- United States

- /

- Retail Distributors

- /

- NYSE:GPC

Genuine Parts (GPC): Exploring Its Valuation as Investor Sentiment Shifts

Reviewed by Simply Wall St

Genuine Parts (GPC) shares have shown mixed performance in recent trading, with monthly returns dipping about 4% while gains year-to-date stand at almost 10%. The stock's steadiness amid sector fluctuations has drawn attention from value-focused investors.

See our latest analysis for Genuine Parts.

Genuine Parts has captured fresh attention after its year-to-date share price return climbed 9.7%, though the last three months have seen momentum wane. Even with some recent softness, its 1-year total shareholder return sits at 5.8%, highlighting both resilience and the cyclical nature of the business.

If Genuine Parts’ shifting momentum has you wondering what else is out there, it is a great time to broaden your investing horizons and discover fast growing stocks with high insider ownership

With shares trading at a meaningful discount to analyst price targets and solid profit growth in recent years, the key question is whether Genuine Parts is undervalued or if the market has already accounted for future growth.

Most Popular Narrative: 12.1% Undervalued

Genuine Parts' last close of $127.26 sits well below the most popular narrative's fair value estimate, leaving room for possible upside if projections hold. The narrative frames this gap through a lens of industrial segment leverage and strategic repositioning.

Execution of global supply chain optimization, pricing strategies, and recent restructuring initiatives is expected to generate over $200 million in annualized cost savings by 2026, supporting future net margin expansion and enhancing long-term earnings power.

The key to this story? Analysts are building their fair value on a future where cost-cutting and global expansion supercharge margins. The boldest assumptions driving the target are rooted in Genuine Parts' rapidly evolving business mix, where new profit engines could ignite. Want to know what precise growth, margin, and valuation numbers fill out the rest of this bullish scenario? Peek behind the curtain to see how consensus crafts a fair price that splits opinion among market watchers.

Result: Fair Value of $144.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stubborn inflation in operating costs or a slower than expected rebound in industrial demand could quickly challenge this bullish thesis.

Find out about the key risks to this Genuine Parts narrative.

Another View: What Do Price Ratios Say?

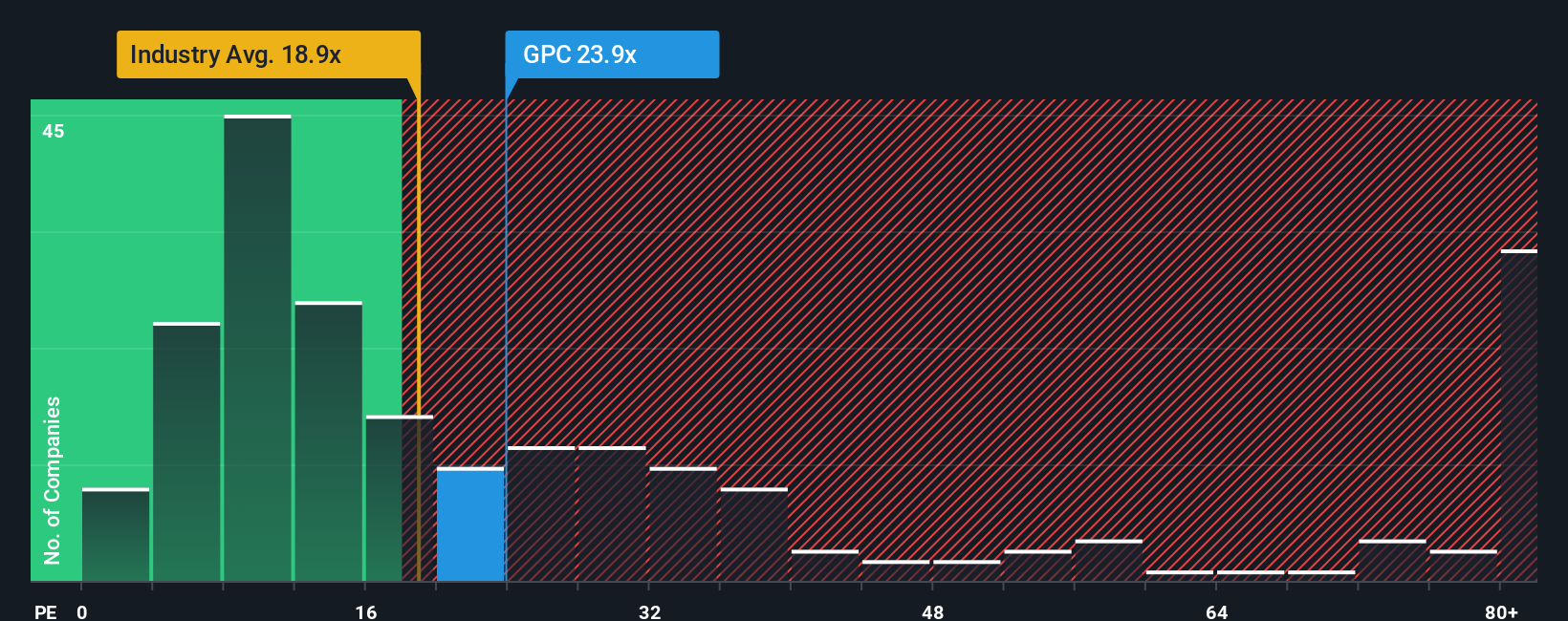

While the fair value estimate points to Genuine Parts being undervalued, a look at its price-to-earnings ratio tells a different story. The company’s ratio of 21.9x is higher than the Global Retail Distributors industry average of 17.1x, and even overshoots its own fair ratio of 18.4x. This suggests shares may be priced for stronger growth than the market or peers expect, which raises questions around valuation risk if these expectations are not met. Could market sentiment be running ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Genuine Parts Narrative

If you think the story looks different from your angle, or want to uncover your own take using the underlying data, you can easily build your own vision for Genuine Parts in just a few minutes. Do it your way.

A great starting point for your Genuine Parts research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Unlock your edge by targeting companies with trends others may miss. Let the Simply Wall Street Screener point you toward the next smart opportunity. Don’t let unique growth stories get away.

- Identify the next wave of medical innovation when you check out these 31 healthcare AI stocks, offering exposure to businesses at the cutting edge of artificial intelligence in healthcare.

- Target strong income streams in your portfolio as you sift through these 16 dividend stocks with yields > 3%, highlighting stocks with robust yields and proven dividend histories over time.

- Stay ahead of tech disruption by reviewing these 26 AI penny stocks, where companies pioneering artificial intelligence are setting the pace for tomorrow’s market winners.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GPC

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives