- United States

- /

- Specialty Stores

- /

- NYSE:GME

GameStop (GME): Valuation in Focus After Recent Index Removals Spark Market Shifts

Reviewed by Kshitija Bhandaru

GameStop (NYSE:GME) was recently dropped from a range of major indices, including multiple Russell and S&P lists. Index removals such as these often spark shifts in trading activity as index-tracking funds adjust their holdings.

See our latest analysis for GameStop.

The wave of index removals appears to be weighing on GameStop’s recent share price momentum, with a 30-day share price return of -11.61%. Still, even after this stretch, long-term investors hold a five-year total shareholder return of 522%. This underscores the stock’s volatile reputation and the shifting perceptions around its growth story.

If GameStop’s wild ride got your attention, now is the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

Given these major index exclusions, is the recent drop making GameStop a value play waiting to be unlocked? Or is the market already factoring in every twist in its future growth prospects?

Most Popular Narrative: 80.8% Undervalued

According to prime_is_back, the current fair value sits dramatically above the last close, marking a sizable gap for those tracking GameStop. This positions the narrative as a play on major financial flexibility and bold transformation, suggesting plenty of fuel for debate.

With $6.4 billion in cash and zero long-term debt, GameStop enjoys unparalleled financial flexibility. Its strategic holding of 4,710 Bitcoin, valued at $516.6 million, positions it to capitalize on Bitcoin’s surge (near $112,000). The board, led by Ryan Cohen, who does not take a salary and owns a significant portion of shares (about 10% of the float), has driven efficiency through aggressive cost-cutting, closing about 590 stores and exiting unprofitable markets like Canada and France. This has boosted margins.

Curious what propels this bold valuation? The secret lies in a unique financial strategy, crypto exposure, and a leadership approach rarely seen in retail. Are you ready to see how this narrative projects a future that could change the game for GameStop?

Result: Fair Value of $120.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, challenges remain, as slower revenue growth and ongoing market volatility could quickly test investor confidence in GameStop's bold transformation story.

Find out about the key risks to this GameStop narrative.

Another View: Market Multiples Raise the Bar

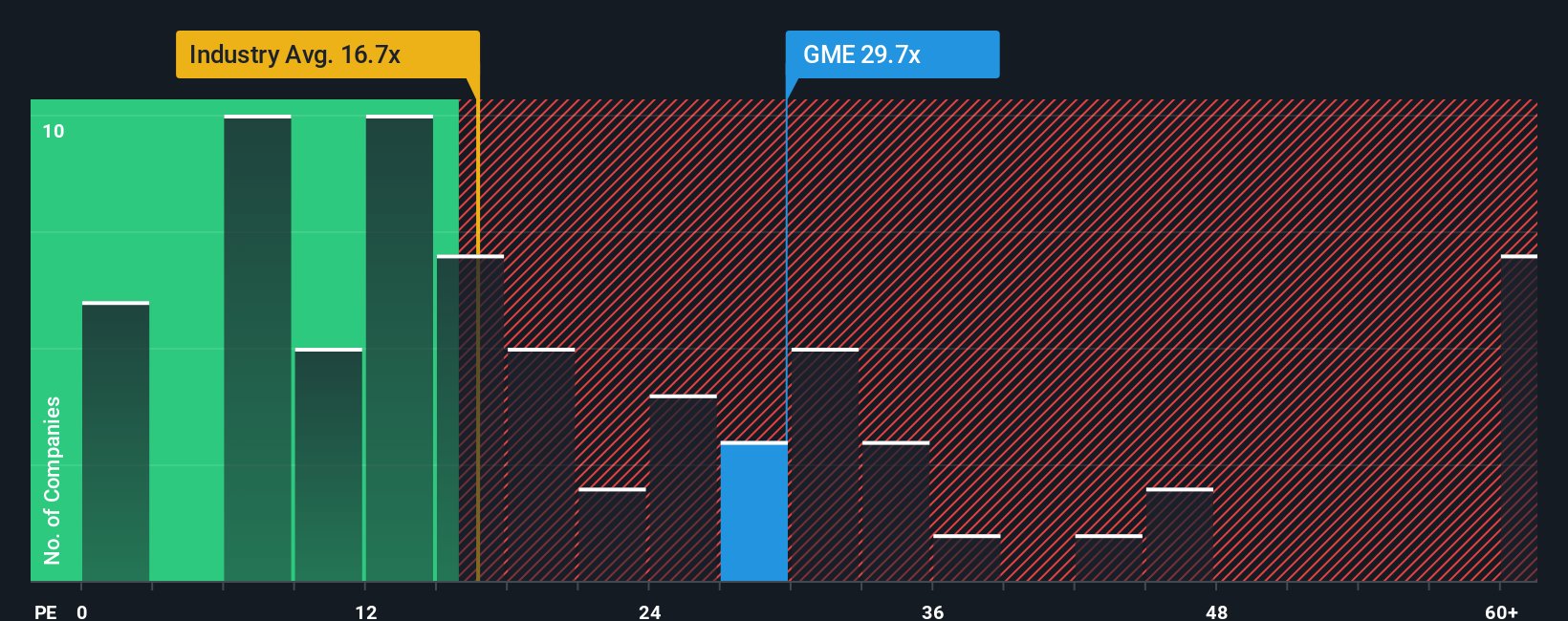

Turning to traditional valuation, GameStop’s price-to-earnings ratio stands at 28.5 times. This appears expensive compared to the US Specialty Retail industry average of 16.1 and the peer average of 19.4. The sizeable gap suggests investors are pricing in high hopes, which heightens the risk if expectations are missed. Does the market see something everyone else is missing, or are expectations getting ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own GameStop Narrative

If you see things differently or enjoy digging into the numbers yourself, why not dive in and shape your own perspective in just a few minutes with Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding GameStop.

Looking for more investment ideas?

Every smart investor knows the best opportunities go fast. Refuse to settle for the usual and sharpen your watchlist with stocks that fit your strategy using these handpicked ideas from Simply Wall Street:

- Unlock the income potential of steady yield-growers by checking out these 18 dividend stocks with yields > 3% offering impressive payouts above 3%.

- Tap into the momentum of high-growth machine learning and automation leaders through these 24 AI penny stocks that are powering tomorrow’s technology evolution.

- Jump ahead of the crowd with these 878 undervalued stocks based on cash flows that the market may be underestimating right now, all based on real cash flow metrics and solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GME

GameStop

A specialty retailer, provides games and entertainment products through its stores and e-commerce platforms in the United States, Canada, Australia, and Europe.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives