 Billion. Analysts anticipate modest growth in the years ahead, forecasting annual free cash flows rising to around $18.4 Billion by 2030. The model relies on analyst estimates for the next five years and extends the projections beyond that using established financial assumptions.

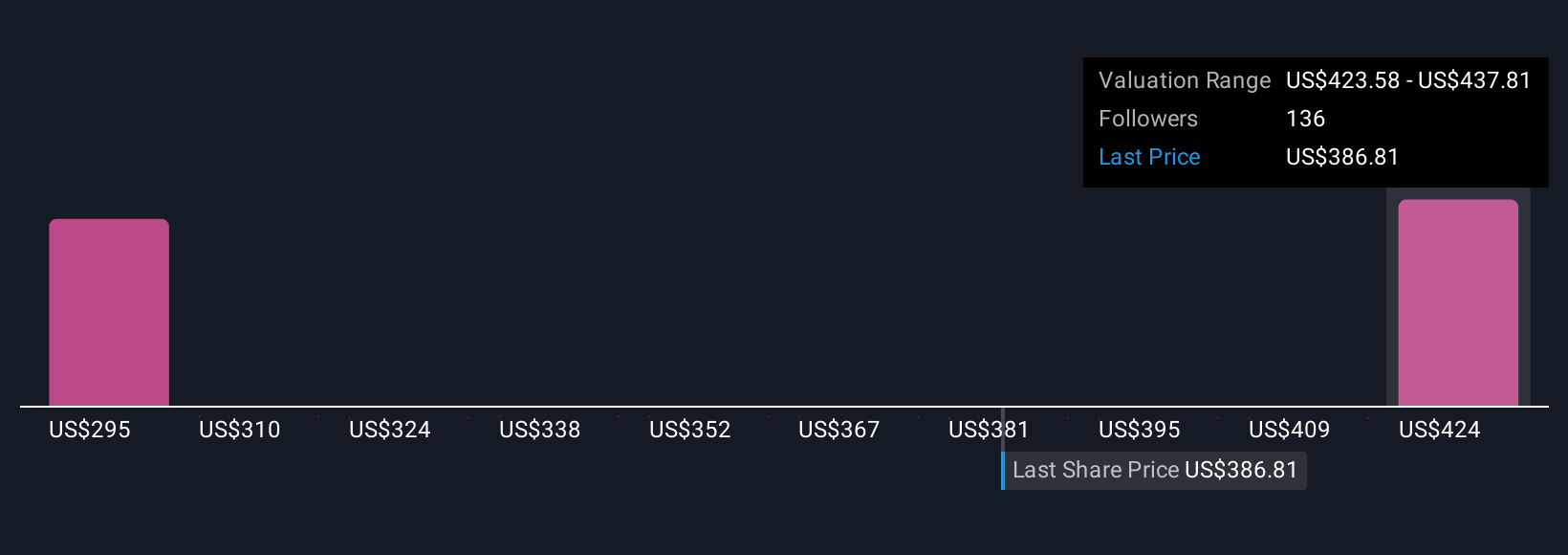

According to this DCF model, the estimated intrinsic value for Home Depot's shares is $298.58. However, when compared to the current share price, this calculation suggests the stock is about 19.9% overvalued at this time.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Home Depot may be overvalued by 19.9%. Discover 894 undervalued stocks or create your own screener to find better value opportunities.

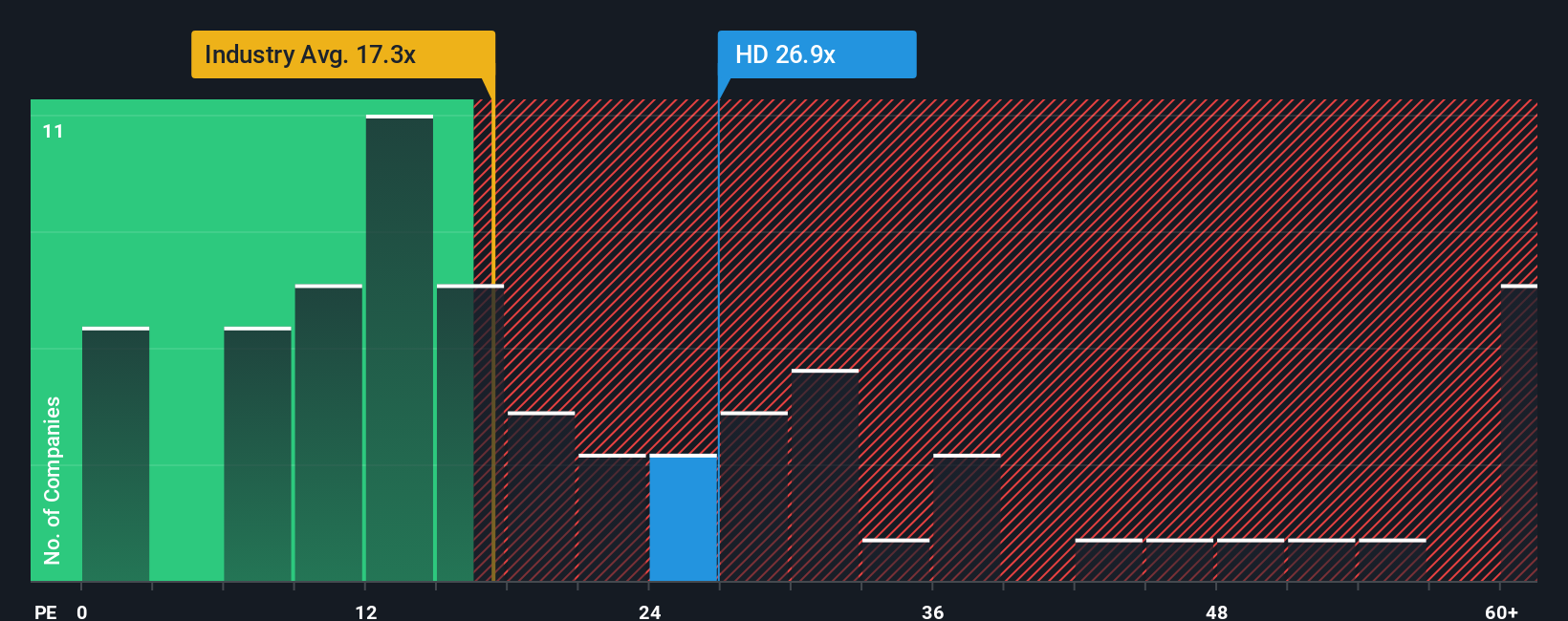

Approach 2: Home Depot Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a popular and practical way to judge a profitable company like Home Depot. It shows how much investors are willing to pay for each dollar of current earnings. Since Home Depot has steady profits, the PE ratio helps reveal whether the stock price matches those earnings, makes sense compared to its peers, and reflects growth potential.

Growth expectations and risk play a big role in deciding what a “normal” or “fair” PE ratio should be. A higher PE ratio might be justified for companies expected to grow faster in the future, while greater risk or slow growth would require a lower PE for the stock to remain attractive.

Home Depot is currently trading around 24.4x earnings, notably higher than the specialty retail industry average of 16.6x and just above the average PE of its close peers, which is 24.0x. However, comparing only against industry or peers can be misleading because it does not account for factors unique to Home Depot.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. The Fair Ratio for Home Depot is 22.9x, which blends company-specific elements like earnings growth forecast, profit margin strength, industry profile, and market cap. This makes it a more tailored benchmark than just using industry or peer averages, since those may miss what makes Home Depot unique or highlight sector-wide distortions.

Since Home Depot’s current PE ratio of 24.4x is only marginally above its Fair Ratio of 22.9x, the stock appears neither significantly overvalued nor undervalued at present. It is just about right by this measure.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1417 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Home Depot Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. This approach empowers you to bring your own story and outlook into your investing decisions, rather than relying only on formulas or averages.

A Narrative connects your view of Home Depot, whether you believe the future looks bright or risky, with your expectations for future revenue, earnings, and margins. This in turn creates your own fair value target for the stock.

Narratives are available to everyone on the Simply Wall St Community page, making it easy to set your own assumptions, track updates, and instantly see whether the stock’s current price is attractive. All of this is available in one place used by millions of investors.

What makes Narratives powerful is that they dynamically update as new news or earnings data emerges, so your conclusions stay relevant in real time.

For example, one investor could build a bullish Narrative and set a price target near $481 by forecasting strong demand and margin expansion. Another could create a bearish Narrative and target only $335 by projecting ongoing cost pressures and slower growth. This demonstrates how your perspective and assumptions can turn into actionable insights for when to buy or sell.

Do you think there's more to the story for Home Depot? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Home Depot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HD

Home Depot

Operates as a home improvement retailer in the United States and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives